Whereas medicare supplier Clover Well being (CLOV) appears optimistic about its prospects, Avenue analysts count on its income to say no within the coming quarters. So, do you have to Purchase, Promote or Maintain the inventory now? Hold studying.

Clover Well being Investments, Corp. (CLOV) has confronted quite a few lawsuits in recent times. Nevertheless, as of June 2023, the company has established an settlement to resolve seven pending spinoff lawsuits in Delaware, New York, and Tennessee courts. Moreover, the corporate has now reached settlements for the entire excellent civil litigation that was filed following its de-SPAC transaction.

By way of monetary efficiency throughout its final fiscal quarter, Clover Well being posted revenues of $513.60 million whereas its web loss stood at $28.80 million. In the meantime, its Insurance coverage MCR noticed an enhancement of over 1,400 foundation factors, and its Non-Insurance coverage MCR skilled greater than 600 foundation factors enchancment.

Scott Leffler, CFO of Clover Well being, expressed optimism in regards to the firm’s future. “We’re enthusiastic about our improved outlook for 2023, the favorable influence on our liquidity place, and are additionally more and more assured within the Firm’s potential to ship profitability on an Adjusted EBITDA foundation for full 12 months 2024 with out the need of elevating further capital,” mentioned Leffler.

Conversely, Wall Avenue analysts don’t anticipate that the corporate will safe profitability quickly. Furthermore, the consensus estimate suggests income will decline throughout the present and the next quarter. Subsequently, I like to recommend potential buyers await a extra appropriate entry level. A complete analysis of varied metrics gives a extra well-rounded understanding of the prevailing state of affairs.

Analyzing CLOV’s Monetary Efficiency: A Key Metrics Overview from 2020 to 2023

The trailing-12-month web revenue of CLOV has demonstrated a substantial downward development with a number of fluctuations from September 2020 to June 2023, as follows:

- On September 30, 2020, CLOV’s web revenue was -$10.01 million.

- There was a big drop in the direction of the tip of the 12 months, contributing to a web revenue of -$136.39 million by December 31, 2020.

- The damaging development continued by means of the primary half of 2021, as proven by values of -$184.80 million in March, -$502.36 million in June, and reaching -$526.94 million by the tip of September.

- 2022 noticed continued fluctuations with excessive damaging measures of -$587.75 million in December of 2021, lowering to -$401.22 million by June of 2022 however spiking once more to -$442.00 million in September.

- The ultimate knowledge set signifies a slight enchancment in CLOV’s monetary situation, highlighting lowered losses in web revenue resulting in -$338.84 million as of December 31, 2022, and additional lowering to -$260.77 million as of June 30, 2023.

In broad strokes, CLOV skilled fairly a steep dive into damaging territory throughout this time-frame. Calculating the expansion charge by evaluating the ultimate determine from June 2023 (-$260.77 million) to the preliminary determine from September 2020 (-$10.01 million), there’s a important improve in losses, displaying a damaging development over this era.

