The almost 20% bull run for the S&P 500 (SPY) from the March lows is over. Now it’s time to relaxation up in a buying and selling vary for the following run greater. That means that is the pure course of issues. To loosen up after a tough run…after which retailer up the required power for the following dash. The perfect half is how we will use these extra vary sure intervals to purchase the dip on some shares with terrific upside potential. Let’s discuss how we’ll do exactly that on this week’s Reitmeister Whole Return commentary.

We FINALLY noticed the inventory market take a step again after a seeming continuous 5 month rally. Many funding commentators level to the Fitch scores downgraded of US debt as the first trigger. Nevertheless, if we’re being sincere with ourselves….this self off was lengthy overdue. The Fitch announcement was only a handy excuse to hit the promote button for some time.

Friday was an fascinating session worthy of observe. The Authorities Employment Report appeared like a Goldilocks announcement. Not too sizzling…not too chilly…excellent serving to the S&P 500 rise almost 1% early within the session.

But because the day progressed these positive aspects melted off the board resulting in a -0.53% session. Much more fascinating was the S&P 500 (SPY) closing beneath 4,500 and now in all probability on our method in the direction of 4,400 (extra on that within the Worth Motion part beneath.)

Despite the fact that we don’t like seeing purple on the display…that is wholesome. That buyers took the chance of an intraday rally to take extra positive aspects off the desk.

On Monday we obtained a stable bounce again as buyers have gotten into the behavior of shopping for each dip the previous a number of months as that technique has paid off handsomely. What they didn’t know was a shock announcement on Monday that Moody’s was downgrading their scores on a slew of small to midsized banks. This reawakened the Threat Off sentiment from final week with extra buyers hitting the promote button in earnest on Tuesday.

That is the traditional swinging of the worry/greed pendulum. The greed of the rally as much as 4,600 was overextended. Merely situations weren’t that pristine to maintain rising. This left buyers weak to any dangerous information for which Fitch and Moody’s have been reminders that the general market could also be forward of itself.

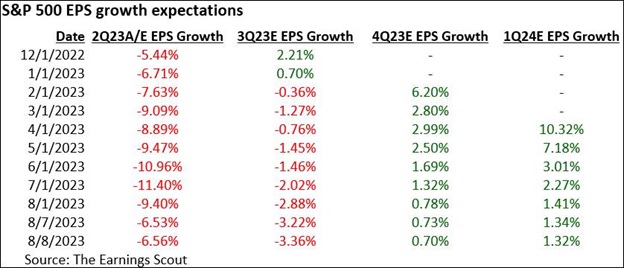

One other reminder of that is on the earnings entrance. As we come down the homestretch of Q2 earnings season we discover that earnings estimates for the long run have been trimmed for the following few quarters. Including these 3 quarters collectively factors to nearly no 12 months over 12 months progress.

The weak earnings outlook is NOT GOOD FUEL FOR A BULL RALLY

Very true when the S&P 500 is already at a PE of 20. That’s not essentially overpriced…however it’s somewhat absolutely priced. Thus, to moderately count on extra upside you want higher earnings progress prospects for the long run to compel greater costs with out overly inflating PE.

It is a good distance of claiming that now could be a logical time for the runaway rally to finish and for us to enter a wholesome consolidation interval to digest latest positive aspects. And thus be extra selective concerning the shares that ought to advance from right here.

So Why Nonetheless Consider in a Lengthy Time period Bull Rally?

As a result of the Fed is offering extra hints of a “dovish tilt”. That gained steam with the speech from Harken of the Philly Fed the place he acknowledged that probably no additional price hikes are wanted. At this stage they only want to provide the present excessive charges time to sink in and convey down inflation additional. Then begin fascinated about decrease charges.

Plain and easy, the long run decreasing of charges is a tail wind for the financial system that will increase the chances of higher progress prospects (what is required to push costs greater). Understanding that’s on the horizon is a motive to be extra bullish now.

