In right this moment’s enterprise world, each greenback counts for greater than ever earlier than. The present financial downturn, funding crunch, and race to be cash-flow optimistic are forcing organizations to reevaluate budgets and spending patterns. This has pushed CFOs to problem mandates — lower software program spend between 10% and 30%.

Primarily based on knowledge accessible from my firm’s platform, spend on software program is now the third-biggest expense for organizations, proper after worker and workplace prices.

CFOs should work carefully with CIOs and division heads to plan good plans to chop their SaaS spend and get extra bang for his or her buck. On the identical time, lowering software program spend shouldn’t negatively influence firm progress or inhibit innovation.

The first goal for CFOs must be to determine the place they’re spending, acknowledge departments with the very best prices, and determine cases of low utilization and utility redundancies.

I believe the precise method to slicing SaaS spend includes an information and metric-driven technique. Understanding the ROI for every vendor and evaluating the SaaS spend per worker will allow the CFOs and CIOs to determine the software program’s true worth and the way rapidly it’ll add to the corporate’s high and backside line. Spend evaluation will empower you to make knowledgeable decisions relating to value optimization.

What does typical software program spend in organizations appear like?

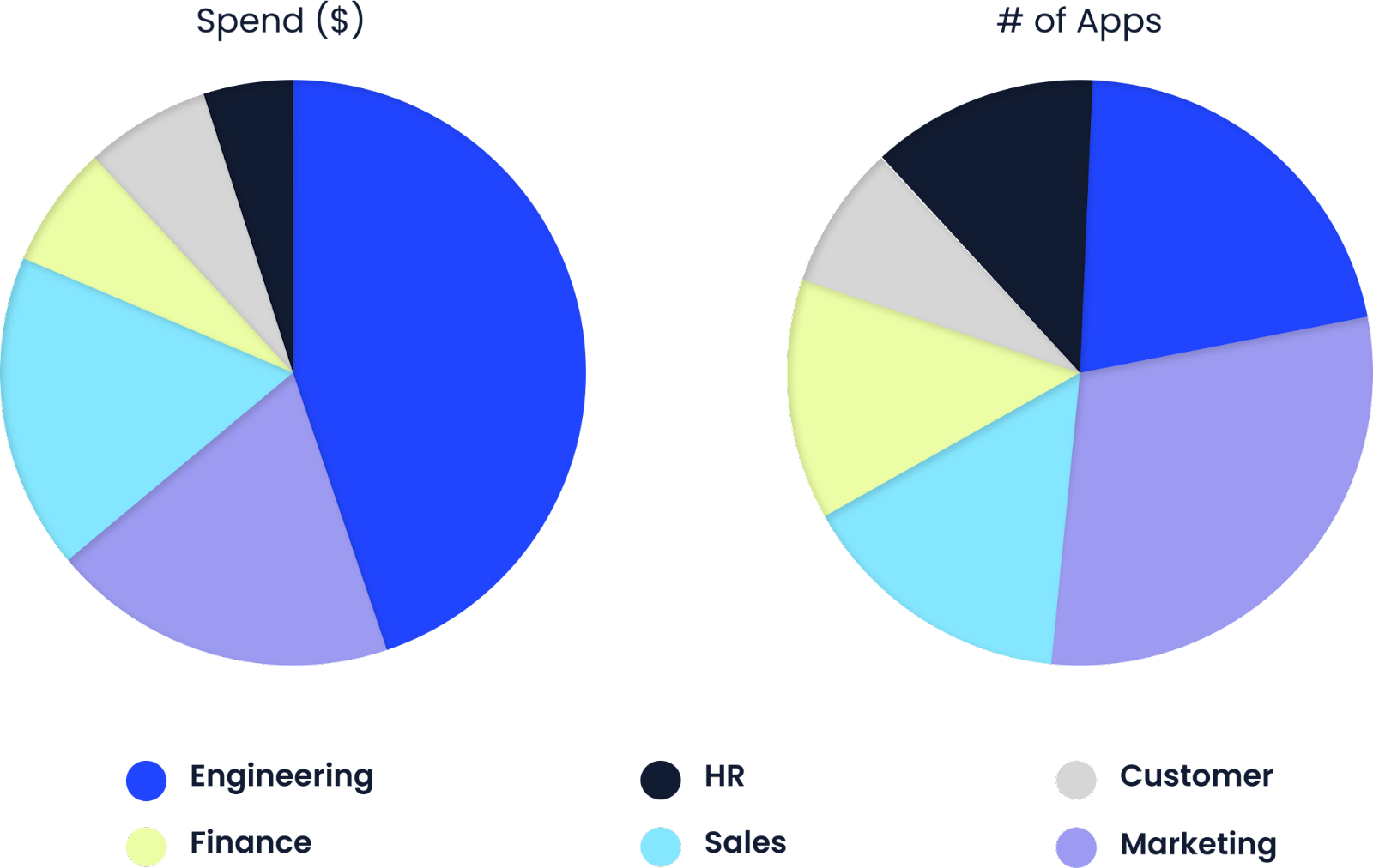

Our knowledge signifies that the engineering division spends probably the most, adopted by advertising and gross sales, after which HR. Whereas the engineering division tops spend by {dollars}, it’s not the division with the very best variety of SaaS functions. That distinction goes to the advertising group.

Picture Credit: CloudEagle’s database

So, ought to we ask the division that spends probably the most to scale back spending?

Software program is now the third-biggest expense for organizations, proper after worker and workplace prices.

Possibly sure, however let’s have a look at the low-hanging fruit first — gross sales and advertising groups have the very best depend of deserted and underutilized apps.

Gross sales and advertising groups should adapt rapidly to adjustments available in the market and evolving buyer necessities; they usually purchase completely different instruments to fulfill their quick calls for, and when these necessities shift, they often transition to new instruments, resulting in low utilization and redundant instruments.

Secondly, CFOs can use benchmark knowledge to make sure their spend aligns with similar-sized corporations. Relying on the dimensions of the corporate and the worker’s division, corporations spend a median of $1,000 to $3,500 on software program instruments per worker. CFOs should collaborate with groups to optimize the shopping for course of and management spending. If your organization’s spend doesn’t meet the standard benchmarks of friends, it could be good to analyze why.