Syscap closed on $2.3 million in seed funding to proceed constructing an infrastructure that helps Mexico’s non-banking lenders to handle and entry non-public credit score.

David Noel Ramírez and Alejandro O’Farrill met whereas working on the multinational beverage and retail firm Fomento Económico Mexicano, S.A.B. de C.V. (FEMSA). Each went on to do different issues — Ramírez co-founded Concéntrico, whereas O’Farrill labored at Amazon and Nubank — previous to founding Syscap.

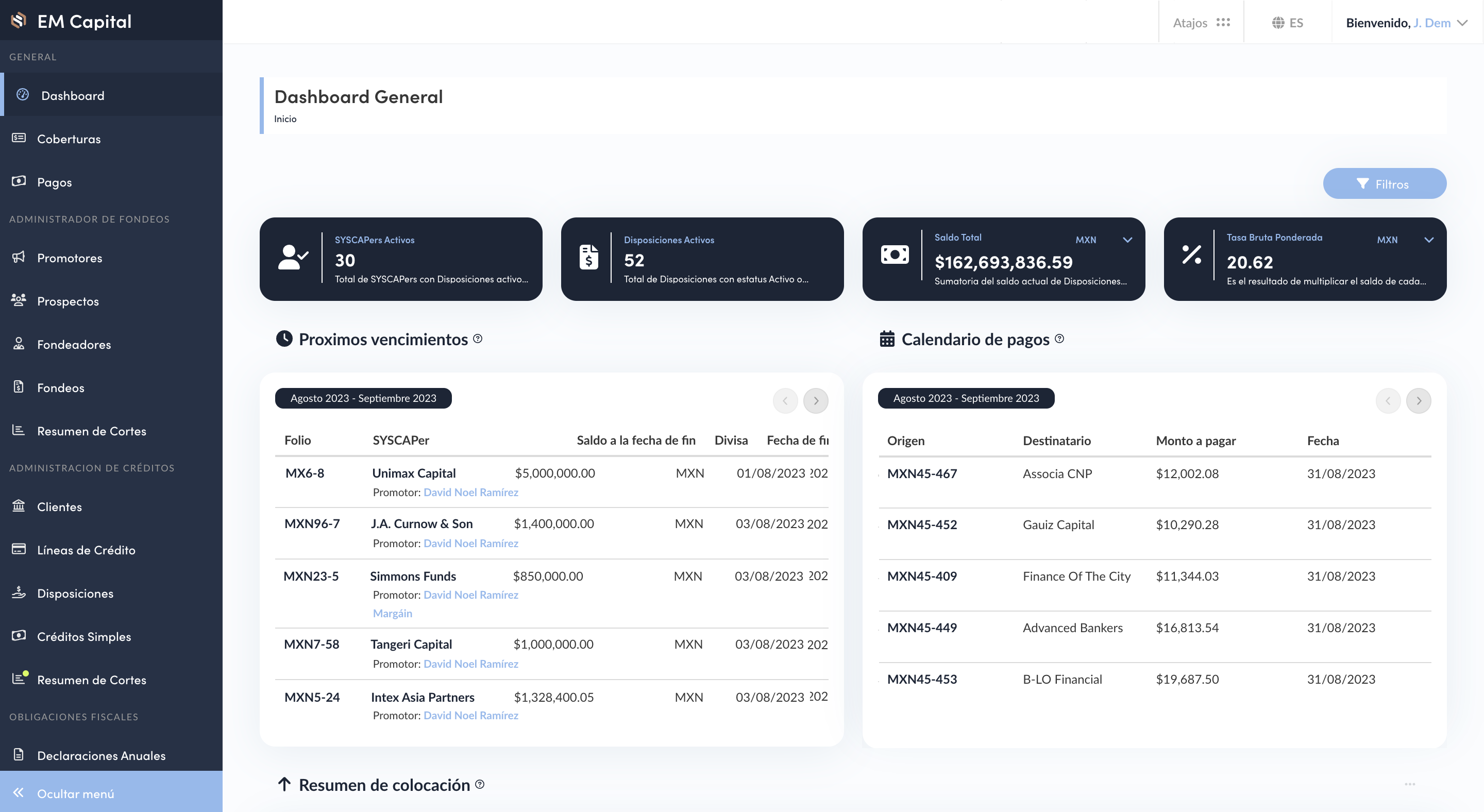

They designed Syscap in order that prospects can register their non-public traces of credit score and carry out communication, monitoring and reporting capabilities multi functional place.

Historically, that is both achieved by means of banking software program and core methods or is finished manually through spreadsheets, e mail threads and unreliable information sources, CEO Ramírez advised TechCrunch through e mail.

Nevertheless, with the non-public credit score market’s belongings below administration having almost tripled between 2011 and 2022, and that development anticipated to succeed in $23.3 trillion by 2027, it presents a chance to fill this credit score liquidity hole, he stated.

Syscap, non-public credit score, Mexico. Picture Credit: Syscap

In consequence, a gaggle of startups has emerged throughout Latin America prior to now yr aiming to deal with the administration and transparency of financing traces. Examples of those embody Kanastra in Brazil; Finley, % and Setpoint in the US; and Vass in Colombia.

“What units Syscap aside is our give attention to constructing a holistic and democratized entry to personal credit score platform, not only for non-banking monetary establishments however for all stakeholders concerned — from lenders and underwriters to debtors and buyers,” Ramírez stated.

Syscap has over 100 non-banking monetary establishments throughout Mexico managing their non-public credit on its platform. The corporate additionally affords entry to short-term financing alternate options.

In the meantime, Wollef led the $2.3 million seed spherical and was joined by Redwood Ventures, Melek Capital, 500 World, Angel Hub Ventures and a gaggle of angel buyers. With the capital infusion, Syscap intends to spend money on know-how and product improvement.