Because of Writser for pointing me to this concept

Rubicon Expertise (RBCN) ($36MM market cap) is primarily an NOL money shell with a small $4MM income, roughly break-even, industrial sapphire enterprise. RBCN was beforehand buying and selling under web present asset worth till 7/5 when Janel Company (JANL) supplied to tender for 45% of the shares at $20/share. Following the tender, Rubicon will distribute a $11/share particular dividend (roughly their extra money) to all shareholders together with Janel and likewise delist from the NASDAQ together with suspending their SEC reporting necessities (“go darkish”). If everybody absolutely participates within the tender supply (which they need to, however is unlikely, most likely a number of forgotten shares on the market), RBCN shareholders will obtain a complete of $15.05 in money per share (45% x $20 + 55% x $11) within the subsequent couple months, plus a darkish NOL stub. The shares roughly commerce for the $15.05 money consideration quantity immediately.

To completely entry the NOLs, Janel will then be incentivized to make one other tender supply on that residual stub in three years (IRS required ready interval to protect the NOL) to get their possession degree above 80% to allow them to consolidate the monetary statements. Janel spells out that potential second step of their schedule 13D:

The aim of the supply is for Janel to accumulate a major possession curiosity in Rubicon, along with illustration on Rubicon’s Board, in an try and (i) rejuvenate, reposition and restructure Rubicon’s enterprise and model by specializing in its worthwhile enterprise line and implementing a decrease price construction to attain profitability and (ii) enable Janel to be ready to doubtlessly extra simply purchase such variety of further Shares of Rubicon three or extra years thereafter that might, after which, ought to such transaction happen, allow Janel to consolidate the monetary statements of Rubicon’s with its personal, thereby permitting Janel to learn from Rubicon’s important web working loss (“NOL”) carry-forward belongings. Beneath federal tax legal guidelines, Janel would then be capable to carry ahead and use these NOLs to scale back its future U.S. taxable earnings and tax liabilities till such NOLs expire in accordance with the Inner Income Code of 1986, as amended.

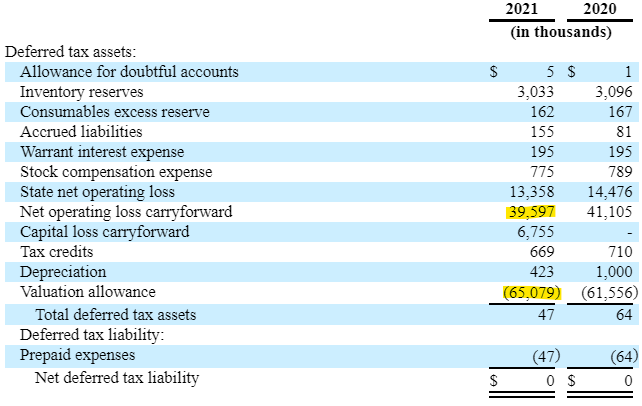

For the reason that firm is not money movement constructive, they at the moment have a full valuation allowance towards the ~$65MM in tax belongings:

Whereas the full tax asset is $65MM, about $39.5MM is federal which is probably going extra precious and simply transferrable than the $13.3MM in state taxes (IL and IN), I am guessing Janel might additionally take full benefit of the $6.75MM of capital loss carryforwards too. Let’s take away the state tax belongings and name it $46.25 in worth or $19/share (plus no matter you worth the remaining enterprise for) that Janel is paying $9/share ($20 minus the $11 particular dividend). You’ve got obtained a while worth of cash in there since they’re going to want to attend 3 years for the following tender, and through that point among the NOL will expire (it began expiring in 2021, however I do not know the amortization schedule of the NOL). Seems like doubtlessly an ideal deal for each side given RBCN traded for $9.00-$9.25 previous to the announcement.

I do not know a lot about Janel Corp, it’s a $37MM market cap firm traded OTC that’s 42% owned by Oaxaca Group. It seems to be a holding firm of smallish operations in logistics, manufacturing and a few well being care. We’re taking some counterparty danger right here in each the deal being accomplished efficiently and Janel in the end having the ability and prepared to buyout the remaining stub in 3+ years. They’ve dedicated financing already from the growth of their established credit score line with Santander (needn’t go to the syndicated or non-public debt markets like FRG/KSS for instance). Santander can also be offering them with a bridge mortgage whereas they await the particular dividend to receives a commission out. The opposite minimal situation is 35% of holders tendering, 4 main shareholders together with names individuals studying this weblog would acknowledge personal 27% of the shares have already agreed to tender, in order that must be no drawback both.

I shuttle in my head on what worth to ascribe to the stub place. Publish tender it is going to nonetheless have the identical $19/share (or roughly that, once more unsure how a lot will expire) in tax belongings, Janel will probably be located as the one bidder but additionally they’re going to have a sunk price of buying 45% of it, we could be beneath a distinct company tax regime, it will likely be instantly useable so no low cost for the time worth or danger from their perspective that they will not get entry to the NOL. I do not see why the bottom case should not be $9 once more, however I might be too optimistic in that view, the great factor right here is it does not matter a lot as it is a free roll as soon as the deal closes.

Different ideas:

- Why is it low cost? Publish tender and particular dividend, it is going to go darkish and be a small stub with a catalyst 3+ years out, that does not enchantment to many buyers, notably within the present atmosphere when time horizons are shrinking as individuals are fearful of the economic system. It’s a CVR like asset, you’ve got obtained some counterparty danger with JANL, it must have the flexibility and want to accumulate the remaining stub in 3 years. Many buyers are down for the yr (me included!), doubtlessly behind their benchmarks and do not need to put money into one thing the place you are simply going to get your a reimbursement in 2022, and have this illiquid onerous to worth darkish safety after that we can’t know the true worth for 3 years.

- I like this higher than different NOL shells, it’s a higher construction for present shareholders, because it does not depend on new administration to make acquisitions at a time when there’s nonetheless loads of SPACs and busted biotechs taking a look at reverse merger fashion offers.

- RBCN offered some uncooked land in Batavia, IL. The sale hasn’t closed but, however the firm expects to web $600k in money, or roughly $0.25/share. The corporate additionally owns their present industrial facility in Bensenville, IL which they purchased for $2.3MM (or simply beneath $1/share) in September 2018. Even after the particular dividend, there must be some residual liquidation worth left within the working enterprise and probably extra if they’ll flip it round.

- Unsure but of the tax implications of this concept, could be greatest to play it in a tax deferred accounts or given it’s 2022 and loads of us have tax losses, may not be so dangerous in a taxable account both.

- There’s at the moment not an odd-lot precedence provision, I am assuming that’s on goal by the 4 giant fund shareholders, they don’t need individuals piling in to the odd-lot provision and find yourself transferring worth to small shareholders enjoying that arb sport. There’s additionally no cancel provision primarily based on a drop within the over market both like we have seen in different tender gives.

- When you’ve got entry to the skilled market, could be value watching this one after the particular dividend, particularly if I am proper that the second step will not be accomplished at an enormous low cost.

Disclosure: I personal shares of RBCN