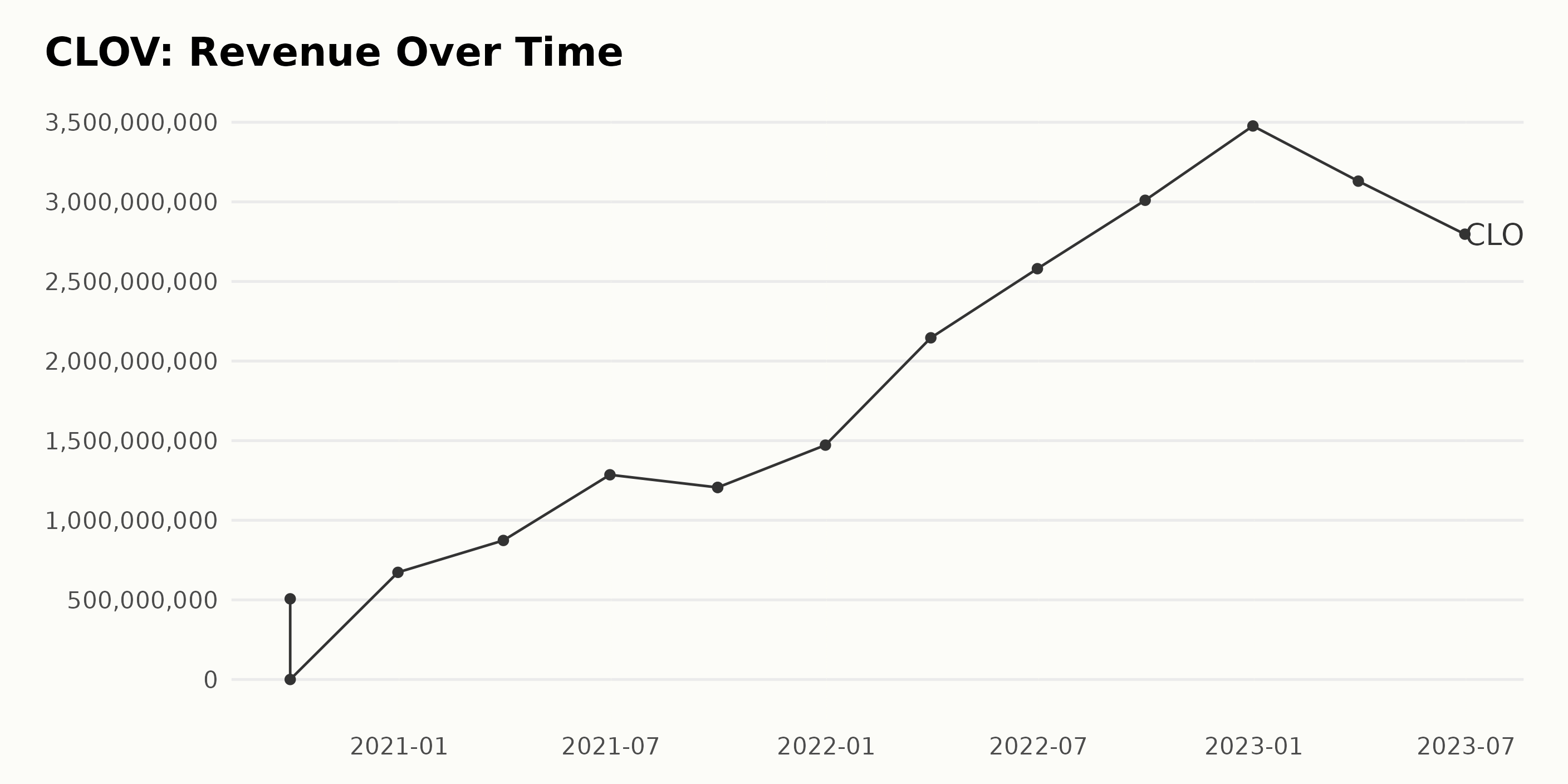

The trailing-12-month income development of CLOV displays an total ascending sample over time, with fluctuations noticed primarily within the later durations.

- On September 30, 2020, income of $506.65 million was recorded for CLOV.

- The determine dramatically rose to $2.14 billion by March 31, 2022, indicating a big development charge.

- An extra surge was noticed by June 30, 2022, when income peaked at $2.58 billion.

- After reaching this excessive, the income skilled a decline by September 30, 2022, to $3.00 billion, and continued to plummet to $2.79 billion by June 30, 2023. Regardless of the talked about fluctuations, CLOV managed to take care of its income above the $2 billion threshold towards the tip of the sequence knowledge.

- The newest worth on file, dated June 30, 2023, is $2.79 billion. This worth signifies a considerable improve from the preliminary file of $506.65 million, displaying a sign of a notable development charge by means of the sequence line.

Deal with the latter a part of the timeline exhibits a reversed development, from a earlier growing sample to a lowering one, significantly from September 2022 onwards. This factors towards a brand new section for CLOV’s income transition that awaits to be both sustained or reverted again to an growing plot sooner or later. This sequence ends with a noteworthy worth of $2.79 billion for June 2023 after a interval of decline.

