Have you ever ever lined up a dream buy or funding solely to understand you have been quick on funds? For me, this expertise goes again to my childhood. One in all my favourite pastimes was going to the grocery retailer to scope out the sweet and soda aisle. Generally, I’d put a few treats on the checkout conveyor, open my pockets, and then the conclusion would hit me: I had no money. Cue disappointment.

As adults, we often expertise the same I-wish-I-could-buy-that letdown with regards to investments. The chance sounds nice, and analysis reveals it’s low-risk, however then we have a look at our financial institution accounts and there’s not sufficient money to shut the deal—the cash is being utilized by different investments and accounts.

For many, that’s the place the story would finish. For the financially savvy, the method continues with a query: How can I discover cash once I really feel like I don’t have any? An typically missed useful resource is leveraging your retirement accounts. You learn that proper.

Why does the reply appear so shocking? It’s as a result of we regularly view retirement accounts as hands-off. A lot of you could have in all probability been at your jobs for some time, and on the recommendation of your CPA, you’ve been funding your retirement account for a few years. In any case, it’s a wise solution to sock cash away.

Nevertheless, these accounts have a slender focus. They have a tendency to spend money on a smattering of shares and bonds. And that doesn’t at all times work. In response to a 2014 Constancy Investments report, the standard retirement for docs replaces, on common, solely 56% of earnings at retirement. That’s a hefty downgrade to your post-retirement high quality of life.

I’m right here to let you know that there are different methods to develop your retirement. You possibly can make investments your retirement financial savings in different belongings, like actual property.

I do know what you’re considering: “Why make investments utilizing my retirement account? What advantages would I see?” Let’s have a look.

Profit #1: Compounding

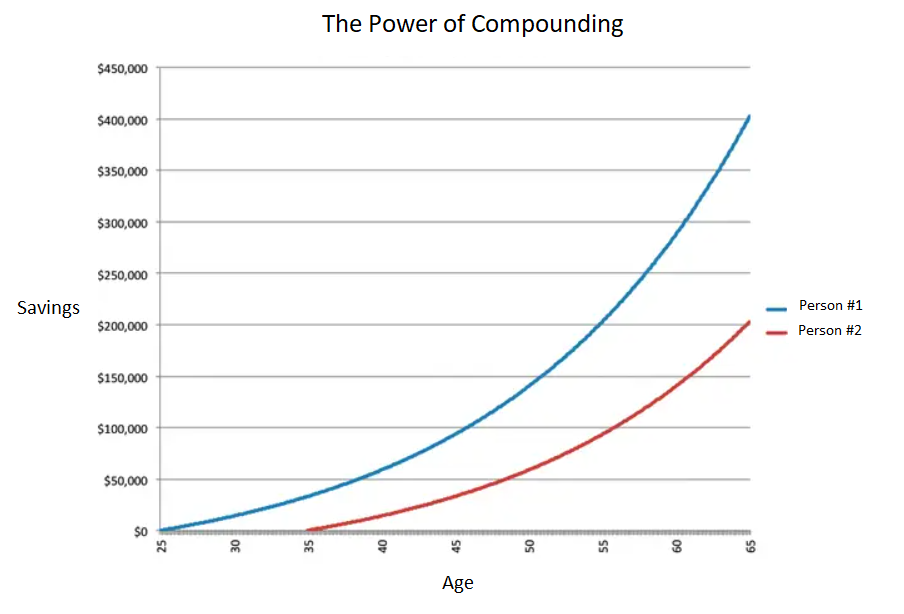

The facility of compounding is profound. And the idea is straightforward: You earn curiosity on the cash you place into your retirement account in addition to any returns or dividends earned. Over time, this may scale your cash. You’ve in all probability seen the graphs on compounding. Right here’s one.

On this graph, every particular person places the identical sum of money of their retirement account every month. However as a result of Particular person #1 began ten years earlier, and since compounding exponentially grows an funding, they’ll have twice as a lot cash than Particular person #2 by the point each are 65. That’s a staggering distinction, and it positions compounding as maybe essentially the most environment friendly type of funding. However let’s take it one step additional. Placing away month-to-month financial savings is one factor. Now think about a gradual stream of actual property earnings rising your compounding energy.

However that’s not all. With out the impression of taxes in your retirement account’s funds yearly—taxes may be as much as 50% in some states—your cash will develop even quicker. Talking of taxes…

Profit #2: Tax Benefits

Years in the past, a Peter Thiel interview opened my eyes to the tax benefits of retirement accounts. Because the co-founder of PayPal, he made the weird transfer of inserting his early inventory holdings right into a retirement account. When his PayPal inventory scaled in worth, and since they have been sitting in his retirement, these huge earnings have been tax-free.

What in case your actual property investments and passive earnings grew tax-free by means of your retirement account? To say the least, it will have a life-changing impression in your retirement.

