Retirement typically appears like a far-off dream for busy entrepreneurs. You’re so targeted on the day-to-day calls for of operating a enterprise that planning on your eventual exit looks like a luxurious you may’t afford.

However ignoring retirement planning is a dangerous gamble that might go away you financially unprepared while you resolve to transition out of your online business. The secret’s leveraging your small enterprise proactively to maximise your nest egg.

On this complete information, we’ll discover numerous methods to assist enterprise homeowners such as you retire comfortably:

- Why retirement planning is important for entrepreneurs

- Tax-advantaged accounts to turbocharge retirement financial savings

- Constructing passive revenue streams into your online business

- Making ready your online business for a easy succession

- And way more

Arm your self with the data it’s essential leverage your small enterprise for a safe retirement future. The time to begin planning is now.

Why Retirement Planning Issues for Small Enterprise Homeowners

Constructing a enterprise from scratch requires great sacrifice. Lengthy hours, monetary threat, continuous stress—it’s the value we pay to observe our desires.

However will all these sacrifices repay down the highway while you’re able to retire? Or will you continue to be chained to your small enterprise, unable to go away with out sinking into poverty?

Sadly, too many entrepreneurs attain retirement age with out satisfactory financial savings. They turn out to be compelled to work properly previous 65 simply to make ends meet.

Don’t let that occur to you. With some planning and business-oriented money-saving ideas now, you may leverage your online business to retire comfortably as a substitute of reluctantly slaving away.

Listed here are highly effective causes to prioritize retirement planning in the present day:

Get pleasure from a Greater Nest Egg

Saving for retirement is a problem for any working grownup. However as a small enterprise proprietor, you may have benefits.

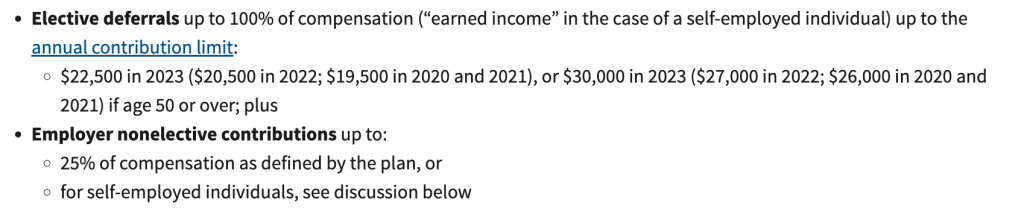

Retirement accounts like SEP IRAs and Solo 401(ok)s permit a lot greater contribution limits in comparison with typical plans, whereas staying organized and holding monitor of your contacts also can contribute to a profitable retirement plan.

Funding these accounts now supercharges your retirement financial savings. For instance, in 2023 you may contribute as much as $22,500 to a Solo 401(ok), plus as much as 25% of your compensation. That’s big!

With constant contributions at these ranges, your retirement financial savings can snowball into a large nest egg.

Cut back Your Tax Burden

As a small enterprise proprietor, you get hammered by taxes. Self-employment taxes, revenue taxes, payroll taxes—it by no means ends.

However tax-advantaged retirement accounts provide a authorized approach to decrease your taxable revenue. Cash you contribute isn’t taxed till you withdraw it in retirement.

That tax break leaves more cash in your pocket in the present day. And your investments develop tax-free for many years, finally decreasing your lifetime tax burden.

Entice and Retain Expertise

Does your small enterprise have workers? Providing a top quality retirement plan will help entice and retain prime expertise.

Employees in the present day anticipate good advantages. And retirement plans provide you with a aggressive edge in hiring.

Plus, when key workers do ultimately retire, you’ll want a succession plan in place. Retirement accounts assist facilitate easy transitions.

Get pleasure from Peace of Thoughts

Above all, retirement planning provides you peace of thoughts. You’ll be able to relaxation simple realizing your online business is about as much as present long-term monetary safety.

No extra stressing about the way you’ll pay the payments after retiring. No extra working your self to the bone into your 70s.