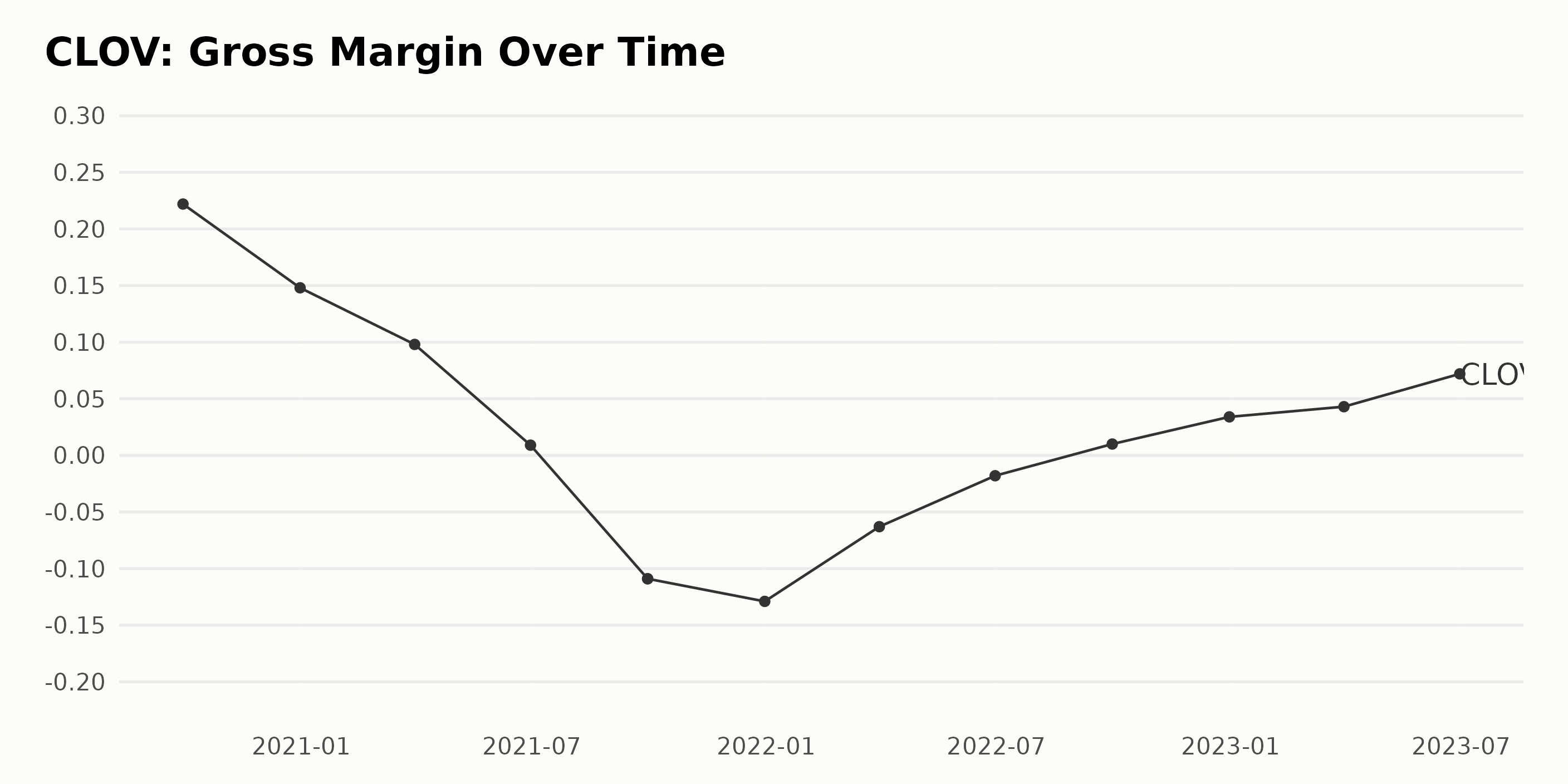

The info sequence presents the Gross Margin of CLOV, from September 30, 2020, to June 30, 2023. Key observations:

- The Gross Margin began at 22.20% on September 30, 2020, however it noticed a constant decline till December 31, 2021, when it reached a low of -12.90%.

- After hitting this backside, the Gross Margin step by step rebounded and reached a price of 1.00% by September 30, 2022.

- CLOV continued to expertise favorable development in its Gross Margin, growing to 7.20% on June 30, 2023. This knowledge signifies important year-on-year fluctuations within the firm’s Gross Margin between 2020 to 2023.

The notable development is a interval of decline adopted by a sluggish restoration. By way of development charge, measured from the preliminary worth to the final worth, there’s a noticeable lower from 22.20% to 7.20%, indicating a relative Gross Margin drop of roughly 15% over almost three years. Emphasizing newer knowledge, significantly the most recent worth as of June 30, 2023, there’s a clear development of restoration, with the Gross Margin standing at 7.20%. This underlines CLOV’s enchancment after a difficult monetary interval.

