Contemplating healthcare represents 18.3% of the US financial system[1], it’s no shock that many buyers are on the hunt for the very best healthcare shares. This sector is a big a part of the investing world.

It’s also a a lot much less unstable sector than many others, as falling sick and needing healthcare is near unavoidable. With an growing old inhabitants, it’s doubtless that the sector will continue to grow for the foreseeable future.

Greatest Healthcare Shares

When discussing healthcare, many analysts conflate it with pharmaceutical, biotech, and different “medical” sectors. On this article, we’ll focus fully on hospitals, insurance coverage, and different “pure” healthcare shares, excluding the pharmaceutical, biotech, and medical gadgets sectors.

So, let’s have a look at the very best healthcare shares.

This record of the very best healthcare shares is designed as an introduction, and if one thing catches your eye, you’ll need to do further analysis!

⚕️ Be taught extra: For these questioning the place the US stands on healthcare spending, our newest evaluation offers readability.

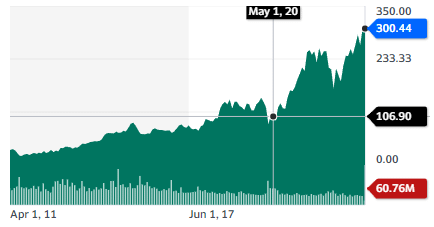

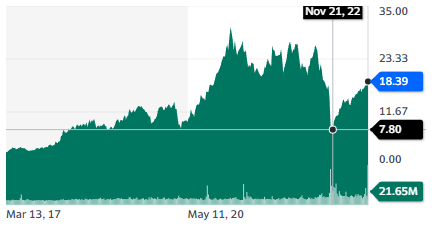

1. HCA Healthcare, Inc. (HCA)

| Market Cap | $82.3B |

| P/E | 15.18 |

| Dividend Yield | 0.80% |

HCA Healthcare is an enormous hospital group, with 182 hospitals within the US and the UK, treating 37.2 million sufferers yearly, of which 9 million are in ERs.

Due to its huge scale, HCA is ready to run its operations very effectively. The corporate has grown its revenues by a 6.7% CAGR since 2017 and grew its diluted earnings per share by a 23% CAGR. HCA can be very shareholder-friendly, with an enormous share repurchase by far bigger than its dividend distribution.

HCA invests in progress by the acquisition of current hospitals and newly constructed services and medical capacities.

It’s no secret that People as a inhabitants aren’t getting more healthy as a result of normal growing old and the weight problems epidemic. This makes HCA among the best healthcare shares to contemplate, because it’s poised to profit from continued excessive ranges of healthcare spending. Sustained demand mixed with giant share repurchases may make HCA’s inventory value maintain rising.

⚕️ Be taught extra: A urgent concern in at the moment’s healthcare debate: What number of People lack insurance coverage? Our article sheds mild on the info.

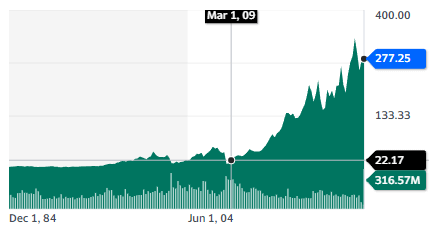

2. The Cigna Group (CI)

| Market Cap | $81.2B |

| P/E | 12.55 |

| Dividend Yield | 1.79% |

Cigna is an insurance coverage firm (Cigna Healthcare) that additionally offers well being providers (Evernorth). Cigna’s well being providers are utilized by 60% of U.S. well being plans for issues like fertility help, digital formulary, vaccination applications, home-based care/telemedicine, or value containment methods.

The corporate serves 180 million prospects within the US and abroad, of which 14 million are within the US insurance coverage section. Cigna Insurance coverage has considerably outgrown the trade, with income rising at 7.1% CAGR in 2018-2021, in comparison with the trade’s 3.5%.

The corporate is rising earnings per share at 10-13% CAGR. The corporate additionally has a really shareholder-friendly coverage, with 4/fifth of the obtainable money move redirected towards dividends, debt reimbursement, and share repurchase/acquisition.