With a well-funded retirement plan and a strong understanding of up-to-date small enterprise statistics, you may confidently go away your online business by yourself phrases.

Tax-Advantaged Retirement Accounts for Entrepreneurs

Okay, you’re satisfied retirement planning is crucial. However the place do you begin?

For small enterprise homeowners, essentially the most highly effective financial savings software is a tax-advantaged retirement account. Choices like SEP IRAs, SIMPLE IRAs, and Solo 401(ok)s can help you save way over typical plans.

Let’s evaluate the professionals and cons of every so you may make the only option.

SEP IRA

A SEP IRA, quick for Simplified Worker Pension, is a particular retirement account for small enterprise homeowners and self-employed people.

Execs of a SEP IRA:

- Straightforward to arrange and administer

- Permits excessive annual contributions

- All contributions are tax deductible

- Solely employer makes contributions

Cons of a SEP IRA:

- Restricted to employer contributions solely

- No catch-up contributions if over 50

- Should embrace all workers in plan

With a SEP IRA, in 2023 you may contribute as much as 25% of compensation or $22,500 per yr, whichever is much less. This enables substantial tax-advantaged financial savings.

A SEP can also be simple to determine at practically any financial institution or brokerage. Simply fill out some kinds and also you’re prepared to begin contributing. Use this information from the IRS to be taught extra.

SIMPLE IRA

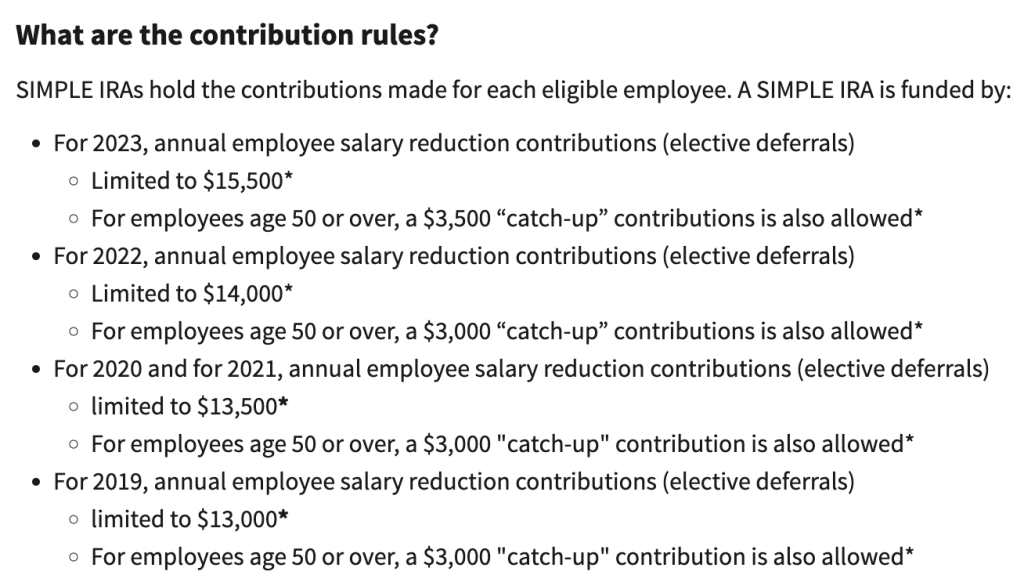

The SIMPLE IRA is one other retirement plan designed for small companies. SIMPLE stands for Financial savings Incentive Match Plan for Workers. It’s a retirement plan for small companies with 100 or fewer workers.

Execs:

- Straightforward to arrange and administer

- Employer matching contributions required

- Individuals can contribute as much as $15,500 in 2023

Cons:

- Restricted funding choices

- Necessary employer match may be expensive

- Solely out there to corporations with 100 or fewer workers

With a SIMPLE IRA, workers can contribute a share of their wage every pay interval. Employers are required to make both:

- An identical contribution as much as 3% of compensation

Or

- A 2% non-elective contribution for all eligible workers

Try this SIMPLE IRA information to be taught extra in regards to the necessities and guidelines.

