New to CRE market analysis? This beginner’s guide walks you through understanding the fundamentals, collecting data, and making informed decisions.

Imagine you’re handing over $2,000 per square foot just to lease an office space. Sound crazy? Well, it may be. That’s just real life in the world’s most sought-after commercial real estate (CRE) markets, where the best locations demand crazy prices. So, why all the hype? Access to talent, money, and massive opportunity.

But jumping into these crazily competitive waters means you need more than just a boatload of cash. It takes serious planning, and in-depth “market knowledge”. So, let’s clear up a crucial thing: What global spot is the “it” place, and what drives all this craziness? Let’s dive in.

What Makes a CRE Market “Expensive”?

When we say “expensive” in CRE, it’s not just about the price tag; there’s a lot to it. We gotta look beyond what it costs at first glance to see how awesome it will be for its market value. Here are metrics so we can see just how overpriced it all is, and according to Paperhouses data these metrics are valid.

“Cost per square foot (PSF)” is the big one both for buying and renting. Basically, divide by property size. One sells for \$2,500,000 with a 5,000 sqft size. Thus, it has \$500 PSF value. Higher PSF rates = more expensive.

Past PSF, “capitalization rates (cap rates)” & “yield” are important. To find, divide by Net income by value. You will find property revenue potential. Low cap rates equal high values, making it more expensive, and “yield” shows how well the investment performs in terms of various income streams. Ultimately, if you consider it “expensive” is your risk.

The Reigning Champion: Currently Most Expensive Market

Get this: It is mid-2025, and there is one clear spot: “Hong Kong”. Yes, Hong Kong! New York City and London always put up their numbers but it still stands to be: limited land, intense demand, and status as an awesome global spot.

Data has recorded prime office rents have exceeded over \$250 PSF over the year. In other words, if you want premium properties, it will cost over \$5,000 per sqft. Sources have reported shifts. Hong Kong has lasting wealth and demand.

Different sectors within HK are more pricey than others. Want a retail spot? It costs more than office spots. You can find pricey industrial properties with lower values. But all this revenue, combined, means Hong Kong remains dominant as the main market!

Factors Driving High Prices

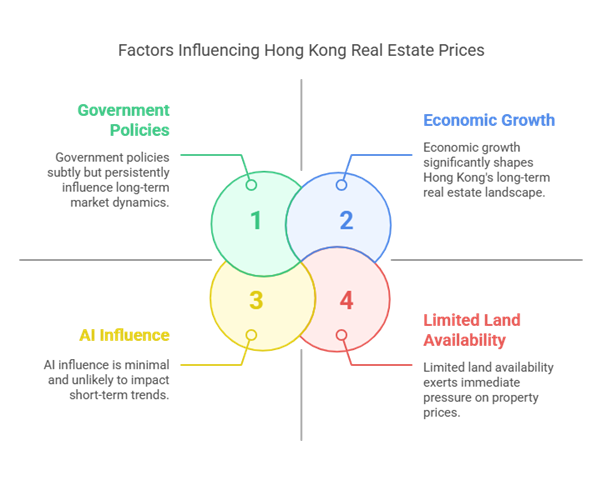

Many interwoven influences put Hong Kong in a dominant position. “Limited Land availability” is huge. With little space to build, there’s intense pressure for current properties.

Now consider “economic growth”. It’s China’s gateway! Hong Kong is a major international place that makes companies demand retail and office places. Foreign investment enhances it. Hong Kong has good policies, stability, and rates that make them attractive around the globe.

Plus, “government policies” like its business environment, put planning, and developing restrictions. Interest rates heavily impact affordability and investment, especially given that US currency has affected the Hong Kong market.

It is unlikely that AI will affect anything in the short term. Space is limited! Thesisdriven notes transformations in Real Estate thanks to AI. It may affect what spaces are attractive, or drive prices up. But, limitedness combined with financial strategy and science will turn business.

Contenders and Close Runners-Up

Hong Kong sits at the top, many global cities still rank high alongside expensive commercial real estate markets. “New York City” and “London” have been and will continue to be dominant, due to their state as business hubs.

NYC has industries that flourish as do companies. NY is not as attractive for investors because of operating costs and high taxes. London has connectivity with large sector benefits but Brexit brings instability.

Emerging markets and new cities like Tokyo and Singapore will flourish with foreign investment. To see these markets bloom can create risks and hurt dominance in today’s market.

Opportunities and Challenges for Investors

If you desire big markets and high value, many high rewards and downsides can occur for RE investors. High returns are obviously a big draw. There can be good capital and general stability!

Obviously:

Downsides show risks as overvaluation harms value to properties, according to Paperhouses data. Keep an eye out for potential big issues happening. Institutional investors are increasing so deal securing comes at a cost.

Capital is what is needed. These markets want to be significant with upfront investment and that is intimidating. Deep understanding of dynamics help.

How to Navigate Expensive CRE Markets (My Expert Advice)

I’ve learned lessons from navigating High Level estate! Success with this means investing and rewarding.

Number one: Always get the specifics right! Due Dilligence is important. To be clear, find agreements and look for a long sustainable future for tenants! Make sure you go for things and get reports that analyze agreements. I once almost overlooked a significant long lease term change and that can lose out on increasing future rent.

Number two, unlock value and “identify undervalued property and reach untapped” potential! You should find strategic value and envision the marketplace. Renovations can make values increase, or you factor value-based-pricing bowtiedparrotfish.substack.com.

Plus, negotiate a deal, and have an eye out for finding funding and financing from others. You must maintain a high price! Work with Brokers/Investors and think about being financed beyond bank rates and you can ultimately win and take your work to the skies.

The Future of Expensive CRE Markets

You can note and keep an eye on possible shifts, as everything revolves around tech progress. If you get these factors it can also help shape future values of properties.

There can be growing emphasis which could also result in changes as shown in ecommerce. Tech and change will be a leading factor to consider later as well.

If that can be done, CRE could shift as well while still keeping those values but look for tech and adapt!

Conclusion

If you know the market and you are business savvy, then markets and strategy can do you justice on what goes around the markets. Make big moves and see how values shift. Take your goals ahead and strategize and make something that fits for you! If that is of use for you and you want to see success and big values in CRE, consult a professional!

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.