Initially written for Livewire

Sure, sure, I get they’re low cost. However when, if ever, will small caps begin working? Halfway by means of what’s wanting like one other 12 months of small-cap underperformance, that’s the query many long-suffering traders are asking.

In fact, the previous quote monetary markets saying attributed (incorrectly) to John Maynard Keynes is often the reply to questions like this: the market can keep irrational longer than you possibly can keep solvent.

A number of latest anecdotes, nevertheless, recommend the reply is perhaps before that.

A few weeks in the past, one among our favorite worldwide small caps introduced its worst quarterly end in nearly three years. Open Lending (NASDAQ: LPRO) earns income by arranging finance insurance coverage on second-hand vehicles within the US. That market was pummelled by a scarcity of latest automotive provide, then falling used automotive costs and, extra not too long ago, a dramatic improve in rates of interest. In contrast with the second quarter of 2021, the corporate organized 30% fewer loans and its profitability greater than halved. Open Lending’s share worth is up over 40% to this point this month.

One other essential funding in our Worldwide Fund, Janus Worldwide (NASDAQ: JBI), is having a a lot better time of it. It reported report first-quarter income, up 45% on the earlier 12 months because of a ten% improve in income and bettering profitability. The corporate is the dominant producer and installer of self-storage amenities within the US and has a quickly rising worldwide operation, together with right here in Australia. It says its pipeline of labor stays wholesome and expects report income and income for the 2023 12 months.

Janus’s share worth has fallen 14% for the reason that finish of February and the bumper consequence did nothing to vary investor sentiment.

Possibly Janus must take a leaf out of Open Lending’s ebook and begin asserting some downgrades? Severely, possibly that’s precisely what must occur.

Everybody is aware of there’s a slowdown coming within the self-storage building sector. Janus’s clients (usually specialist listed property trusts) depend on folks renting space for storing whereas they transfer homes. Covid was a boon. The following housing slowdown is clearly going to place the breaks on. Nobody (besides us, it appears) desires to personal Janus earlier than the slowdown arrives and, the higher the reported outcomes, the extra satisfied everybody appears to get that the approaching correction is barely a matter of time.

For Open Lending, the primary quarter outcomes recommended that that is as dangerous because it will get. Nearly 40% of the loans it organized had been refinancings within the first quarter of 2022. Due to quickly rising charges, this 12 months they represented lower than 8% of the enterprise. It could possibly’t be any worse than zero. In the meantime, its core enterprise has been rising sequentially for the previous few quarters. Now that potential traders can see a path out of the valley, they’ve come speeding again to the inventory (the share worth remains to be down 75% from its 2021 peak).

