Regardless of the investor warning narrative permeating the startup world all through the financial downturn, sure startup-types have been a little bit extra impervious to market situations. The worldwide provide chain was one of many main industrial casualties of the pandemic, so it maybe goes with out saying that corporations tackling points associated to the worldwide provide chain would stay an alluring proposition for in any other case hesitant enterprise capitalists.

Previously couple of months alone, we’ve seen Germany-based IntegrityNext ingest $109 million to assist corporations audit their provide chains for ESG (environmental, social, and governance) compliance; Texas-based Overhaul haul in $73 million for a provide chain safety platform; San Marcos-based Everstream safe $50 million to convey predictive insights to provide chains; France’s Sesamm snap up $37 million to offer corporates ESG insights into their provide chain; and India’s Pando pull in $30 million to develop its freight administration platform.

As we speak, it’s Prewave‘s flip to reveal that the worldwide provide chain continues to be one of many hottest tickets for elevating VC bucks. The Austrian startup revealed that it has raised €18 million ($20 million) in what it’s calling a Sequence A+ spherical of funding, following on from its €11 million ($12.3 million) Sequence A spherical eight months in the past.

For its newest money injection, Prewave has additionally attracted European VC heavyweight Creandum, which has beforehand backed the likes of Spotify, Klarna, and iZettle.

Danger components

Prewave founders Harald Nitschinger and Lisa Smith Picture Credit: Prewave

Based out of Vienna in 2017 by Harald Nitschinger and Lisa Smith, Prewave touts itself as a holistic provide chain threat platform that spans “each part of the danger lifecycle,” by way of figuring out, analyzing, mitigating, and reporting these dangers.

For instance, corporations akin to BMW, Lufthansa, and PwC use Prewave to observe each entity of their provide chain by way of channels akin to social media, information stories, and different knowledge sources to grasp not solely what is occurring inside corporations of their provide chain, but additionally externalities akin to earthquakes, floods, political unrest, lawsuits, or employee strikes — something that might impression the worldwide switch of products.

