Now onto one thing that is a bit more in my historic wheelhouse.

Radius International Infrastructure (RADI) is a holding firm that owns 94% of the working firm APWireless (however I am going to simply consult with the corporate as Radius/RADI going ahead). Radius is a wi-fi tower floor lease firm (the authorized construction can range by nation, however in every case works much like a floor lease) that purchases lease streams largely from mother and pops, people or smaller traders who personal the underlying actual property. Traditionally, earlier than tower REITs actually took off, the wi-fi carriers would construct their very own towers and lease the land/rooftop from people or constructing homeowners. Right this moment, tower firms largely develop and personal the land underneath their new buildings, however there’s a big fragmented world market of leases for Radius to rollup.

Radius checks a couple of different bins for me:

- RADI is just not a REIT and does not pay a dividend, though the enterprise mannequin would lend itself effectively to each, thus limiting its investor pool as we speak. This is able to be an ideal YieldCo (see SAFE).

- RADI does not actually develop new towers, however they’ve a world originations crew that scours the market to create new leases, in consequence their SG&A appears excessive for his or her present asset base (it does not display screen significantly effectively), however their SG&A may arguably be separated and considered development capex (HHC or INDT are semi-similar, however RADI’s distinction might be cleaner). Their origination platform would doubtless be precious to somebody with entry to numerous capital, for instance, an alternate supervisor like DigitalBridge (DBRG).

- Bloomberg not too long ago reported that Radius was exploring strategic choices together with a sale. RADI has some monetary leverage and given the steadiness of their lease streams may commerce privately for a low cap price juicing any returns to fairness holders.

A bit extra concerning the enterprise, stealing slides from their newest supplemental:

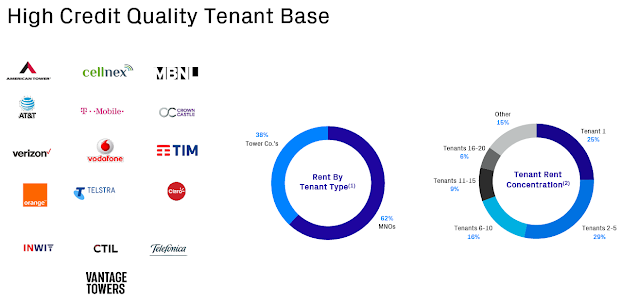

Radius has all the key tower firms and wi-fi firms as tenants, wi-fi infrastructure is a vital service that’s solely growing in significance. As a floor lessor, Radius is senior to the tower firms that are nice companies and have traditionally traded at excessive multiples.

Within the present surroundings, everybody is worried about inflation, Radius has inflation listed escalators in 78% of their portfolio in opposition to a largely fastened price debt capital construction, additional growing the attractiveness of their lease streams.

For a again of envelope valuation, I am merely going to take the annualized in-place rents minus some minimal working bills to create an NOI for the as-is portfolio. This portfolio ought to have minimal bills aside from a lockbox to money the lease checks as there is no such thing as a upkeep capex (these are structured as triple internet leases). Notice the RADI share worth under is my price foundation, issues are transferring round a lot this week, do not know what the worth can be after I hit publish.

The opposite difficult factor for RADI is all of the dilutive securities. There’s additionally an incentive price that’s rebranded because the Sequence A Founder Most well-liked Inventory dividend, I’ve left that out for now however could attempt to exercise how a lot it will dilute any takeover provide, though I feel there’s sufficient room for error right here both means. As ordinary, I’ve most likely made a couple of errors, please be happy to appropriate me within the feedback. However above is roughly the mathematics if the acquirer buys Radius and fires everybody, sits again and collects the inflation-linked levered money flows.

The piece I battle valuing is the origination platform, however I’ve a sense somebody like DBRG (simply for instance, any non-public fairness supervisor actually) could be very fascinated by it as they may deploy a ton of capital over time and generate fairly dependable returns. RADI has guided to originating $400MM of recent leases in 2022 at a mean cap price of 6.5% inclusive of origination SG&A and different acquisition prices. Even utilizing the present market implied cap price of 5.1% above, the origination platform would create ~$110MM in extra worth this yr by placing the 5.1% public market valuation on the lease streams they originated for six.5%. RADI’s administration thinks they’ve an extended runway for origination development as they’ve simply scratched the floor (low-mid single digit penetration) of this fragmented market. Any worth prescribed to the origination platform could be above and past my basic math within the Excel screenshot.

Apparently, through the Q1 DBRG convention name, DBRG CEO Marc Ganzi stated the under close to the digital infrastructure M&A surroundings (transcript from bamsec):

We do see public multiples retreating in a few of these totally different information middle companies or fiber companies or floor lease companies. There’s been a reasonably sizable contraction and the window is starting to open the place we see alternative. And I feel by being as soon as once more by being finally an excellent steward of the stability sheet and being prudent in how we deployed that stability sheet final yr, we have taken our pictures the place we’ve good ball management, and we have taken our pictures which can be candidly going to be accretive

And there is cause to take Ganzi’s feedback fairly actually as DigitalBridge made a splashy deal this week in one of many three classes he referred to as out by buying information middle supplier Swap (SWCH) for $11B.

I’ve purchased some RADI widespread this week and in addition supplemented my place with some Aug $15 name choices. Just like different concepts over time, I like name choices right here, there isn’t any cause to essentially assume that RADI’s enterprise is deteriorating alongside the general market, their leases are inflation linked and structurally very senior in an infrastructure like underlying asset. There’s monetary leverage, low cap charges and an origination platform that might be precious to somebody, all of which may result in an enormous takeout premium in the event that they strike a deal.

Disclosure: I personal shares of RADI (plus DBRG, HHC, INDT) and name choices on RADI