Someday, I had gotten a number of payments within the mail and thought I’d add up the entire of all my debt simply out of curiosity.

It totaled over $18k.

I bear in mind being so CONFUSED.

Wait…I used to be in $18,000 value of debt? The place was it?!

I seemed across the cell dwelling trailer that I used to be dwelling in. That was $24k and I didn’t even depend that quantity within the $18k.

How might I probably have that a lot debt? The place did it go? The place was it? I didn’t have something worthwhile.

I used to be so ashamed. Right here I used to be, working in banking as a senior teller, dealing with different individuals’s cash, and my OWN cash was a whole and utter mess.

I didn’t need to know the reply of the place all of it went. I used to be in denial. Ashamed and embarrassed. I didn’t need to know something. I needed to maintain my head in the dead of night, like an ostrich within the sand.

Nevertheless it haunted me. I had cash. It wasn’t that I didn’t have cash. My husband on the time and I had been doing positive. Each of us working, we had a pair hundred {dollars} left over each month however we simply weren’t getting forward.

We couldn’t take holidays like we needed. Go to the locations we needed. I needed to work 40 hours every week, he labored 40 hours every week.

However one thing inside me stated I needed extra. No more cash, however a distinct life. I didn’t need to be in debt. All my pals had been in debt. It appeared so widespread, however I didn’t need to be. I needed to be DIFFERENT.

However the quantity was overwhelming and whereas I attempted for a little bit bit to get out of debt, my husband wasn’t on board. He spent each penny additional we had. So as to have the ability to spend some cash myself, I spent my cash and we simply by no means did something concerning the debt.

We had been younger and thought that the debt would magically disappear after we received older.

Nevertheless it didn’t.

And shortly sufficient, we began making an attempt to have youngsters and I had my first little one, a wholesome child lady.

That’s when all the pieces modified.

I needed to remain HOME with my child! I couldn’t think about somebody ELSE elevating MY child. Somebody ELSE’S fingers holding her. Somebody ELSE’S hugs. Somebody ELSE touching her and coddling her. Some stranger. I needed to do this. I needed to be together with her.

However at that time, we had been silly for years. The debt was a lot. It now totaled over $30k PLUS our $55k home, grand complete of $85k.

I needed to be sick. Simply excited about it NOW, scripting this to you in the present day, makes me really feel so queasy. That was my life. In debt, with little one, nowhere to go, nothing to do. My husband couldn’t assist us. He didn’t make as a lot as we wanted. I knew I didn’t need to work, so my answer was to get out of debt.

Making more cash wasn’t the reply. No matter extra we made, he’d simply spend it. What’s the purpose of constructing more cash if what you may have all flies out the window. No. Getting out of debt was the reply.

If I stayed dwelling, I might get out of debt, then he wouldn’t complain and all the pieces can be higher. All of the stress can be gone. We might afford a home with warmth and air-con (we had a hearth, that was it- in a metropolis that will get under zero within the winters and no air-con in any respect.)

So I mustered up my braveness that actually took me YEARS to construct up and I created a worksheet for myself. “Let’s begin at floor zero,” I believed to myself.

I didn’t manage to pay for to purchase Dave Ramsey’s program, however I did learn someplace concerning the debt snowball plan so I attempted to implement it.

I received inventive and made my DIY spreadsheet/worksheet and began working, as he urged on the time, to repay the best rate of interest mortgage. For me, that occurred to be essentially the most highest mortgage AMOUNT. I attempted for a number of months, however not seeing the entire go down quick sufficient, sadly, I stop. Thanks Dave. 🙁

I gave up. I couldn’t do it. I wasn’t getting ANY WHERE!!!! I used to be SOOO mad. So pissed off. I felt like, there was NOTHING I might do. Utterly aggravated. I wanted assist however couldn’t discover any assist wherever.

Sleep disadvantaged from a brand new child, a husband that refused to assist with caring for her (AT ALL!) I felt alone. Utterly alone, afraid, and with none choices.

