The great rally for S&P 500 (SPY) this week has extra folks believing the bull market is at hand. 43 yr funding veteran Steve Reitmeister weighs in along with his up to date market outlook at buying and selling plan. (Spoiler alert: the long run for inventory costs is probably not as brilliant as marketed). Get the complete story under.

Shares burst by stiff resistance at 4,200 for the S&P 500 (SPY) on Thursday. Then Friday put an exclamation level on the transfer by closing all the best way up at 4,282.

Can we lastly name this the brand new bull market?

And what does that imply for shares within the days forward?

These well timed subjects would be the focus of right this moment’s commentary in addition to our buying and selling technique going ahead.

Market Commentary

There are already many individuals claiming that is the brand new bull market. And it may be true in time. Nevertheless, proper now shares fail the official definition which is a 20% achieve from the closing low.

So again on October 12, 2022 the S&P 500 closed at its lowest degree of three,577.03. Now add 20% to that equates to shares needing to shut above 4,292.44 to technically be known as a brand new bull market.

(Sure, the market did hit an intraday low of three,491 in October. However the official measure of bull and bear markets relies on closing costs like shared above).

In order of Friday’s shut we’re simply 10 factors away from an official crowning of a brand new bull market. That occasion would seemingly would spark a critical FOMO rally as extra bears would throw within the towel, however first a phrase of warning…

DON’T BELIEVE THE HYPE!

Please do not forget that this rally was all in regards to the announcement of a debt ceiling deal. But as shared in my current article, that final result was by no means unsure as a result of permitting a default is a nuclear possibility that neither get together can afford.

When the irrational exuberance clears out subsequent week buyers shall be proper again to the identical bull/bear debate as as to whether we may very well be heading right into a future recession. The latest financial information was a combined bag in that regard beginning with ISM Manufacturing coming in properly underneath expectations at 46.9. Plus, the forward-looking New Orders element plummeted to 42.6 level to weaker outcomes forward.

Sure, under 50 = contraction. And sure, we now have been underneath 50 since November with no recession forming. However with it directionally getting worse, it’s definitely not a optimistic for these calling for a bull market.

However Reity, how in regards to the sturdy employment report Friday morning…definitely that’s trigger for some bullish cheer, proper?

Flawed.

Generally, the market ought to be ok with indicators of financial energy like 339K jobs added which was a whopping 80% higher than anticipated. Nevertheless, it isn’t a optimistic factor when the Fed continues to be very a lot urgent on the brakes of the financial system to tamp down inflation.

One of the vital resilient (aka sticky) types of inflation is wage inflation. That’s nonetheless too excessive as a result of the labor market too sturdy. Thus, in case you are a Fed official relying upon the current information to make your subsequent price determination…then right this moment’s far too sturdy employment report will solely stiffen their hawkish resolve.

In the present day’s information nonetheless has the chances of a 6/14 price hike at solely 30%. That means buyers expect a pause which the Fed has signaled is most probably. BUT the chances of a price enhance once more in July simply spiked to 70% which says that buyers notice the Fed just isn’t performed with their hawkish regime (and that’s NOT bullish).

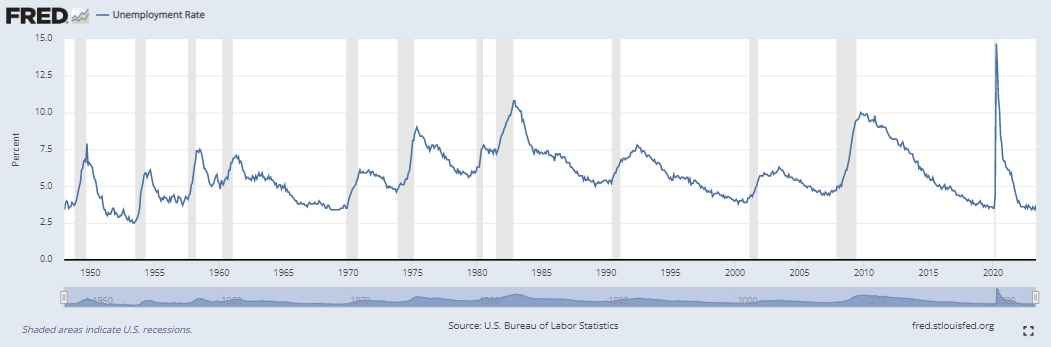

Now think about this chart of the unemployment price simply earlier than the beginning of every recession:

It’s abundantly clear that the unemployment price is a lagging indicator of recessions as it’s trying its effervescent finest simply earlier than the following recession begins.

However certainly, we do have to see job provides truly roll destructive, and unemployment price spike to substantiate {that a} recession is at hand. Given all of the earlier false alerts of a recession forming…that is what shall be essential to persuade buyers to promote shares in earnest as soon as once more.

Reity, is it attainable that you’re flawed and that that is truly the beginning of the brand new bull market?

Sure. That’s attainable which is why my 2 publication portfolios are mainly 50% lengthy presently. What you would possibly name balanced and able to shift extra bullish or bearish when extra concrete proof avails itself.

The important thing presently is to recollect the painful classes from the 2007 to 2009 bear market (aka Nice Recession). Shares technically rang in a brand new bull market given a 20% rally from the November 2008 lows into early January 2009. Subsequent factor you realize shares fall one other 28% to a closing and painful low in March 2009.

These false breakouts are far too widespread within the fashionable period given the undue affect performed by pc primarily based merchants. Their favourite recreation is pushing shares previous key ranges of resistance and help to attract within the suckers…then they reverse course locking in ample income on the expense of others.

I’ll get extra bullish when the chances of recession actually diminish. As already shared, that’s not the case leaving my balanced strategy in place.

At this stage I believe shares will mess around in a spread of 4,200 to 4,300 into the 6/14 Fed announcement the place they prone to remind of us ONCE AGAIN that there’s extra work to do. And charges will keep increased for longer. And nonetheless do not plan to decrease charges til 2024. And that inflation is simply too sticky. And that their base case is {that a} recession will type earlier than they’re performed with their efforts to get inflation right down to 2% goal.

Buyers appear to have a month-to-month case of amnesia between Fed bulletins. Then unload as they’re in some way shocked by what Powell says again and again on the press conferences. So, I believe getting extra aggressively lengthy shares earlier than that mid June announcement appears fairly unwise.

What To Do Subsequent?

Uncover my balanced portfolio strategy for unsure occasions. The identical strategy that has crushed the S&P 500 by a large margin in current months.

This technique was constructed primarily based upon over 40 years of investing expertise to understand the distinctive nature of the present market surroundings.

Proper now, it’s neither bullish or bearish. Somewhat it’s confused and unsure.

But, given the info in hand, we’re most probably going to see the bear market popping out of hibernation mauling shares decrease as soon as once more.

Gladly we will enact methods to not simply survive that downturn…however even thrive. That is as a result of with 40 years of investing expertise this isn’t my first time to the bear market rodeo.

In case you are curious in studying extra, and need to see the hand chosen trades in my portfolio, then please click on the hyperlink under to begin getting on the fitting facet of the motion:

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares rose $0.08 (+0.02%) in after-hours buying and selling Friday. 12 months-to-date, SPY has gained 12.32%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Steve Reitmeister

Steve is healthier identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The publish NOW is it a Bull Market? appeared first on StockNews.com