Usually, I do not like to write down about shares that I do not personal however I’ll break that gentle rule right here, as talked about within the Yr Finish publish, I bought my shares in Superior Emissions Options (ADES) ($59MM market cap). My authentic publish outlining the thesis from November 2021 is right here, as regular, the remark part is price going by way of for a blow-by-blow of the occasions.

This afternoon, ADES revealed a press launch asserting their merger with Arq Restricted had been accomplished. That required a double take and a fast click on because the merger as initially constructed required a shareholder vote to finish, and no such vote was held.

To take a step again, in Might 2021, ADES introduced it was pursuing strategic options because the run off in a single section was producing loads of money, however that enterprise was coming to an finish because of the expiration of a tax credit score, leaving simply their Activated Carbon enterprise (Crimson River plant) which is subscale for a public firm. In keeping with the background part within the authentic deal’s S-4 submitting, ADES obtained a number of non-binding indications of curiosity from personal fairness companies shortly after publicly asserting a course of for his or her remaining Activated Carbon enterprise for between $30-$50MM. Nonetheless, ADES flipped to being a purchaser and in August 2022, lastly entered into an settlement with Arq Restricted for a reverse merger the place ADES would purchase Arq for money and inventory. It was a really SPAC-like deal (here is the SPAC deck) with a pre-revenue startup and rosy income outlook a number of years out. Shareholders who have been anticipating a liquidation sort transaction revolted, sending the shares from $6.41 instantly previous to the deal announcement (to be truthful, it had spiked over the earlier week after ADES administration indicated a deal was close to on their Q2 earnings name) to a $3.86 on the shut, then drifting all the way in which right down to $2.20/share in December. For context, as of 9/30 the corporate had $86MM of money or $4.50/share, in the event that they bought the Activated Carbon enterprise to one of many PE companies, shareholders may have netted someplace within the space of $6.50/share. A lot decrease than I initially penciled out, however properly forward of the place shares commerce at the moment.

With that worth discrepancy, you’d anticipate an activist to return in and try to interrupt the deal, drive a fast sale of the Activated Carbon enterprise, distribute all of the money and reap a pleasant tidy revenue. Nonetheless, that was not possible as a result of ADES has a rights settlement stopping anybody from crossing the 5% possession threshold as a way to preserve their NOLs and tax credit. That 5% possession restrict together with the small market cap prevented most funds from proudly owning shares (its particular person traders who’re getting screwed right here). In a wierd twist, the unique transaction with Arq Restricted would qualify as an possession change, subsequently eliminating the NOLs and tax credit, however the rights settlement defending these tax belongings was nonetheless in place. Regardless of that, there was some hope that shareholders would vote the deal down (like MTCR that was mentioned in my SESN publish feedback) or it could be terminated earlier than to avoid wasting the embarrassment, forcing the corporate right into a liquidation.

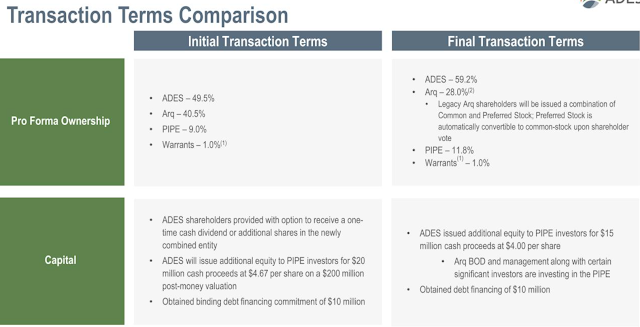

That brings us again to at the moment, ADES recut the merger with Arq presumably to bypass the shareholder vote by issuing a brand new collection of most well-liked shares (this sort of rhymes with the shenanigans over at AMC with the APE most well-liked shares) to Arq shareholders as consideration.

The popular shares characteristic a 8% coupon and are convertible to frequent inventory at a $4/share conversion value if authorised by frequent inventory holders. Frequent inventory holders don’t have any purpose to not approve the conversion, saves the 8% coupon the corporate cannot afford (it will likely be money move unfavourable for the subsequent couple years, even beneath their rosy projections) and it could convert at an above market value. The debt financing can be to a associated celebration, a board member of Arq (may even be on the brand new ADS board) that pays 11% money coupon, plus a 5% PIK.

Whereas the deal is optically higher for ADES shareholders (not saying a lot, presumably does protect the tax asset, however questionable whether or not the mixed firm ever generates vital taxable earnings), it probably would nonetheless get voted down, after hours buying and selling displays this as properly, shares have been down ~16% as of final examine. Onerous to take a position on motivation, however administration owns little inventory and doubtless needs to maintain their properly paying jobs. Apologies to anybody that adopted me into this example, I hope I am lacking one thing. None of this smells proper.

Disclosure: No place