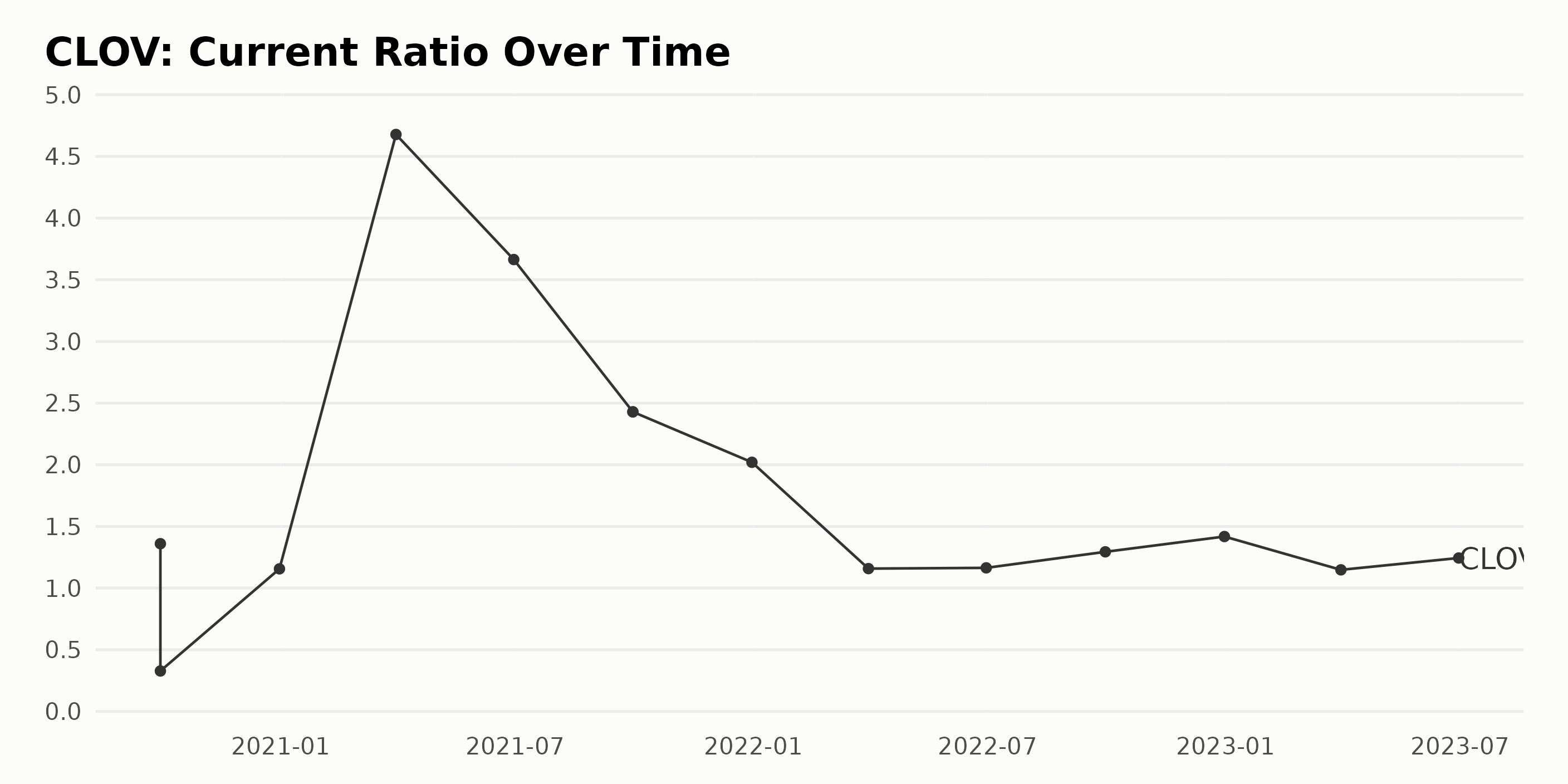

The Present Ratio of CLOV has fluctuated over the noticed time sequence, with a basic downtrend from the third quarter of 2020 to the third quarter of 2023. Listed below are key observations:

- Beginning at 1.36 in September 2020, there was a direct decline in the identical month to 0.328.

- By December 2020, a slight restoration was famous, taking it as much as 1.156.

- The height of this development was reached on the finish of the primary quarter of 2021 when the Present Ratio of CLOV dramatically surged to 4.678.