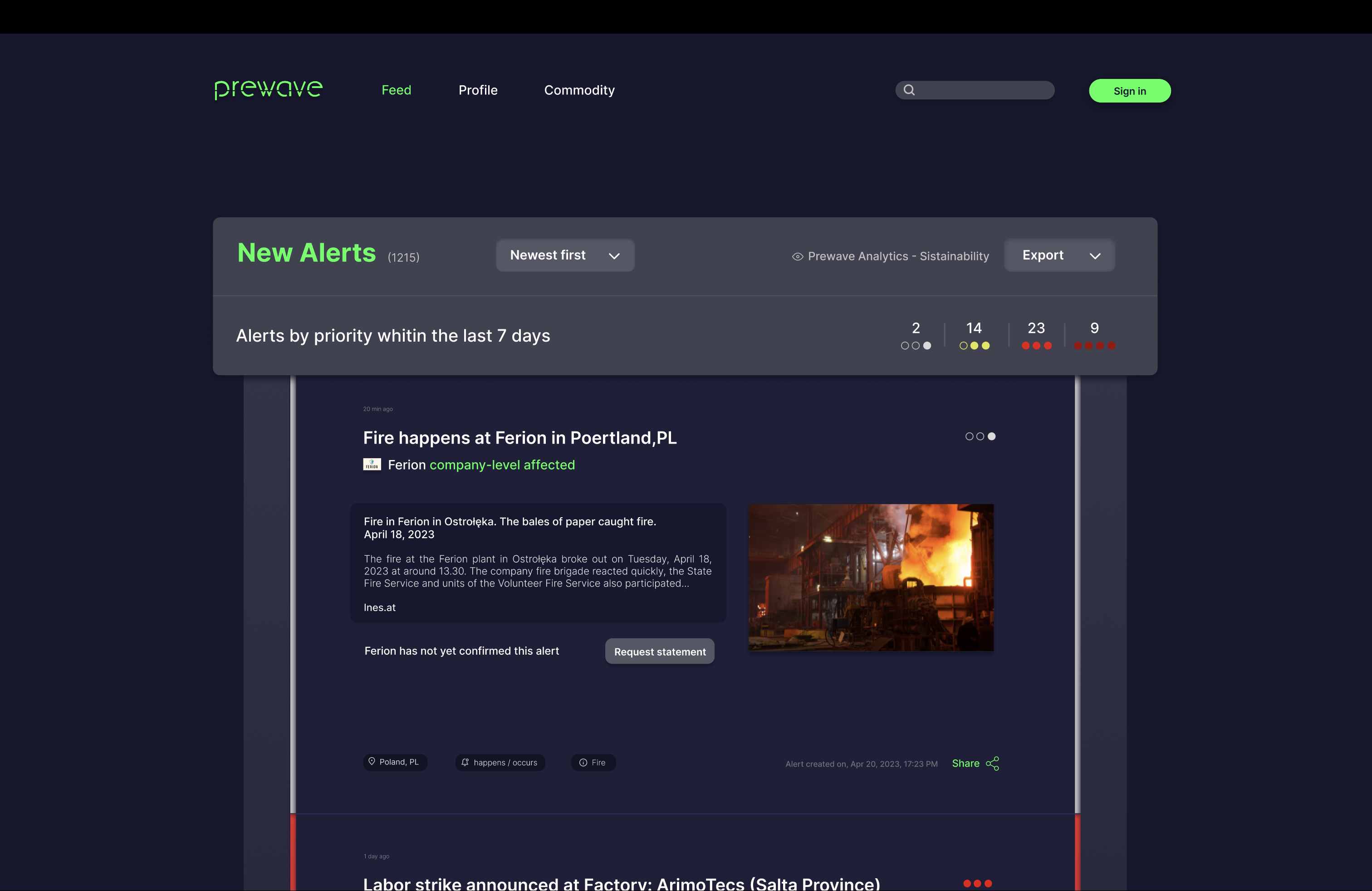

Prewave feed Picture Credit: Prewave

The corporate says it has developed its personal proprietary “crawler” that finds publicly out there data throughout dozens of languages.

“Having our personal crawler as a substitute of relying purely on exterior provide chain knowledge suppliers permits us to constantly increase and enhance our protection,” Smith defined to TechCrunch by e mail. “We additionally connect with a number of social media platforms and for particular occasion varieties we use exterior knowledge sources as for instance USGS (United States Geological Survey) for earthquake knowledge or GDACS (World Catastrophe Alert and Coordination System) for climate data. The mix of all of those knowledge factors ensures a broad protection of each native and world provide chain threat occasions.”