When contemplating the very best healthcare shares, Cigna stands out. Due to its service section, Cigna advantages from the general healthcare exercise within the US and is main the digitalization of the trade. Along with the insurance coverage exercise, this offers Cigna a powerful progress profile, one thing that doesn’t appear absolutely priced at present ranges.

⚕️ Be taught extra: Self-employed and on the hunt for high quality medical health insurance? Our information breaks down essentially the most becoming choices for you.

3. Veeva Methods Inc. (VEEV)

| Market Cap | $31.4B |

| P/E | 61.42 |

| Dividend Yield | – N/A |

Veeva is a supplier of cloud-based software program for the medical analysis trade. This contains scientific trials, high quality management, security, confidentiality, medical communications, and information.

The corporate is so embedded into the medical and pharmaceutical ecosystem that 83% of recent medication authorized have been launched utilizing Veeva CRM.

The corporate has been rising its revenues rapidly, at a 16% CAGR since 2017.

The enterprise is extraordinarily worthwhile and advantages from the development of well being digitalization and information mining. The primary destructive level is usually a fairly expensive valuation, as Veeva is a high-quality inventory that’s well-known amongst healthcare and biotech buyers.

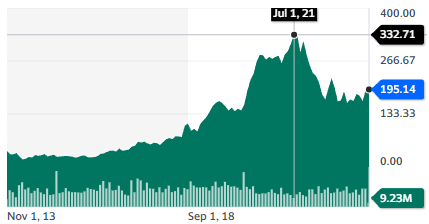

4. DaVita Inc. (DVA)

| Market Cap | $8.9B |

| P/E | 18.46 |

| Dividend Yield | – N/A |

One other among the best healthcare shares is DaVita, which is a community of three,100+ clinics specialised in kidney illness and associated therapies. It treats 241,000+ sufferers globally, with 65,000 staff. The corporate is lively in any respect levels of persistent kidney illness, from detection to common dialysis to transplants.

Kidney failure is a treatable however very severe illness, typically requiring greater than 10-20 hours of dialysis per week, with 8-10 days in hospital per yr.

DaVita’s built-in care mannequin can save as much as $8-13k per yr per affected person in medical prices, of which DaVita captures $2-4k. It achieves this by monitoring sufferers rigorously, resulting in 7% fewer hospitalizations and a 4% discount in mortality.

In addition to care, DaVita has invested in kidney-focused startups, notably Miromatrix, which is making an attempt to create transplantable bioartificial kidneys and Neprhosant, which is working to foretell transplant failure.

The corporate is focusing on incomes progress of 8-14% CAGR till 2025. It has additionally engaged in an aggressive share repurchase program, decreasing the share depend from 182 million in 2017 to 90 million in 2023.

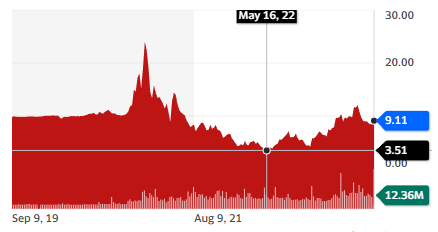

5. R1 RCM Inc. (RCM)

| Market Cap | $7.6B |

| P/E | – N/A |

| Dividend Yield | – N/A |

R1 is likely one of the finest healthcare shares obtainable available on the market because it gives software program and cloud-based options to handle the income cycle of sufferers within the healthcare system. Its options enable docs and hospitals to scale back the gathering value of medical payments, automate duties, register sufferers, handle schedules, and general enhance the operations of the medical services.

R1 has managed 28% year-to-year income progress in 2023, with a 15% CAGR since 2018 for revenues and a formidable 60% CAGR for adjusted EBITDA.

This can be a reasonably “sticky” line of enterprise, as a hospital utilizing R1 providers won’t need to change and threat disrupting its workflow for marginal positive aspects.

It additionally provides R1 entry to a big treasure trove of medical information, permitting it to additional enhance its automated answer, together with its CouldmedAI, automating 125 million duties yearly for 95% of US payers.

With 70% of spending managed in-house, in a complete market of $115B, the corporate nonetheless has giant house to develop, because it gives superior outcomes at scale to hospitals in comparison with home-grown options. The identical inertia that restricted the adoption of third-party suppliers will play a job in holding R1’s retention charges excessive.

