- If you happen to don’t beginning interested by taxes till January you might be already behind. Planning now saves time for you later.

- Tax planning as a freelancer solely appears daunting till you begin doing it. It’s simple to procrastinate, however when you begin tax planning, life turns into simpler and sooner or later.

- Don’t neglect deductions! That is the commonest factor that freelancers fail to do, any expense associated to enterprise operations is tax deductible.

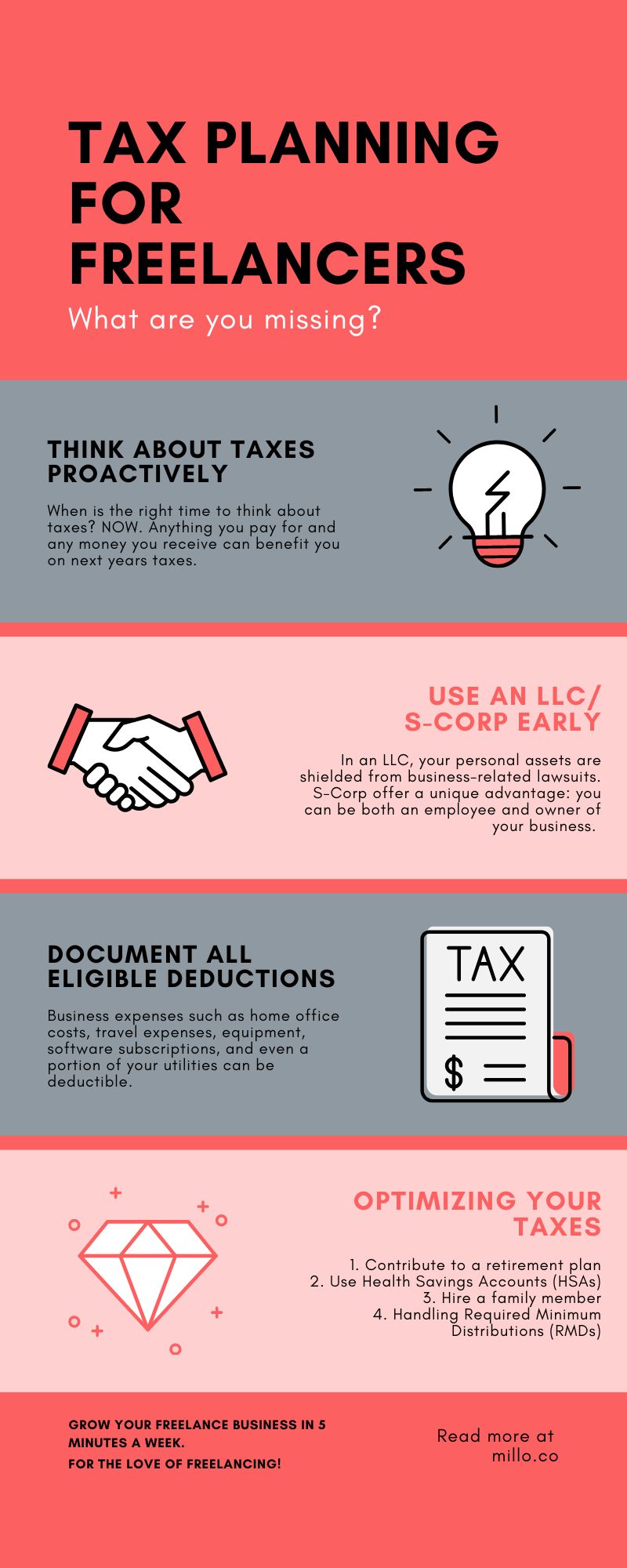

Failing to Suppose About Taxes Proactively

Bear in mind, you’re basically a small enterprise proprietor. Freelancers usually make the error of treating their taxes as an afterthought, solely contemplating them when tax season rolls round. This reactive strategy can result in missed alternatives for deductions and tax financial savings.

Proactive tax planning for freelancers, or anybody actually, includes common evaluations of your revenue, bills, and potential deductions all year long. This ongoing course of means that you can determine tax-saving alternatives, make mandatory changes, and keep away from undesirable surprises come tax season. It’s important to seek the advice of with a tax skilled who might help information your selections and supply recommendation tailor-made to your particular state of affairs.