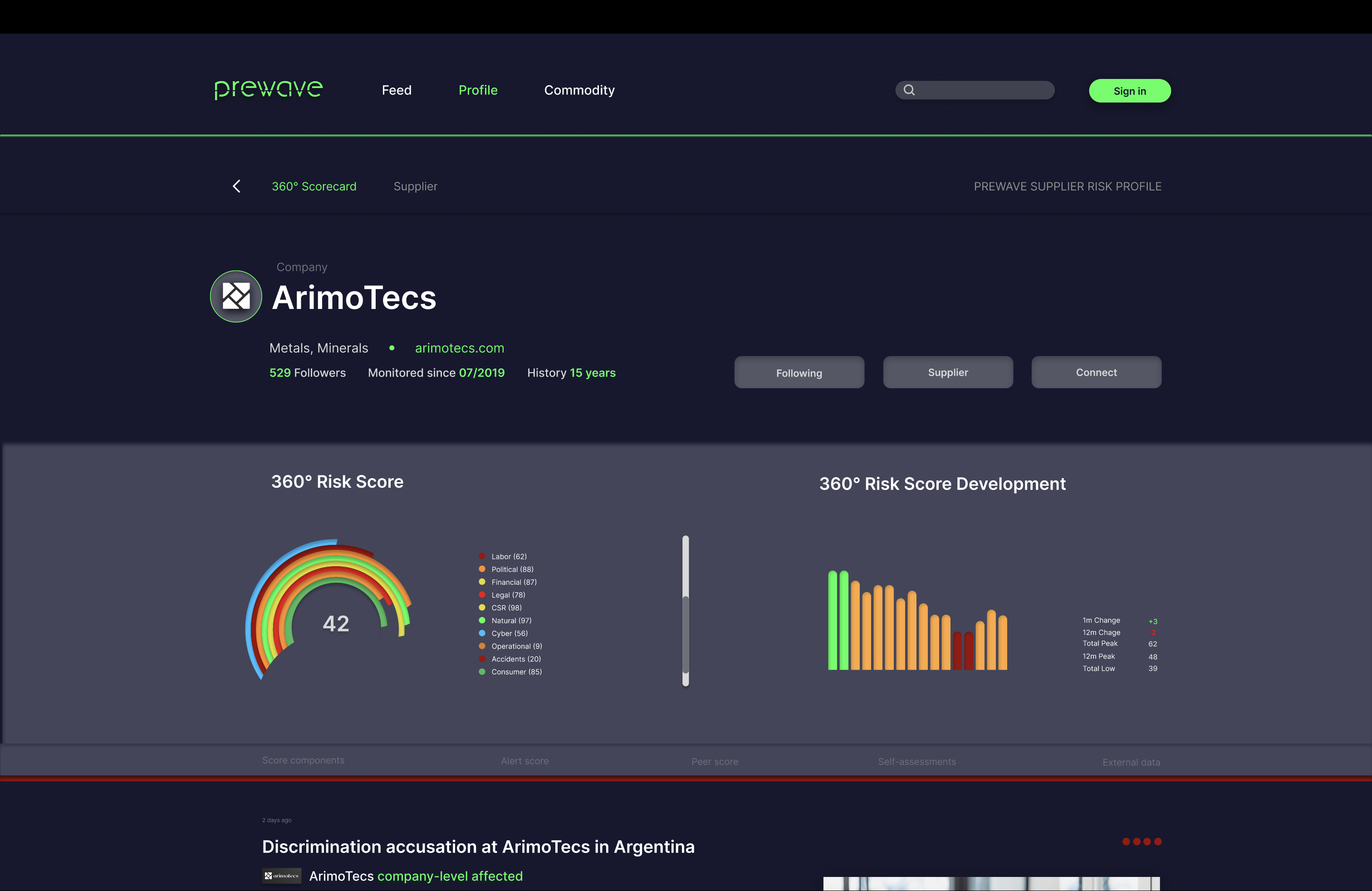

Prewave then crunches all the info and delivers a dynamic provider threat rating that modifications according to all the brand new knowledge it ingests.

Prewave provider web page with 360-degree scorecard Picture Credit: Prewave

Provide (chain) and demand

There are a variety of the reason why demand for provide chain insights is skyrocketing, past merely enhancing their backside line by averting disruptions. These embrace authorized obligations, for instance Germany just lately handed a brand new provide chain due diligence regulation that makes it the accountability of enormous corporations to trace human rights violations and environmental dangers by way of their provide chain. A comparable directive is at the moment being proposed for the broader European Union (EU) too.

After which there’s the straightforward reality that buyers more and more anticipate the businesses they do enterprise with to have not less than some ethical and moral rules, and aren’t purely beholden to shareholder sentiment.

“Provide chain know-how has withstood the financial headwind in recent times as a result of it has turn into more and more important for corporations to optimize their operations, adapt to exterior dangers and scale back prices inside their provide chain,” Nitschinger instructed TechCrunch by e mail. “The pandemic, for instance, uncovered crucial vulnerabilities in world provide chains, making it clear that companies want to speculate into applied sciences that enhance visibility and sustainability, predict potential disruptions and allow extra agile and responsive methods. As companies proceed to face financial challenges, the significance of provide chain threat administration know-how is just anticipated to develop.”

With one other $20 million within the financial institution, Prewave is planning to double down on a current progress that has seen its headcount develop from 20 staff in the beginning of final 12 months to greater than 100 in the present day, which Nitschinger says “mirrors the substantial income enhance” it has seen over the identical interval.

Apart from lead backer Creandum, Prewave’s newest funding included contributions from Ventech, Kompas, Seed+Velocity, Segnalita, Speedinvest, Working Capital Fund and Xista Science Ventures.