- Following this peak, it fell over consecutive quarters to three.664 in June 2021, 2.429 by September 2021, after which reasonably stabilizing at this degree.

- The downward development resumed in December 2021, the place the worth stood at 2.02, falling additional to 1.158 by March 2022.

- A relative plateau between the second quarter of 2022 to the second quarter of 2023 is noticeable, oscillating barely between 1.164 and 1.244, with a minor peak at 1.418 in December 2022.

- As of the most recent knowledge level in June 2023, it stands at 1.244, representing a lower of roughly 9% from its preliminary worth in September 2020.

Typically, the dataset implies that the present ratio state of affairs of CLOV has been largely erratic, with a promising begin adopted by an unstable interval of ups and downs.

Analyzing CLOV’s Share Worth Volatility and Subsequent Late Surge in 2023

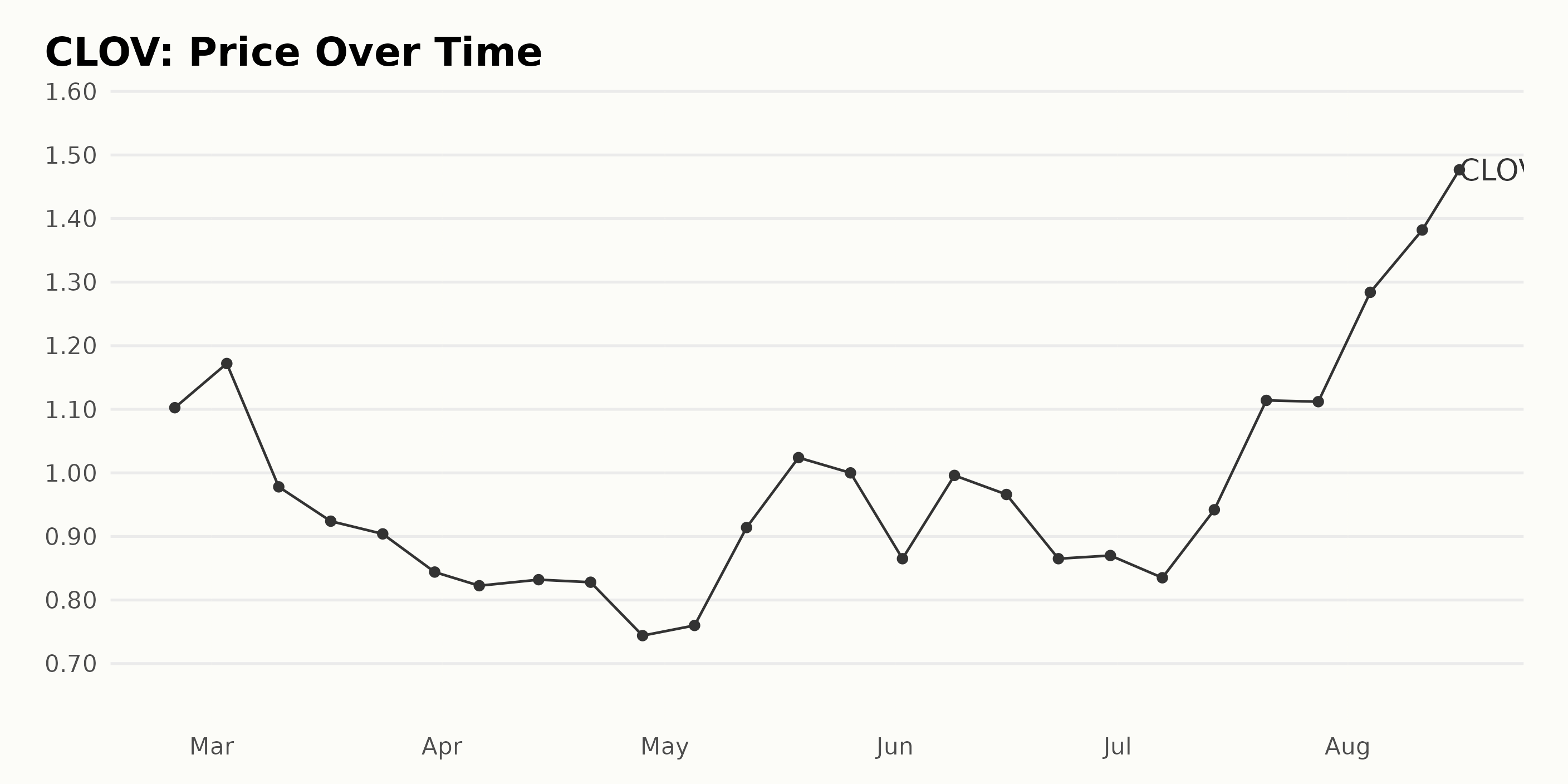

The info introduced describes the share worth development for CLOV from February 24, 2023, to August 16, 2023. From the information supplied, a clearer understanding could be derived of CLOV’s pricing development and development charge over this era.