But when I needed a greater life, I HAD to get out of debt. I simply HAD TO!!!

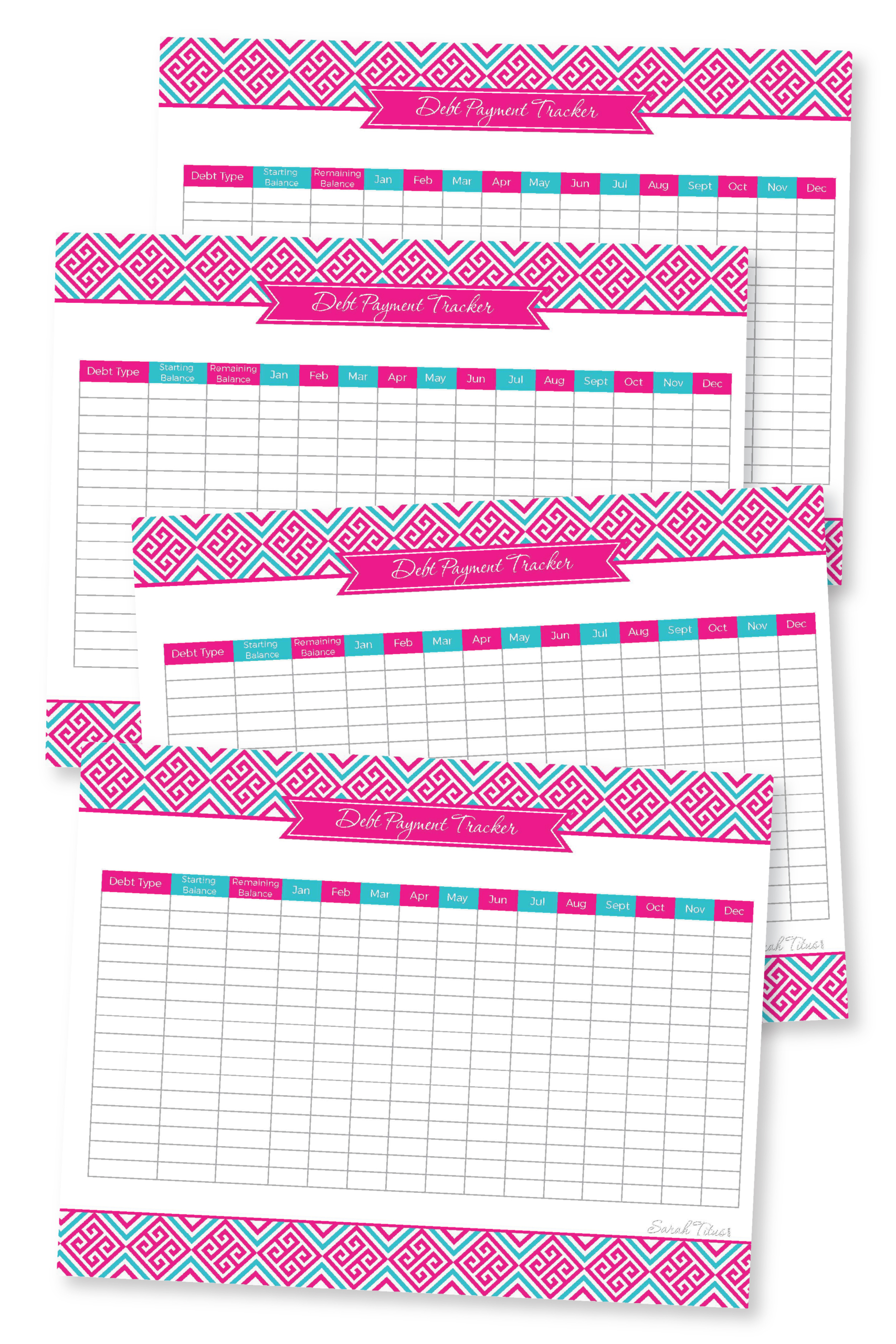

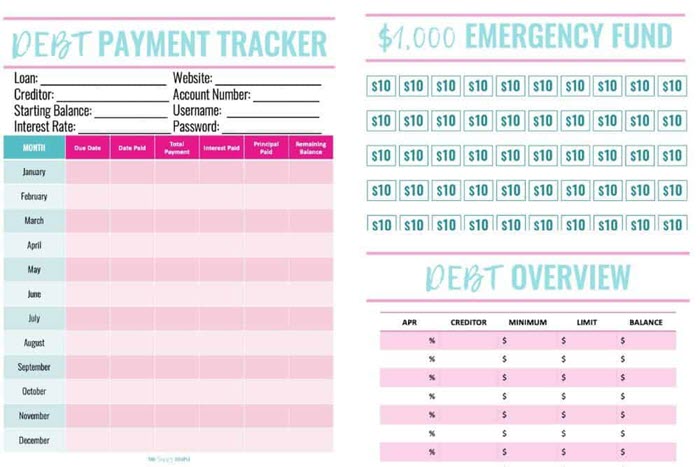

So I created a NEW worksheet (it is a prettier model of that one)!

Obtain the Debt Fee Tracker free printable right here.

I made a decision to start out paying on the LITTLEST quantity invoice. It was round $500 and took me 3-4 months to pay it off.

After I paid off that invoice (it was the LOWEST rate of interest), I felt like I completed one thing. Now, we had $60/month additional from THAT invoice’s minimal fee and I might put it on the subsequent invoice. No downside.

I began engaged on the subsequent invoice. It was round $1,500. I began paying it off little by little and after IT was paid, began the subsequent and so forth.

Lots has occurred in my life since then. My husband deserted me and the youngsters (we now have two) and I ended up homeless, in round $30k debt at the moment.

However now by myself, after I received a spot, I might repay debt MYSELF, with out him thwarting the plans, spending cash, and many others.

Lastly, that final fee was made, $5k to that final invoice (the best curiosity one). I used to be a co-signer on HIS mortgage and he was not making funds so it was affecting my credit score. I knew if I needed to get someplace and away from his entanglements, I needed to repay the mortgage FOR him.

I did. Now not was he in a position to maintain my credit score rating as hostage.

I’ve no debt (I do have a mortgage home fee that I exploit to construct my credit score and my funds are made mechanically so I by no means have to fret about lacking one). I’ve no bank cards and no debt exterior of that home fee to assist my credit score rating. I purchased my $27,000 automobile with money.