💰 Be taught extra: Medical payments don’t at all times must be overwhelming; uncover a step-by-step technique for negotiation in our newest article.

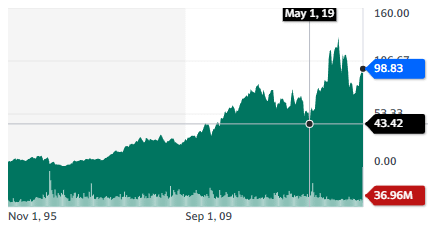

6. Hims & Hers Well being, Inc. (HIMS)

| Market Cap | $6.2B |

| P/E | – N/A |

| Dividend Yield | – N/A |

Hims & Hers is a telehealth firm targeted on a subscription mannequin for males’s & ladies’s well being, in addition to psychological well being and dermatology. The corporate can be contemplating the prospects for increasing in new functions like weight, fertility, diabetes, or ache administration.

This can be a typically poorly addressed market, with “90% of the relevant inhabitants but to hunt remedy in some circumstances”.

The corporate places a powerful emphasis on privateness and information security, in addition to personalised care, counting on digital apps, on-line consultations, and modern merchandise & formulations. For instance, personalised ED formulations with a number of completely different attainable molecules and concentrations to attain the very best consequence for every affected person.

This technique targets the usually embarrassing or personal well being issues many individuals is likely to be reluctant to speak about with their household physician.

The advertising and marketing technique is multi-channeled, with social media celebrities but additionally advertisements on streaming platforms and main sports activities occasions.

The subscription mannequin permits for repeat gross sales and additional time cross gross sales for different well being points. The payback interval (time to recuperate buyer acquisition prices) is lower than 1 yr. Each subscriber depend and revenues have grown very strongly, by 87-88% as of early 2023.

The corporate has turned EBITDA constructive in This autumn 2022, with a strong money place and no debt, making it among the best healthcare shares available on the market.

Through the use of digital instruments, the corporate may have the ability to develop this market and overcome the reluctance of sufferers to hunt remedy. Unwillingness to speak to or belief household docs is solved by teleconsultation with specialists. The discretion and “from residence” nature of the session and remedy supply permits sufferers to beat the thought of being too embarrassed to go to a physician’s workplace or go to a pharmacy in search of the remedy.

With the unit financial system now confirmed with the corporate reaching an environment friendly scale, this may be an fascinating progress story regardless of a inventory value basically unchanged since 2020.

Greatest Healthcare ETFs

For a lot of buyers, healthcare is engaging for the sector’s normal attributes reasonably than any firm specifically. An ETF can present a excessive degree of diversification whereas nonetheless capturing the investing efficiency of the healthcare trade.

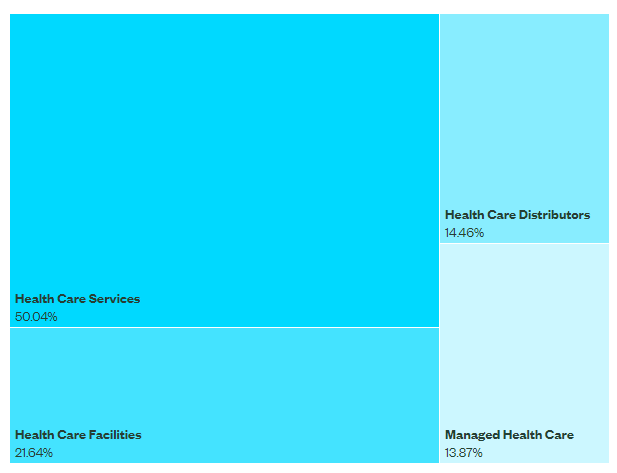

1. SPDR S&P Well being Care Companies ETF (XHS)

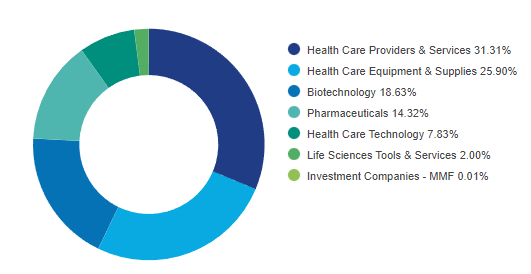

This ETF focuses on healthcare suppliers, like hospitals, clinics, and so forth. This makes it one of many uncommon ETFs with none publicity to the biotech/pharma sectors and solely targeted on pure healthcare suppliers.