- On February 24, 2023, the share worth stood at $1.10.

- There was a slight rise within the following month, with a peak of $1.17 on March 3, after which a damaging development ensued.

- From the start of March till the tip of April 2023, there was a constant lower in share worth, which reached its lowest level on April 28, 2023, at a price of $0.74.

- Could 2023 noticed a restoration development, peaking on Could 26 at $1.00. This, nevertheless, was adopted by one other dip within the first week of June 2023, bringing the worth all the way down to $0.86.

- June confirmed an unstable sample, with costs fluctuating each upwards and downwards.

- By mid-July 2023, an upward development started, reaching $1.11 on July 21, 2023. The expansion accelerated additional in August, ending at a peak of $1.41 on August 16, 2023.

General, the worth of CLOV shares confirmed appreciable fluctuations over this era. Nonetheless, finally, an upward development emerged from mid-July to August 2023, implying that the expansion charge of CLOV skilled a late surge throughout this time. Here’s a chart of CLOV’s worth over the previous 180 days.

Analyzing CLOV’s POWR Scores: High quality, Development, and Worth

CLOV has an total C score, translating to a Impartial in our POWR Scores system. It’s ranked #8 out of the 12 shares within the Medical – Well being Insurance coverage class.

The POWR grade of CLOV has constantly been of grade C from February 2023 to the most recent accessible knowledge in August 2023. Right here’s a abstract of the rating and date pairings for the given knowledge:

- On February 18, 2023, the rating was 11.

- On February 25, 2023, the rating remained at 11.

- In March 2023, the rating improved barely, beginning at ten on March 4 and transferring as much as 9 by March 11. Nevertheless, the POWR grade dropped to D throughout this similar month.

- From April 1, 2023, to April 22, 2023, the POWR grade for CLOV remained at D.

- From April 29, 2023, to the start of August 2023, the POWR Grade alternated between C and D, with the following weeks typically sustaining the identical grade because the prior week.

- From mid-June 2023, the POWR grade stabilized again at C.

- The rating within the class remained regular at place ten all through your complete interval from April 8, 2023, to August 9, 2023—indicating a secure, however not top-tier, inserting on this class.

Subsequently, as of the latest knowledge on August 9, 2023, CLOV has a POWR grade of C and ranks #8.