As a normal rule of thumb, to guard your self, put aside 25-30% of your revenue for taxes. This can enable you to keep away from the dreaded ache of owing hundreds of {dollars} come tax season.

Failing to Use an LLC/S-Corp Early

Many freelancers function as sole proprietors, unaware that altering their enterprise construction might supply vital tax benefits. Working as an LLC (Restricted Legal responsibility Firm) or S-Corp can present authorized safety and tax advantages.

In an LLC, your private belongings are shielded from business-related lawsuits. On the tax aspect, an LLC gives flexibility as earnings and losses can move by means of on to your private revenue with out going through company taxes.

S-Corps, alternatively, supply a novel benefit: you might be each an worker and proprietor of what you are promoting. This lets you pay your self a “cheap wage” and take extra revenue as distributions, which aren’t topic to self-employment tax, probably saving you hundreds annually.

Failing to Doc All Eligible Deductions

Freelancers usually overlook helpful deductions. Enterprise bills corresponding to house workplace prices, journey bills, gear, software program subscriptions, and even a portion of your utilities might be deductible. It’s essential to maintain detailed information of all of your business-related bills all year long.

Bear in mind, correct documentation is essential. The IRS requires proof of all bills claimed as deductions. So, save your receipts, invoices, and financial institution statements. Think about using a cellular app or cloud-based system to trace your bills and retailer your information digitally.

Optimizing Your Taxes

Tax optimization includes utilizing authorized methods to scale back your tax legal responsibility. Listed here are some tax planning methods freelancers can take into account:

1. Contribute to a retirement plan: Self-employed people can contribute to a Simplified Worker Pension (SEP) IRA or a Solo 401(ok) plan. These contributions are tax-deductible, and the funds develop tax-free till retirement.

2. Leverage Well being Financial savings Accounts (HSAs): In case you have a high-deductible well being plan, you’ll be able to contribute to an HSA. Contributions are tax-deductible, and withdrawals for eligible healthcare bills are tax-free.

3. Rent a member of the family: In case you have kids or different dependents, take into account hiring them. You may deduct their wages as a enterprise expense, and so they could also be in a decrease tax bracket.

4. Dealing with Required Minimal Distributions (RMDs)

If you happen to’ve contributed to retirement accounts like a 401(ok) or an IRA, you’ll have to begin taking RMDs while you attain the age of 72. RMDs are calculated based mostly in your life expectancy and account balances. Failing to take your RMD can lead to a hefty penalty—50% of the quantity you need to have withdrawn.

In planning for RMDs, take into account the next methods:

- Contemplate a Roth Conversion: In case your conventional IRA or 401(ok) funds are transformed to a Roth IRA, you’ll be able to keep away from RMDs, as Roth IRAs don’t have this requirement. Nonetheless, keep in mind that you’ll owe taxes on the quantity transformed.

- Certified Charitable Distributions (QCDs): If you’re charitably inclined, you can also make a QCD out of your IRA. This distribution goes on to the charity of your alternative, counts in the direction of your RMD, and isn’t included in your taxable revenue.

- Strategic Withdrawals: If you happen to retire earlier than the RMD age, take into account withdrawing out of your retirement accounts strategically to attenuate the affect of RMDs in your tax bracket later.

You Work Laborious For Your Cash, Preserve It

Navigating the tax panorama as a freelancer might be difficult, however proactive tax planning might help you decrease your tax legal responsibility and maximize your earnings. Repeatedly reviewing your revenue and bills, working below the suitable enterprise construction, precisely documenting deductions, optimizing your taxes, and planning for RMDs are all key methods.

All the time seek the advice of with a tax skilled to make sure you’re making the most effective selections to your distinctive state of affairs. Proactive tax planning isn’t just about saving cash—it’s about constructing a stable monetary future.

Turn out to be much more monetary sound by utilizing our free Freelance Charge Calculator.

Preserve the dialog going…

Over 10,000 of us are having each day conversations over in our free Fb group and we might like to see you there. Be a part of us!