Retirement Account Choices

Not all retirement accounts are fully tax-free, although, so fastidiously plan your retirement together with your CPA. For conventional retirement accounts, your earnings will probably be taxed when the funds are extracted. However for Roth IRAs and different types of retirement accounts, you’ll by no means pay taxes on earnings, capital beneficial properties, or dividends.

If this sounds intriguing to you, listed below are a few retirement accounts to think about.

Self-Directed Roth IRA

Self-Directed Roth IRAs are so-called as a result of they can be utilized for different investments, together with actual property. Not like 401Ks, Roth IRAs should not employer-sponsored. Due to that, and relative to different choices, they’ve decrease contribution limits.

Like with any IRA, your contributions will probably be taxed upfront. Nevertheless, invested contributions develop, compound, and may be withdrawn tax-free. As with most retirement accounts, there are penalty charges for withdrawing cash earlier than your flip 59 ½. However as a result of the compounding of retirement accounts is, in observe, a long-term funding, you’ll be setting your self up in your future.

Roth Solo 401K

Often, 401Ks are employer-sponsored, and that usually means the investments are managed by the employer. This locks you right into a sure form of conventional investing. On the upside, they characteristic employer-matched contributions, and so they have comparatively excessive limits on contributions.

Nevertheless, there are third-party corporations that may unlock what’s potential with these accounts and set you up with a Roth solo 401K. This opens up a world of prospects and permits for extra flexibility in investing. Better of all, 5 years after your first contribution, all funds withdrawn out of your Roth Solo 401K are fully tax-free (and penalty-free after turning 59 ½).

Retirement Investing: Actual Property

Why must you use your retirement cash to spend money on actual property? Actual property has traditionally been among the best hedges towards inflation and does effectively towards the volatility of inventory markets. Better of all, most actual property investments are long-term, making them appropriate for compounding development in a retirement account.

That every one sounds nice, however actual property investing may be advanced. Let’s simplify it by just a few of my favourite actual property investments to take to your CPA.

REITs:

An acronym standing for “actual property funding trusts,” these are blind or semi-blind trusts the place your funding is dealt with by a decision-making administration workforce or occasion. The most effective REITs are managed by teams with industry-leading experience. They’re publicly traded like shares and are open to all buyers, giving publicity to actual property funding with out the danger of direct possession.

REITs present regular earnings right into a retirement account. There’s additionally the end-of-investment upside. When the REIT property is bought, you stand to achieve a one-time lump sum primarily based in your funding settlement.

Syndications and Funds:

With syndications and funds, buyers grow to be the financial institution. You lend a certain amount of capital to the fund for a promised annual return proportion. Ensure you select an accredited fund to speculate with confidence.

MLG Capital is one such firm that builds relationships with buyers and makes good investments. They prioritize money movement in addition to their distinctive tool-sourcing methods.

Debt Funding:

Just like funds, debt investments are like non-public lending mortgage notes. Your funding cash gives debtors a mortgage for the acquisition or improvement of actual property and receives a gradual return.

Revenue from debt funding will get taxed in the identical bracket as your medical earnings. Nevertheless, in case you spend money on these debt offers by means of your retirement account, you don’t have to fret about that tax. Your regular, predictable earnings will go into your retirement account to compound over time.

Fairness Investments:

That is the possession of an funding property outright or by means of shared possession with someone else, resembling rental properties or improvement tasks.

When fairness investments are tied to retirement accounts, you lose entry to depreciation and loss tax breaks. Nevertheless, the quantity flowing into your retirement account ought to compound far past that tax benefit.

Diversification and Danger

Leveraging your retirement account to gasoline your actual property investments can develop your retirement portfolio by means of long-term capital appreciation. Once you combine a wide range of actual property investments with the usual types of retirement funding, you present diversification that may shield towards draw back.

Take me, for instance. It’s nice realizing I’ve debt investments that inject regular, non-taxed earnings into my retirement accounts. However I even have fairness investments to benefit from the returns of a surging or regular house market. When my retirement is flush with an excessive amount of money, I put it in syndications to ensure I’m beating inflation but in addition seeing glorious returns. Creating a various mixture of debt and fairness mitigates threat and optimizes returns.

Faucet into what’s potential together with your retirement accounts; they supply a terrific alternative to generate passive earnings that builds wealth in your future. You received’t have entry to it now. However that cash will probably be there, and it is going to be tax-free.

After all, the alternatives and choices concerned are tough to parse by means of, so seek the advice of your CPA or monetary advisor. Use your workforce to make nice selections whereas your portfolio holistically. As Invoice Perkins, creator of Die with Zero, says, “Don’t let problem dissuade you from dwelling your greatest life!”

What do you suppose? What actual property investments would possibly work in your retirement account? Remark beneath!