If you take a look at the surging S&P 500 (SPY) on Friday…and just about all June…and heck, just about all yr, it positive appears like a brand new bull market is at hand. Nevertheless, funding veteran, Steve Reitmesiter, factors out “that was then…and that is now”. You’ll want to tune in for his 2nd half of 2023 inventory market outlook, buying and selling plan and prime picks. Get the remainder of the story beneath.

Shares closed on a excessive be aware this Friday. This places a bullish exclamation mark on the primary half of the yr!

That’s now…however what occurs later is a little more of a thriller.

Sure, the present pattern may proceed. Or maybe there will probably be cause for extra warning within the months forward.

Let’s spend a while immediately to think about what occurs within the 2nd half of the yr so we will craft the very best buying and selling plan to carve earnings from the market.

Market Commentary

Essentially the most full approach for me to share my inventory market outlook and buying and selling plan is by watching the presentation I simply gave for the MoneyShow that covers the next subjects:

- Evaluation of…How Did We Get Right here?

- Bear Case

- Bull Case

- And the Winner Is??? (Spoiler: Bear case extra doubtless)

- Buying and selling Plan with Particular Trades Like…

Assuming you watched the video, let me add some extra shade commentary.

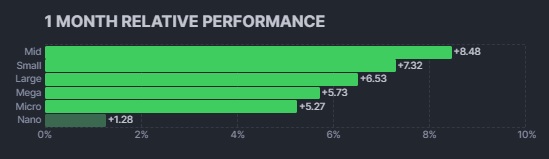

That begins by admitting that the current worth motion is straight up bullish. Even beforehand famous issues with lack of market breadth are enhancing as features are lastly making their approach past the tech mega caps within the S&P 500 (SPY) to different shares together with small and mid caps.

Sadly, on the basic entrance I nonetheless see issues as largely bearish. The important thing being the chance of a future recession forming which might beget decrease company earnings and thus decrease inventory costs.

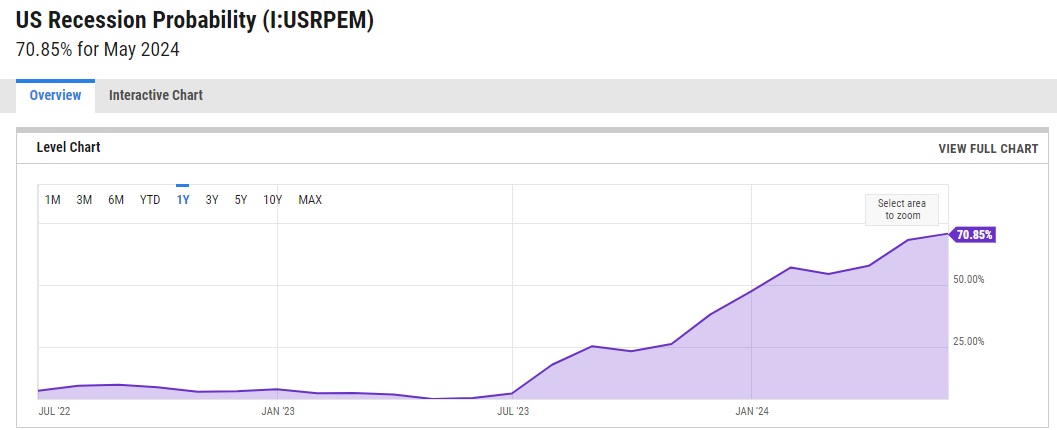

Utilizing the favored recession chance measure the place people examine the inversion between the three month & 10 yr Treasuries, that now appears like this at simply over 70% chance of recession by Might 2024:

So how can shares be up this a lot as the long run chance of recession darkens?

This matches in with the “Boy Who Cried Wolf” model of the funding story. Simply substitute “Wolf” with “Recession”.

Buyers are uninterested in listening to in regards to the chance of recession because it retains NOT taking place. At this stage they won’t react UNTIL that recession/wolf is on their doorstep with blood dripping from its fangs. THEN buyers will promote shares in earnest. Till that point, it appears to be…”Celebration on Garth” for buyers.

You might have heard a snippet immediately that the Core PCE inflation studying was barely higher than anticipated. Since that is the Fed’s favourite inflation measure it was thought-about the principle catalyst for shares flying greater as soon as once more.

Now the info…

+4.6% yr over yr inflation is certainly higher than the 4.7% studying from final month. However until I’m mistaken, it’s nowhere near the two% goal inflation fee required by the Fed.

Additional, the month over month studying got here in precisely as anticipated at +0.3% which nonetheless factors to the present tempo of improve between +3.6% and 4%. Once more, nonetheless too sizzling.

This explains why the percentages of a fee hike on the subsequent Fed assembly on 7/26 is now as much as 87% chance vs. 72% per week in the past and up from 53% a month in the past. Which means this inflation studying doesn’t make anybody suppose the Fed will cease placing their foot on the neck of the economic system with future fee hikes.

Please do not forget that on Wednesday, Chairman Powell famous as soon as once more that 2 extra fee hikes are on the menu. This was accompanied by the standard sound bites about extra work to do…and better charges for longer…and please get off your crack pipe in the event you suppose that we’ll decrease charges this yr (OK…that final half was me, not Powell 😉

There may be a whole lot of key financial reviews this coming week like ISM Manufacturing, ISM Service and Authorities Employment. Nevertheless, until they SCREAM RECESSION, then I think buyers will stay blissfully ignorant.

No…I’m not saying the bull market will hold advancing continuous from right here. I’m saying it’s not prepared for an actual dump till proof of a recession is seemingly irrefutable.

Word that always the tip of 1 / 4 ends with a bang adopted by a whimper. That’s the reason I’m not chasing this market. We’ve got sufficient available in the market too take part in upside whereas not extending our necks to far lest our heads get chopped off.

I nonetheless suppose we have now a gentle case of irrational exuberance which ought to give approach to a modest pullback and buying and selling vary to start out July. This may be the logical selection as buyers await extra clues to level out the percentages of recession and whether or not that pushes us extra bullish…or again into our bearish caves.

However…who says the market is logical? 😉

For now, a balanced portfolio nearer to 50% invested feels probably the most applicable given the info in hand. We are going to proceed to watch the state of affairs and make changes as applicable. Simply don’t be too late to react to that recessionary wolf when it begins shifting your approach.

What To Do Subsequent?

Uncover my full market outlook and buying and selling plan for the remainder of 2023. It’s all out there in my newest presentation:

2nd Half of 2023 Inventory Market Outlook >

Simply in case you’re curious, let me pull again the curtain a little bit wider on the principle contents:

- Evaluation of…How Did We Get Right here?

- Bear Case

- Bull Case

- And the Winner Is??? (Spoiler: Bear case extra doubtless)

- Buying and selling Plan with Particular Trades Like…

- High 10 Small Cap Shares

- 4 Inverse ETFs

- And A lot Extra!

If these concepts attraction to you, then please click on beneath to entry this important presentation now:

2nd Half of 2023 Inventory Market Outlook >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares have been buying and selling at $443.25 per share on Friday afternoon, up $5.14 (+1.17%). 12 months-to-date, SPY has gained 16.78%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Steve Reitmeister

Steve is best recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Study extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The submit Is the Bear Market TRULY Lifeless? appeared first on StockNews.com