Solo 401(ok)

The Solo 401(ok) is a retirement account focused to self-employed people and small enterprise homeowners with no full-time W-2 workers (besides a partner).

Execs:

- Permits very excessive contribution limits

- Could make each worker and employer contributions

- Loans allowed from the plan

- Roth contributions permitted

Cons:

- Extra advanced to manage than SEP or SIMPLE IRA

- Annual IRS filings required

- Trustee charges may be excessive

In 2023, you may contribute as much as $22,500 as an worker, plus as much as 25% of compensation as an employer (max $66,000 whole). Solo 401(ok)s provide great tax-advantaged financial savings potential.

Be taught extra on this Solo 401(ok) information from the IRS.

Producing Passive Revenue from Your Small Enterprise

Along with leveraging tax-advantaged accounts, good entrepreneurs generate ongoing passive income streams that can proceed paying out throughout retirement.

Listed here are just a few methods to rework your small enterprise right into a passive revenue machine:

License Your Mental Property

Do you may have proprietary merchandise, software program, or know-how? Take into account licensing your mental property (IP) to different corporations for an ongoing royalty payment.

For instance, you may license your software program as a service (SaaS) product to different companies in trade for five% in royalties. Or license your patented know-how to producers for a 2% reduce of gross sales.

Licensing converts your IP right into a lifetime income stream with minimal effort in your half. Simply accumulate these recurring royalty checks yr after yr.

Franchise Your Enterprise

One of many quickest methods to scale up passive revenue is franchising your small enterprise. This lets you open up tons of of places nationally or globally whereas amassing an upfront franchise payment and ongoing royalty funds.

As an illustration, a franchise payment of $25,000 per location plus 5% royalties creates vital cashflow with minimal day-to-day involvement. Franchising is advanced however may be very profitable.

Spend money on Revenue-Producing Belongings

Use your online business earnings to put money into property that produce ongoing revenue, like dividend shares, rental properties, or peer-to-peer lending platforms.

The secret’s selecting investments that generate cashflow with minimal upkeep and administration in your half. Then reinvest the payouts for compound progress.

Making ready Your Small Enterprise for a Easy Transition

The ultimate piece of the retirement puzzle is readying your online business for a profitable transition when you’re able to promote or go the baton.

Correct succession planning ensures your online business continues to thrive in your absence, holding its worth excessive. It additionally paves the way in which for a easy management transition.

Listed here are some ideas:

Groom Your Successor

Determine a successor and groom them years upfront. Prepare them to ultimately take over your function. This retains enterprise data and ensures uninterrupted management.

Create a Transition Plan

Define an in depth transition plan for handing off possession, administration, and strategic path. Set clear timelines for the brand new management takeover.

Handle Authorized and Monetary Points

Seek the advice of legal professionals and accountants to tie up any free ends across the firm’s authorized construction, possession fairness, valuation, taxes, and accounting.

Talk with Workers and Prospects

Be clear in regards to the transition and preserve belief. Guarantee workers and clients it’s “enterprise as regular” beneath the brand new management.

With the appropriate succession methods, you may transition out by yourself phrases whereas holding your online business operating easily with out you.

Begin Planning Your Small Enterprise-Funded Retirement Now

Retirement could really feel distant, however the time to begin planning is now.

With the methods we’ve coated in the present day—tax-advantaged accounts, passive revenue streams, succession planning—you may have a blueprint for leveraging your small enterprise to retire comfortably.

No extra fretting and uncertainty about the way you’ll afford to go away your online business. You’re outfitted with actionable steps to lock in monetary safety on your later years.

The secret’s taking that first step:

- Arrange a Solo 401(ok) or different retirement account ASAP

- Discover passive revenue concepts that match your online business

- Map out a transition plan for the longer term

Small, constant actions in the present day will compound into big rewards down the highway. You’ve labored laborious to construct this enterprise. Ensure that it takes care of you properly into retirement.

The publish How one can Leverage Your Small Enterprise for a Snug Retirement appeared first on Due.