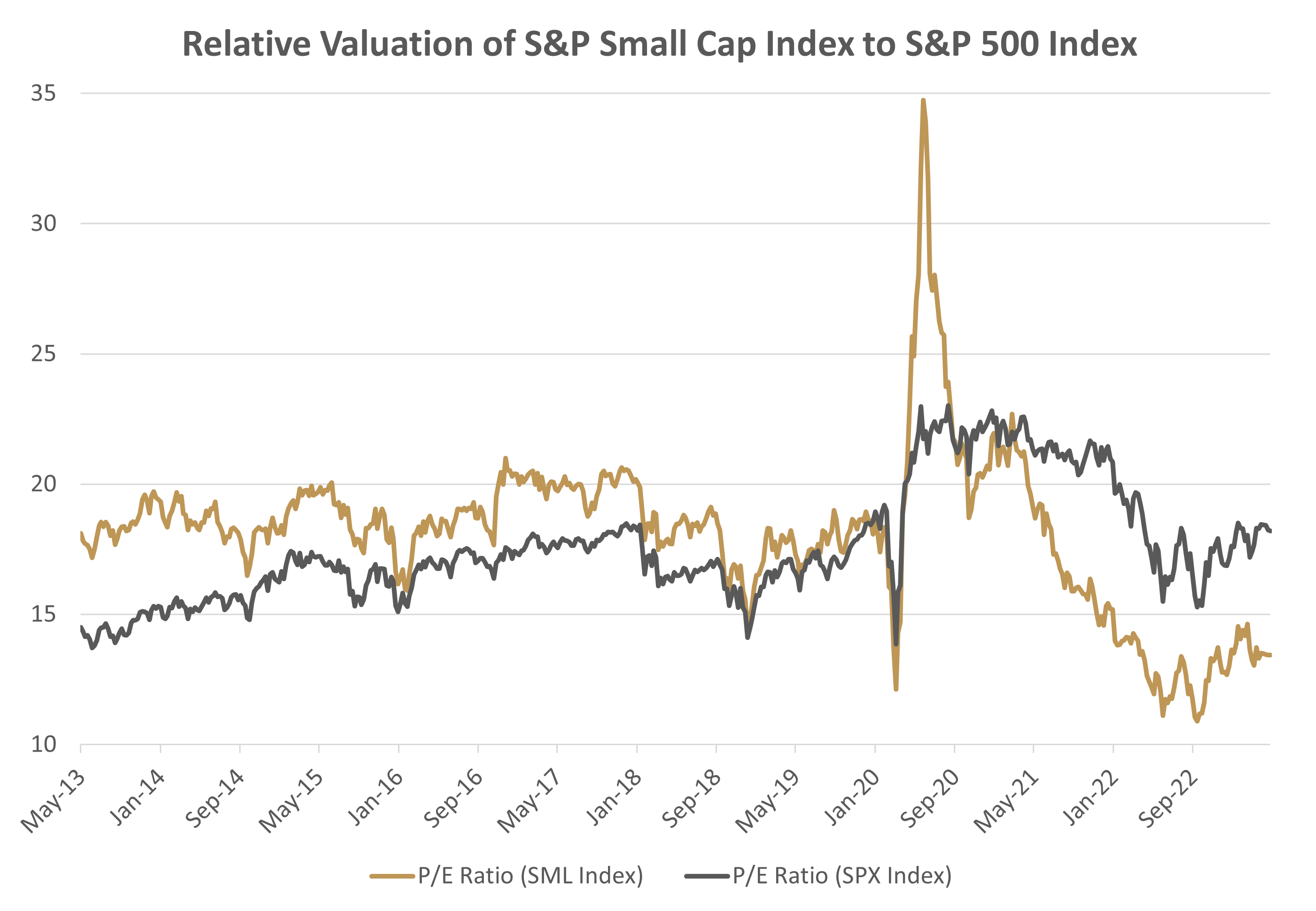

I feel the identical will probably be true of the broader small-cap malaise. Potential traders are petrified a couple of recession that hasn’t but arrived. Nobody is aware of how dangerous will probably be or how lengthy it’s going to final. Within the US, relative valuations for small caps are at their lowest ranges on report. That is partly as a result of massive caps are costly but in addition as a result of small caps are low cost.

Supply: Bloomberg

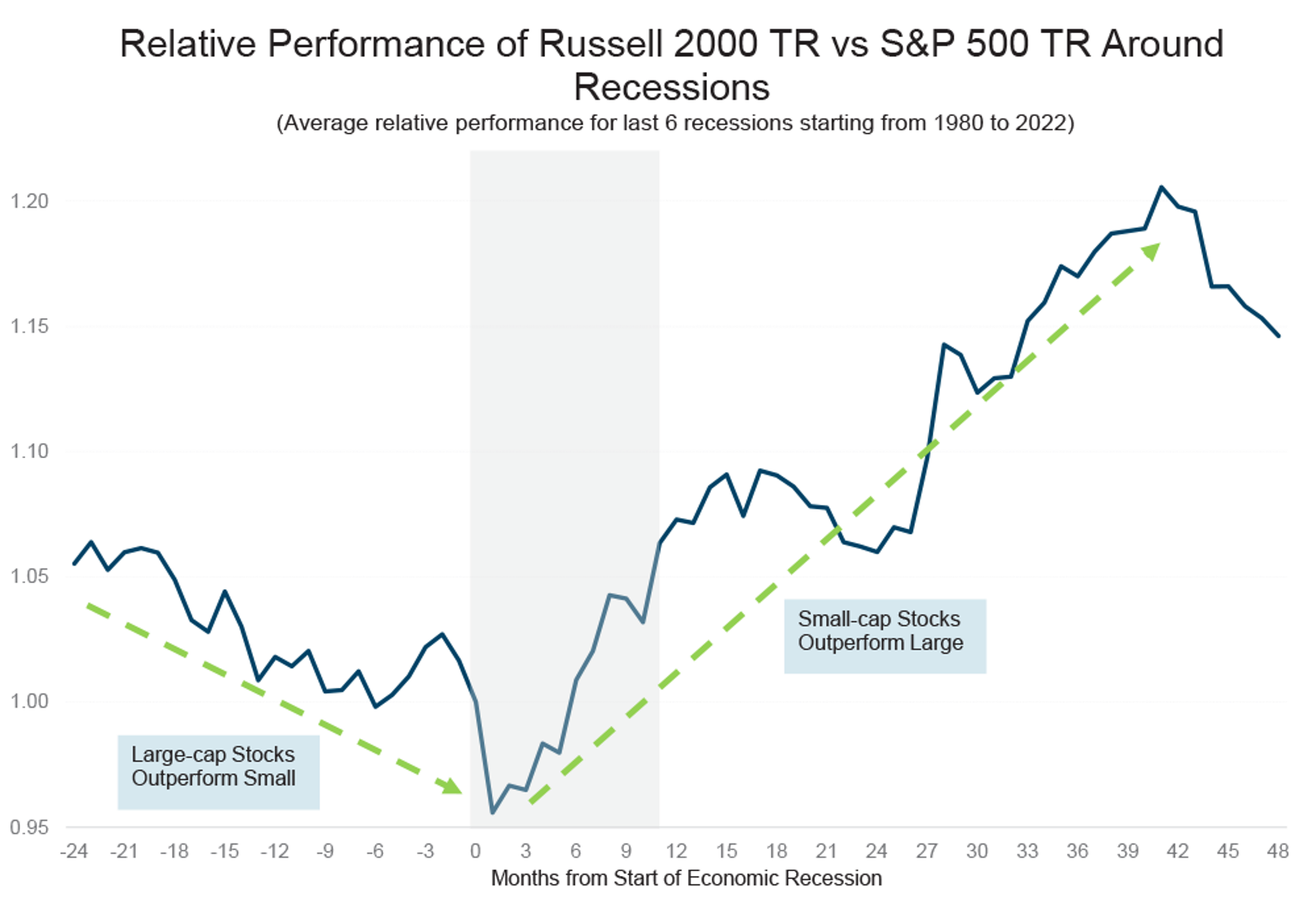

Because the Open Lending instance reveals, sentiment can enhance lengthy earlier than outcomes. As soon as a recession arrives, folks in a short time begin trying to the opposite facet. A latest article by International Alpha offered information exhibiting small-cap efficiency into and out of the six most up-to-date US recessions. It received’t shock anybody that there was underperformance previous to an financial contraction. But it surely stunned me that small-cap shares began working rapidly as soon as a recession arrived. Inside one month of historic recessions beginning, small caps began outperforming. And the outperformance lasted three years.

Supply: International Alpha Capital

Previous efficiency isn’t any assure of future efficiency. However possibly there may be a solution to the query, when will small caps begin to work? It’s the recession we’ve to have.