Actually, I’m dwelling my dream life. It has NOT occurred in a single day. It took years and years and years as a gradual and constant sample and behavior to get out of debt, but it surely was value it.

As a result of now I CAN have my dream life BECAUSE I caught with it. And that’s my finest recommendation to you in the present day.

You’ll want to surrender.

You’ll want to stop.

You’ll want to throw within the towel.

You’ll get unmotivated.

Issues will go fallacious.

You’ll get off monitor.

However I would like you to recollect one factor: you possibly can’t HAVE your dream life for those who stop.

I didn’t get to the place I’m in the present day by quitting and you’ll’t both. Yeah, issues get robust, preserve going. Yeah, you’ll fail miserably. All of us mess up. Preserve going.

Work on the SMALLEST mortgage quantity FIRST. Why? It’ll preserve you motivated! You see progress. You see payments being paid off and it’s nice.

It’s like beginning to eat wholesome. Except you see you’re shedding pounds, defining your physique, you’re not going to keep it up. We, as people, must see RESULTS.

Beginning with the smallest quantity mortgage helps you see these outcomes rapidly.

So for me, this debt payoff printable above received me out of $30k+ debt!

Perhaps it’s not the best plan for you. Hear, that’s OKAY! So long as you discover one thing that works for you, that’s completely positive. Right here’s extra actually cool printables that assist with debt, credit score, and all issues cash associated. 🙂

These printables may fit higher for you, no downside, however the secret’s to keep it up. Don’t surrender in your goals, since you are value getting them! I by no means imagined I’d be capable to get this far, from homeless, in debt $30k+ to now working two multi-million greenback empires. Not in 1,000,000 years would I think about my life like this!

