MBIA Inc (MBI) ($680MM market cap) is now a shadow of its former self, previous to the 2007-2009 monetary disaster, MBIA was the main monetary assure insurer within the U.S., the place MBIA would lend out its AAA ranking to debtors for an upfront charge. This enterprise mannequin most likely by no means made sense, it assumed the market was persistently mispricing default danger, the charge MBIA charged needed to make it economical to remodel a decrease rated bond to the next rated one.

Within the early-to-mid 2000s, MBIA was leveraged over 100 instances, they assured the well timed cost of principal and curiosity on bonds that have been 100+x that of their fairness, solely a small variety of defaults would blow a gap into their stability sheet. When the enterprise was first based, MBIA centered on municipal debt by means of their subsidiary Nationwide Public Finance Assure Corp (“Nationwide”), with the thesis being that even when some municipal bonds weren’t formally backed by taxpayers, there was an implied assure or a authorities entity up the meals chain that may bail out a municipal borrower. That has largely proved true (minus the current quasi-bankruptcy in Puerto Rico), nevertheless MBIA was grasping and grew into guaranteeing securitized autos (through subsidiary MBIA Corp) previous to the GFC. MBIA and others (notably AIG Monetary Merchandise) obtained caught, discovering themselves on the hook for beforehand AAA senior tranches of ABS CDOs and subprime-RMBS that went on to undergo materials principal losses. There was nobody up the chain to bail out a Cayman Islands particular objective car with a P.O. field as a company deal with. So much has occurred within the 15 years since 2008, MBIA Corp stopped writing new enterprise nearly instantly, Nationwide continued to jot down new enterprise on municipal issuance however stopped in 2017 after Puerto Rico went additional into misery, Nationwide had vital publicity to island. The enterprise has been in full runoff since then.

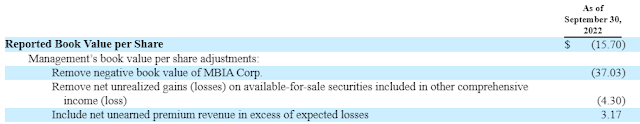

The excellence between Nationwide (municipal bonds) and MBIA Corp (asset backed securities) is essential, MBIA Corp and Nationwide are legally separate entities which are non-recourse to the holding firm, MBIA Inc. MBIA Corp’s fairness is approach out of the cash, utterly nugatory to MBIA Inc, the entity is being run for the good thing about its former policyholders. Nationwide alternatively has constructive fairness worth, however when consolidated with MBIA Corp on MBIA Inc’s stability sheet, leads to an total unfavourable e book worth. However once more, these are two separate insurance coverage corporations which are non-recourse to the dad or mum. The SEC slapped MBIA Inc’s wrist for reporting an adjusted e book worth based mostly on the idea that MBIA Corp’s unfavourable e book worth was not related to the dad or mum, as some compromise, MBIA Inc stopped offering the tip end result, however nonetheless gives the elements of their adjusted e book worth (unsure how that is considerably totally different, however no matter). Listed here are the changes for Q3:

By making these changes, MBI’s adjusted e book worth is roughly $28.80/share, right this moment it trades for $12.50/share. The final two objects within the adjusted e book worth bridge are extra runoff-like ideas, these are the values that MBIA Inc would theoretically earn over time because the bonds mature of their funding portfolio and erase any mark-to-market losses (largely pushed by charges final 12 months) after which any unearned premiums assuming their anticipated losses assumptions are correct.

I’ve type of ignored Puerto Rico, I’ve passively adopted it over time through Reorg’s podcasts, it’s an excessive amount of to enter right here, however MBIA Inc’s (through Nationwide) publicity is essentially remediated at this level (asserting in December that they settled with PREPA, Puerto Rico’s electrical utility that was destroyed in Hurricane Maria), clearing the way in which to promote itself. From the Q3 earnings press launch:

Invoice Fallon, MBIA’s Chief Govt Officer famous, “Given the substantial restructuring of our Puerto Rico credit, we have now retained Barclays as an advisor and have been working with them to discover strategic alternate options, together with a doable sale of the corporate.”

Primarily all the bond insurance coverage corporations have stopped writing new enterprise, the one one in every of any actual measurement remaining out there is Assured Warranty (AGO) ($3.7B market cap). Assured has vital overlap with Nationwide that may drive lifelike synergies. Avenue Insider reported that AGO and one other firm are in superior talks with MBIA. They’re the one true strategic purchaser (possibly among the insurers that bid on runoff operations may be too), AGO additionally trades low-cost at roughly 0.75x GAAP e book worth. AGO would want to justify a purchase order to their shareholders that may no less than be on par with repurchasing their very own inventory (which they do continually).

In my again of the envelope math, I am solely pulling out the unfavourable e book worth related to MBIA Corp from the adjusted e book worth, then slapping a 0.75x adjusted e book worth a number of on it. Once more, the opposite two objects in MBI’s adjusted e book bridge appear extra like market dangers a purchaser could be assuming and must be compensated for bearing the chance of ultimately attaining. AGO ought to be capable to justify paying the identical a number of for MBIA Inc since it is going to embody vital synergies. I provide you with a deal goal value of roughly $16/share, or 28% upside from right this moment’s costs.

I purchased some shares not too long ago (I do know, one other speculative arb thought!).

Disclosure: I personal shares of MBI