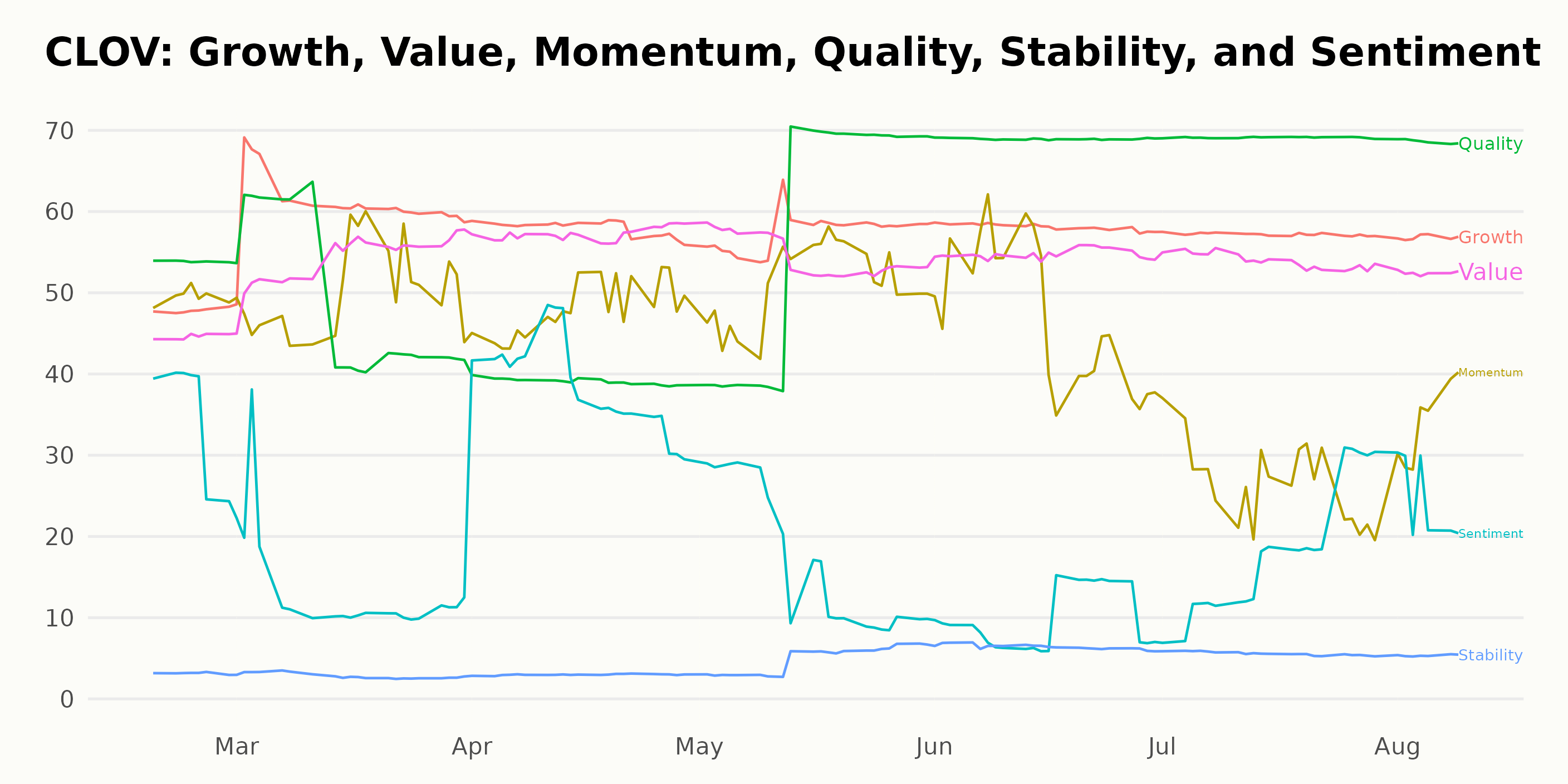

Primarily based on the POWR Scores for CLOV, the three most noteworthy dimensions are High quality, Development, and Worth.

- High quality: This dimension constantly grew over time and finally had the very best score. Beginning at 54 in February 2023, it decreased barely to 48 in March 2023 however then elevated constantly. By June 2023, the High quality score had reached a excessive of 69 and maintained this by means of August 2023.

- Development: The purpose system signifies an upward development throughout the preliminary months. In February 2023, the rating was 48; by March, it rose to 61. Regardless of minor fluctuations, the Development score stayed above 57 by means of August 2023.

- Worth: The Worth score confirmed slight fluctuations over the months however remained typically sturdy. It began at 45 in February 2023, peaked at 57 in April 2023, after which zigzagged across the mid-50s mark till August 2023.

These findings counsel that CLOV’s High quality stays its strongest level in line with the POWR Scores whereas additionally displaying important potential with regards to Worth and Development elements.

How does Clover Well being Investments, Corp. (CLOV) Stack Up In opposition to its Friends?

Different shares within the Medical – Well being Insurance coverage sector that could be price contemplating are Humana Inc. (HUM), Elevance Well being (ELV), and Centene Company (CNC) — they’ve higher POWR Scores.

What To Do Subsequent?

Get your arms on this particular report with 3 low priced corporations with super upside potential even in at present’s risky markets:

3 Shares to DOUBLE This 12 months >

CLOV shares have been unchanged in premarket buying and selling Thursday. 12 months-to-date, CLOV has gained 51.69%, versus a 15.83% rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Subhasree Kar

Subhasree’s eager curiosity in monetary devices led her to pursue a profession as an funding analyst. After incomes a Grasp’s diploma in Economics, she gained information of fairness analysis and portfolio administration at Finlatics.

The publish Purchase, Promote or Maintain: What Ought to Buyers Do With Clover Well being Investments (CLOV)? appeared first on StockNews.com