I’m actually grateful for all that I’ve and for now with the ability to flip round and assist others get out of debt, generate income, and achieve their goals too. It’s superb.

Think about how a lot good you are able to do on the earth for those who had been utterly out of debt! How many individuals you would assist. What number of lives you would serve. Nevertheless it begins with getting out of debt. Use whichever debt printable you need, simply USE ONE! Choose one, anybody. 🙂 However use it. Change your life. Then flip round and assist others. <3

220+ Web page Budgeting Cash Binder {Sarah Titus}

This Budgeting Cash Binder is packed filled with all the pieces it’s good to handle your cash higher! It’ll let you know precisely what to trace, show you how to set targets and pay of your debt and a lot extra!!!

Free Debt Compensation Printables {Sugar, Spice, And Glitter}

When you collect and fill the entire info for every of your money owed, this debt reimbursement tracker won’t solely show you how to keep organized but additionally have a transparent overview of your funds and all the time be ready for the subsequent one.

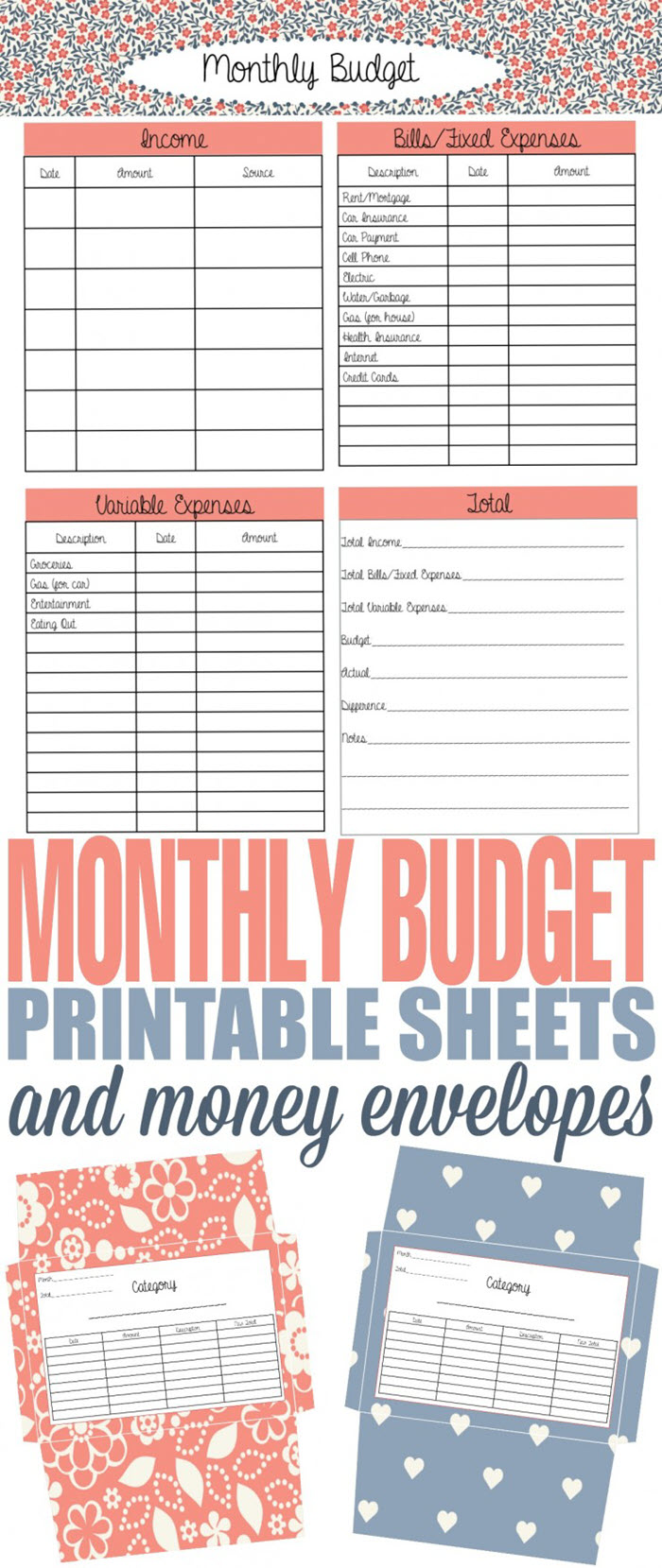

Finances Printables {Blooming Homestead}

