No product on Wall Road attracts extra criticism than leveraged ETFs. Leverage funds are designed to multiply the efficiency of indexes, however usually accomplish that poorly in the long term. These merchandise had been constructed for merchants – not buyers. They match the each day return of the underlying index and multiply that.

As such, over time, the returns begin to get very skewed. The longer you maintain onto these leveraged ETF merchandise, the larger the disparity in returns you may see (and it isn’t in your favor). That is known as decay – particularly leveraged ETF decay.

So, why does it occur? Let’s test it out.

Instance Of Leveraged ETF Decay

The ProShares Extremely S&P500 ETF (SSO) tracks twice the each day return of the S&P500 index day-after-day. If the S&P 500 is up 1%, then SSO ought to be up 2%. If the S&P 500 is down 2%, then the SSO ETF ought to be down 4%.

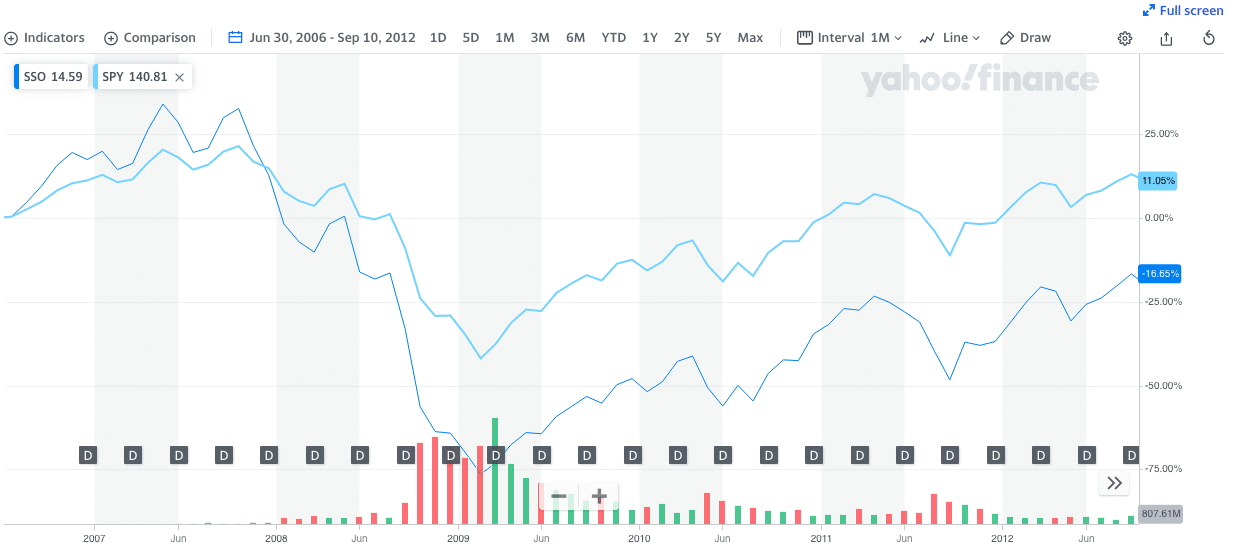

Simply how nicely this monitoring works will be seen in a since inception chart evaluating the 2:

The S&P 500 was up almost 16%. SSO was down almost 14%. Why the disparity?

Observe: We have been working by means of a decade-long bull market. As volatility will increase available in the market, you possibly can count on extra examples just like the one above.

Leveraged ETFs Lose from Compounding

Compounding, the very factor that’s presupposed to make buyers wealthy in the long term, is what retains leveraged ETFs from mimicking their indexes within the lengthy haul. Easy arithmetic can clarify why leveraged ETFs fail to maintain tempo.

Suppose that the S&P 500 index had been to lose 10% on someday, after which acquire 10% the subsequent day. (Not often do large strikes like these occur, however it helps illustrate the purpose – spherical numbers are simpler!)

So, if the S&P 500 begins on the spherical worth of 1400, it will lose 140 factors on day one to shut at 1260. The following day, it will rise 10%, or 126 factors, to shut at 1386. The whole loss from this two day transfer is 14 factors, or 1%.

Supposing that SSO began out at a worth of $60 per share, SSO ought to lose 20% of its worth on the primary day. The ETF would shut at a worth of $48. The following day, it ought to rise 20% from $48 to $57.60 per share.

On the finish of this two day interval, the S&P 500 would have misplaced 1% of its worth. Against this, the SSO ETF would have misplaced 4% of its worth.

Hazard of Multiplication

The order by which we do that operation doesn’t matter. Do that out: utilizing the spherical variety of 100, subtract 10%. You arrive at 90. Then add 10%. You get 99. For those who reverse the order and add 10% to 100 earlier than subtracting 10%, you get the identical outcome – 99.

The decay occurs even sooner whenever you use bigger numbers. Subtract 50% from 100 earlier than including 50%. You’ll get 75.

However let’s get into the true enjoyable. What when you’ve got a number of days in a row of motion in the identical route? If the S&P 500 index had been to maneuver up 2% a day for 10 days straight, its ending worth could be 21.8% higher than its beginning worth.

A 2x leveraged ETF like SSO would transfer up 4% a day for 10 days straight and thus its ending worth could be 48% increased than its beginning worth. SSO’s return of 48% is bigger than two occasions the 21.8% return of the S&P 500 index.

Volatility Destroys Leveraged ETFs Returns Over Time

The issue is that the market doesn’t transfer up or down in a straight line. As a substitute many each day optimistic and detrimental strikes produce – hopefully! – a optimistic return in the long term. Trade-traded funds that monitor and compound the each day strikes, nonetheless, at all times lag their index (and finally produce detrimental returns) in the long term.

Triple-leveraged ETFs decay a lot sooner than double leveraged ETFs. For instance, Direxion’s TNA fund tracks 3x the each day change within the Russell 2000 index. For the reason that fund was launched in late 2008 it delivered a lackluster 32% return in comparison with the Russell 2000 index, which delivered a 66% return.

Regardless of leverage of 3x, the leveraged fund gained 32% to the index’s 66% return.

The top results of that is, you’d have been higher off merely protecting your cash invested within the underlying index!

The way to Juice Returns Safely and Reliably

The one “protected” solution to leverage a portfolio is to open a margin account. For those who had $50,000 to take a position and wished twice the return of the S&P 500 index, you possibly can purchase $100,000 of the S&P 500 index ETF (SPY) on margin. Nonetheless, this isn’t a advisable technique in any respect – it is extremely dangerous.

Because you really personal 2x the quantity of the ETF you need to double, you possibly can assure that you’re going to get twice the return (minus the price of curiosity in your margin account.) You can’t assure {that a} leveraged fund will present double the return over time. Simply understand that you just additionally took on an enormous quantity of threat – if the ETF drops in worth, you’ll owe more cash than your preliminary funding.

Shopping for and holding leveraged ETFs is taking part in with hearth. They’re designed for day merchants… Within the lengthy haul, you are sure to get burned.

Ultimate Ideas

On the finish of the day, the perfect factor to do is solely to put money into a low price ETF or mutual fund portfolio and benefit from the market returns over time. You may even make investments totally free and never pay a fee to take a position! There are even expense-ratio free mutual funds that you could put money into!

Editor: Clint Proctor

Reviewed by: Chris Muller

The put up Why Leveraged ETFs Don’t Match Market Efficiency appeared first on The School Investor.