Franchise Group (FRG) is one in all my largest positions, naturally I really feel obligated to submit one thing on the headline grabbing information that FRG is the obvious winner of the public sale for struggling retailer Kohl’s (KSS). Kohl’s could be a transformative acquisition, FRG is at the moment a $2.7B enterprise worth firm and press reviews have them paying $8B for KSS ($60/share). FRG is at the moment guiding to $450MM in 2022 EBITDA, TIKR has the consensus KSS estimate at $2.1B. The mix of FRG being smaller than the goal, little identified exterior of sure worth/event-driven circles and fears of credit score markets tightening appear to have the market doubting this deal will get achieved (KSS final traded for $45.75). However I think about CEO Brian Kahn, FRG entered my portfolio as a particular scenario when it was then known as Liberty Tax, which went a couple of difficult merger and tender supply transaction that seemed novel and fascinating from an outsider perspective. Right here is FRG’s most latest investor presentation for what the corporate appears to be like like at the moment, so much has modified, together with FRG promoting the unique Liberty Tax to a SPAC (sponsored by NexPoint). My thesis within the final two years has largely revolved round “in Kahn we belief”, given the information leaks round credit score suppliers being lined up, it seems this deal is getting achieved. I’ve added some KSS as a small speculative merger arbitrage place alongside FRG.

Taking a couple of steps again, in April, information broke from Reuters that FRG was becoming a member of the bidding for struggling retailer Kohl’s (KSS), I used to be a bit shocked however not completely, Kahn is a inventive deal maker and certain appears to be like at many acquisition alternatives that do not match Franchise Group’s acknowledged technique of “proudly owning and working franchised and franchisable companies”. My guess is the “franchise” half is extra aspirational than reality, it’s a generic title and technique, they simply search for engaging offers. Kohl’s definitely would not appear to suit the franchise mould, onerous to think about somebody working a division retailer as a franchise, however the deal does resemble different latest FRG acquisitions because the non-core property may very well be used to finance the transaction.

Final November, FRG entered right into a transaction to purchase southeastern furnishings retailer W.S. Babcock for $580MM. Subsequently, FRG went on to promote Babcock’s credit score accounts receivables to B Riley (RILY) for $400MM, the retail actual property for $94MM, and the distribution facilities and company headquarters to Oak Avenue Actual Property Capital for $173.5MM. Greater than paying for the acquisition with asset gross sales and nonetheless anticipating to obtain $60MM in proforma LTM EBITDA. The same transaction appears to be in retailer for Kohl’s, the division retailer chain owns their company headquarters, nearly all of their distribution and e-fulfillment facilities, and personal 410 of their retail shops outright and one other 238 of them owned however on floor leases.

Experiences have FRG re-teaming up with Oak Avenue Actual Property Capital (a part of Blue Owl’s platform) to offer $6B in financing based mostly on the company headquarters and distribution services actual property (may also embrace the retail actual property, so my 6% cap quantity beneath is perhaps too low), and $2B (fuzzy, Looking for Alpha quantity) from Apollo in non-recourse Kohl’s degree time period mortgage financing, with FRG kicking within the further $1B by way of an upsized time period mortgage. Apollo is not the perfect lender, however since they are a direct lender and are not counting on syndicating the mortgage instantly like a big regulated financial institution, the financing appears safer within the present unsure atmosphere. It’s an fascinating construction, FRG is utilizing no fairness, financing all of it with debt and can absolutely personal a levered fairness stub KSS.

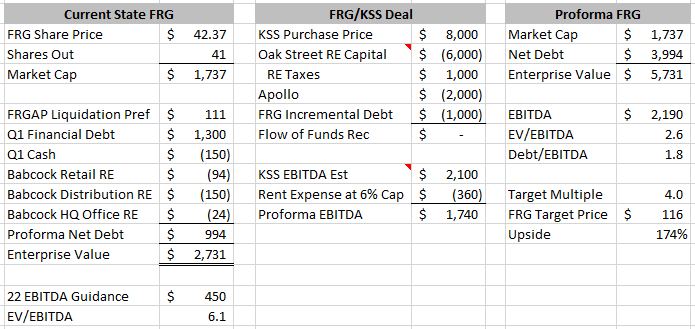

Placing collectively a fast again of the envelope proforma, I provide you with the beneath:

As at all times, in all probability a couple of errors above, be at liberty to level them out, and clearly, that is all excluding the capitalized leases which is actual leverage even whether it is non-recourse, however even in the event you did an EBITDAR valuation, the proforma firm could be extraordinarily low cost. However I believe it reveals the creativity of Kahn and FRG, they’re making a diversified sequence of levered bets by way of non-recourse sale leaseback financing.

Different ideas:

- Whereas not a “wager the corporate” deal, it’s fairly shut and positively dangerous. The market would not like extremely leveraged corporations, FRG will seemingly commerce cheaply for some time as they bring about down the debt and finally additional diversify away from Kohl’s with future offers. Kohl’s is definitely a weak enterprise, it’s within the center floor of not likely having an identification, I am unable to consider something you need to purchase at Kohl’s that you simply could not get elsewhere. There’s loads of debt right here, issues might go horribly mistaken.

- There may be some political stress to reject the deal, notably in Kohl’s house state of Wisconsin, seemingly if FRG acquires KSS, long run this can be a gradual movement liquidation. FRG usually companions with B Riley, the 2 are intertwined some, B Riley has a retail liquidation enterprise and infrequently invests in these distressed retailers. Promoting to FRG in all probability cements Kohl’s as a declining enterprise and that may face political backlash.

- FRG is closely into house furnishings (beforehand talked about Babcock, additionally they personal American Freight which sells clearance home equipment and Buddy’s, a rent-to-own retailer), based mostly on the latest Goal stock debacle, individuals aren’t shopping for house furnishings anymore now that covid is usually within the rear view mirror. Cynically, FRG is perhaps doing this deal to distract from points on the core enterprise. Nonetheless, Brian Kahn has sounded sober by the pandemic concerning stock, provide chain, going ahead expectations, he hasn’t sounded shocked by the slowdown and to date hasn’t needed to drastically change steering.

- Macellum Capital Administration has been partaking in an activist marketing campaign in opposition to Kohl’s, they misplaced their proxy combat lately, however have been placing vital stress on the corporate to promote themselves. Kohl’s administration believed they have been value $70+, however with the latest downturn and disappointing Q1 earnings, bids have are available decrease, so it is perhaps an opportunistic time for FRG to swoop in and be the white knight. FRG additionally runs a decentralized administration construction, so it may very well be seen as a most popular purchaser for administration as they may maintain their jobs.

- FRG did lately put a $500MM buyback in place (after it was reported they have been a KSS bidder), issues might get fairly wild in the event that they use the KSS money flows to buyback shares versus paydown debt given their Debt/EBITDA ratio would seemingly stay inside there goal vary instantly upon closing of the transaction.

- Brian Kahn has by no means been shy about shopping for shares within the open market (did so much throughout that preliminary Liberty Tax/Buddy’s transaction, signed huge boy letters with anybody that might promote him shares) and his non-public fairness agency, Classic Capital, owns 25+% of the corporate.

Disclosure: I personal shares of FRG and KSS