It’s really easy to overspend today, which is why it’s so necessary to all the time preserve monitor of your funds. These beautiful price range printables will make private funds simpler but additionally extra enjoyable!

Monetary Planner Free Printable {Merely Stacie}

This beautiful monetary planner PDF has all of the sheets it’s good to monitor your price range, earnings, bills, debt funds and far more and it will get yearly updates.

How To Finances And Spend Properly With An Envelope System {Frugal Momeh}

Why solely monitor your price range when you possibly can truly plan it forward? The envelope system will show you how to accomplish that and these cute printables are the proper option to apply it!

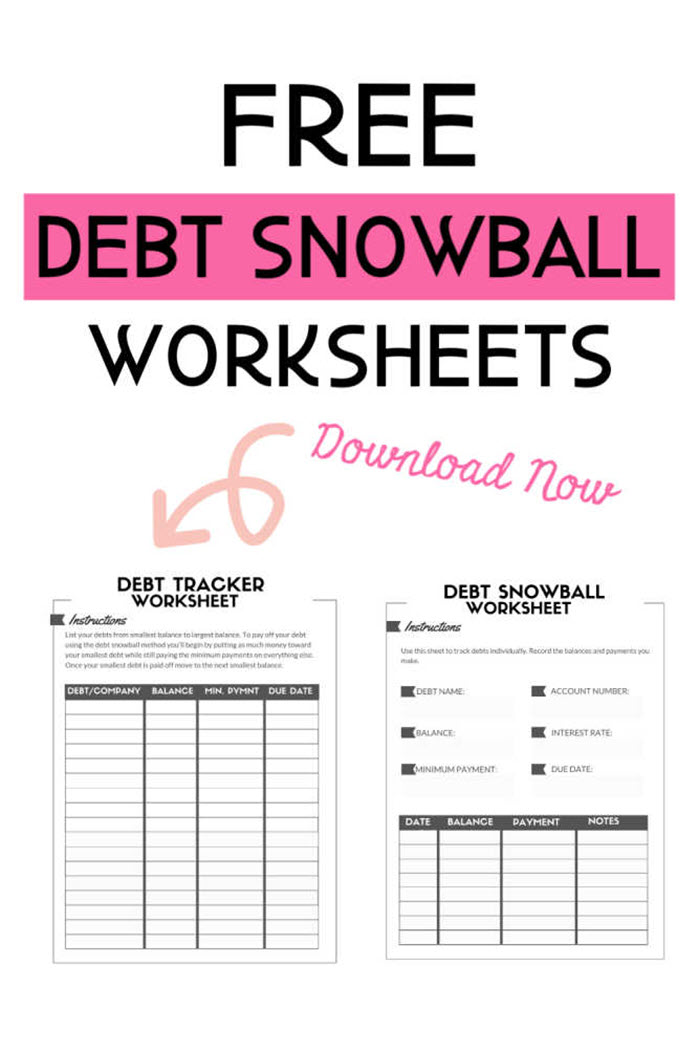

Free Debt Snowball Worksheet {Single Mother’s Revenue}

The debt snowball is a good technique if that system works for you, to maintain you on monitor whilst you’re on the street to changing into debt-free. It will probably take some time which is why getting small wins frequently is precisely what it’s possible you’ll want to stay to your funds.

Free Printable Finances Sheets {Printable Crush}

These colourful price range sheets are additionally tremendous practical and will certainly make private funds a bit easier, particularly for those who’re not pals with numbers.