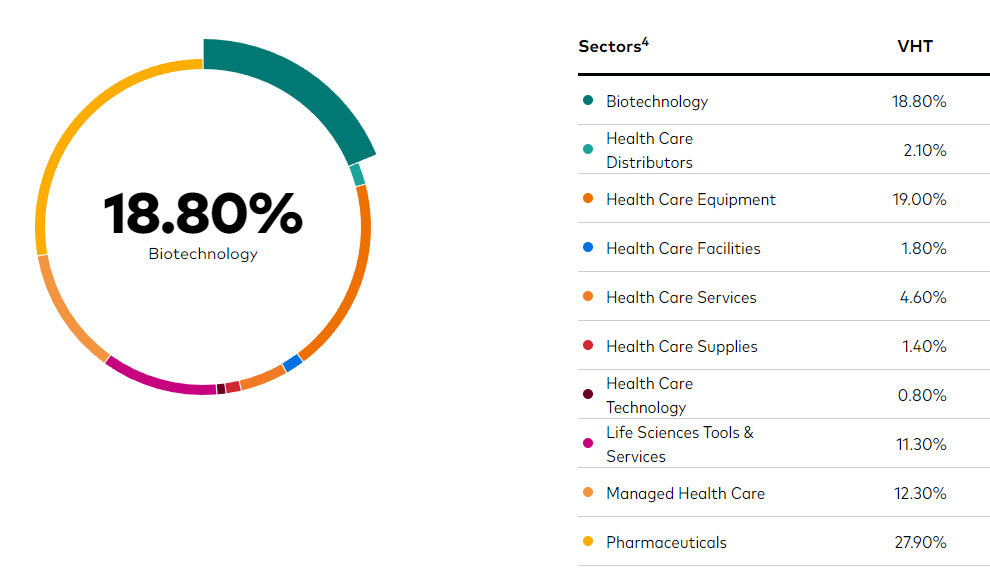

2. Vanguard Well being Care ETF (VHT)

This ETF is concentrated on healthcare at giant, with a concentrate on managed healthcare, biotech, pharmaceutical, and gear. This makes it a great decide for betting on healthcare spending typically and no firm specifically.

3. Invesco S&P SmallCap Well being Care ETF (PSCH)

Most healthcare ETFs concentrate on the most important firms within the sector, from large pharma to mega-insurance firms. For buyers in search of extra progress potential, even at the price of extra volatility, small caps is likely to be extra engaging.

The main focus is on healthcare suppliers and gear and expertise/service suppliers to the trade, with biotech/pharma taking a again seat, combining for under 33% of holdings.

4. iShares U.S. Healthcare Suppliers ETF (IHF)

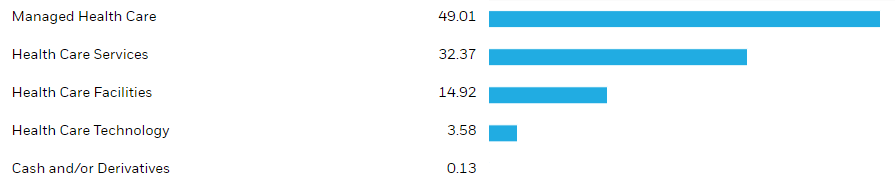

This ETF contains healthcare suppliers but additionally insurance coverage firms like Cigna, its fifth largest holding, and laboratories performing medical analyses. That provides this ETF a wider number of healthcare suppliers whereas nonetheless not together with biotech and pharmaceutical firms.

Conclusion on the Greatest Healthcare Shares & ETFs

Healthcare is one thing we might not suppose a lot about once we and our members of the family are wholesome. It’s additionally crucial factor we take into consideration if anybody will get sick. That is unlikely to vary sooner or later and makes the trade one of the crucial resilient in the complete financial system.

Traders may need to diversify their healthcare-related holdings to incorporate among the finest healthcare shares available on the market, rising startups upending the established order, and repair suppliers which might be at key junctions of the trade.

Whether or not to incorporate or not biotech and prescribed drugs relies upon largely on the extent of volatility an investor is prepared to just accept.