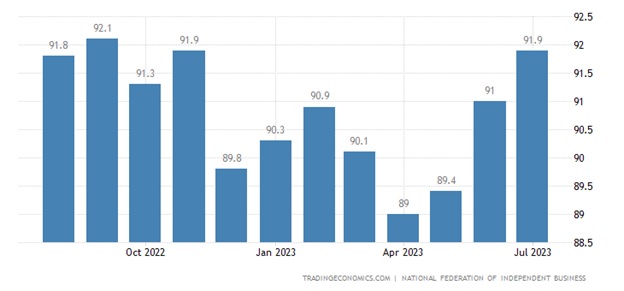

On high of that you’ve got extra enterprise folks feeling optimistic concerning the future. Right here is the chart for the NFIB Small Enterprise Optimism studying on Tuesday morning at 91.9.

As you’ll be able to see that is the threerd straight month of enchancment and the best studying in fairly some time. This elevated optimism is a precursor to enhancing progress tendencies.

Take into consideration this. First you be ok with one thing…you then act on that optimistic impulse. This is the reason sentiment surveys are thought-about main indicators of future financial exercise.

Placing it altogether there may be stronger causes to consider that recession can be averted throughout this price hike cycle. In that case, then the financial system ought to choose up from right here…which lifts earnings prospects…which is important gasoline for share value appreciation.

Worth Motion & Buying and selling Plan

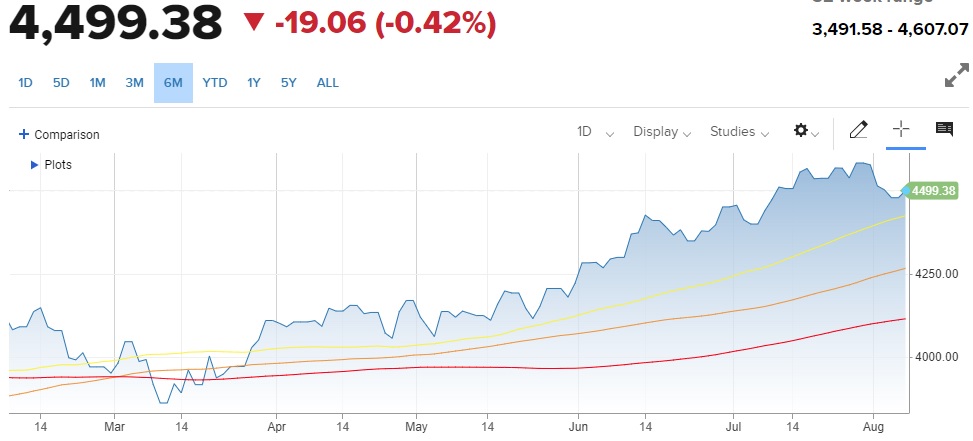

Right here is the up to date S&P 500 chart:

Transferring Averages: 50 Day (yellow), 100 Day (orange), 200 Day (purple)

Proper now 4,600 is establishing as a spot of stiff resistance and now looking for help on the underside for probably a buying and selling vary to kind. My guess is that the 50 day shifting common round 4,420 is about as little as shares must go.

This units up for a buying and selling vary the place we probably swim round for a couple of months earlier than the standard vacation rallies of November/December kick in giving us an actual shot on the earlier all time excessive of 4,818.

This units us up properly for a inventory pickers market which is my favourite. That means the place the general market is form of lukewarm…however these with a inventory selecting benefit discover strategy to carve out income.

In our case, the POWR Rankings is a giant benefit in our nook to seek out inventory selecting income in any market setting…particularly an setting the place the leaders are overripe and buyers will rotate to extra enticing, underpriced performs.

What To Do Subsequent?

Uncover my present portfolio of 5 shares packed to the brim with the outperforming advantages present in our POWR Rankings mannequin.

Plus I’ve added 4 ETFs which are all in sectors effectively positioned to outpace the market within the weeks and months forward.

That is all based mostly on my 43 years of investing expertise seeing bull markets…bear markets…and the whole lot between.

If you’re curious to study extra, and need to see these 9 hand chosen trades, then please click on the hyperlink beneath to get began now.

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Whole Return

SPY shares fell $0.10 (-0.02%) in after-hours buying and selling Tuesday. 12 months-to-date, SPY has gained 18.23%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Steve Reitmeister

Steve is healthier recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The publish House on the Buying and selling Vary appeared first on StockNews.com