Free Printable Debt Payoff Tracker {The Savvy Couple}

When you’ve been looking for a clear and easy debt payoff tracker, this one will get the job finished. With only one sheet you possibly can preserve monitor of your mortgage funds for the complete yr!

Printable DIY Money Envelope System {Carrie Elle}

You may rapidly make your individual money envelope system with these free printables and preserve your spending beneath management all through the complete month.

Credit score Card Debt Free Tracker Printable Worksheet {Melissa Voigt}

Having bank card debt is one thing quite common however there may be all the time a option to get out of it! This bank card debt fee tracker may come in useful once you resolve to work your option to a debt-free life.

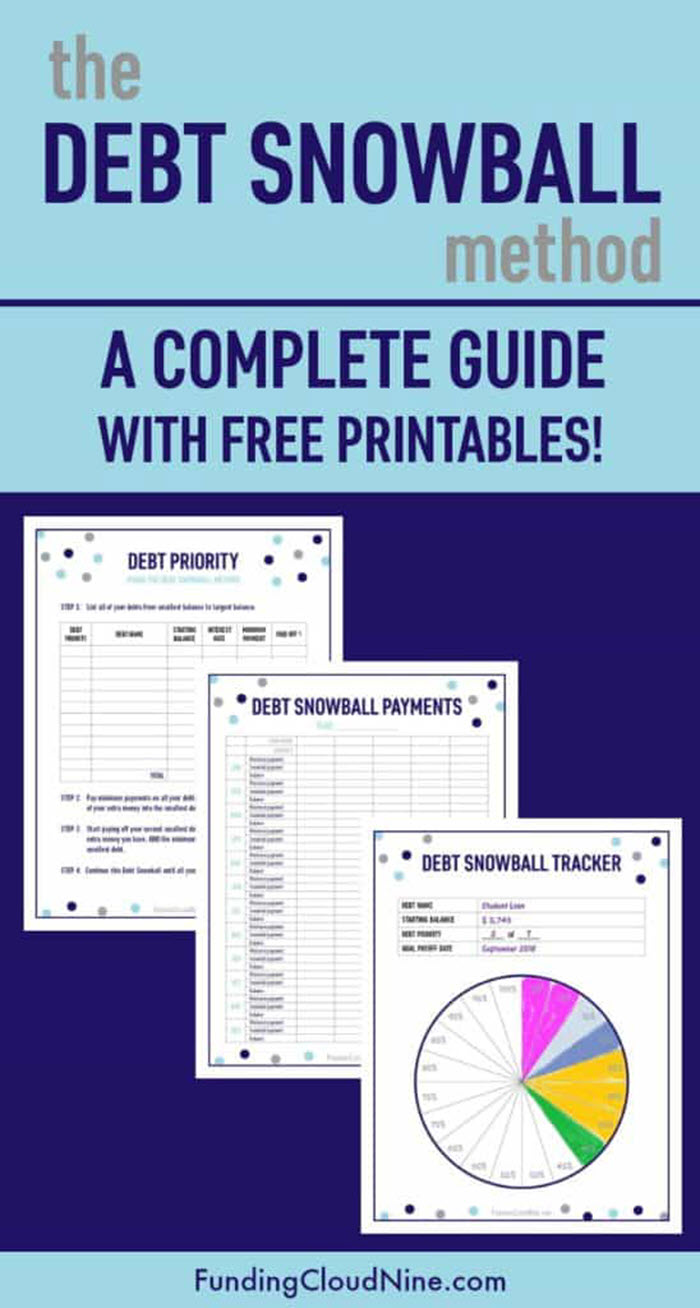

The Debt Snowball Technique Information With Printables {Funding Cloud 9}

This can be a nice complete information for the debt snowball technique. It would show you how to perceive precisely tips on how to use it and the included printable charts have good, practical layouts.

Free Want Record Printable For Budgeting {Saturday Present}

Planning your future purchases and doable reductions is a wonderful manner to economize. These want checklist printables make issues loads simpler as they let you preserve monitor of the gadgets you intend on shopping for in addition to their costs.