When I first started freelancing, I wasn’t very strategic with my client choices. I’d often partner with red-flag clients (or scammers), which would either result in very late payments for my business (think: longer 90 days overdue) or unpaid invoices.

Thankfully, that’s all changed now — I now have great clients who are a joy to work with (and also make timely payments!).

Having said that, I’m no stranger to the anxieties that come with overdue payments. I’ve also got to acknowledge that I’m not the anomaly here. As freelancers, we’ve all had clients who pay later than we’d like or those who don’t pay at all.

Today, I’ll share a few options you can consider for a few options you can consider for payment reminder messages. I’ve either personally used these templates or have seen other freelancers leverage them. All in all, they have a perfectly polite tone but will still help you get paid and maintain a positive relationship.

A few templates to consider for reminder emails

Without further ado, here are some tried-and-true payment reminder email templates you can steal.

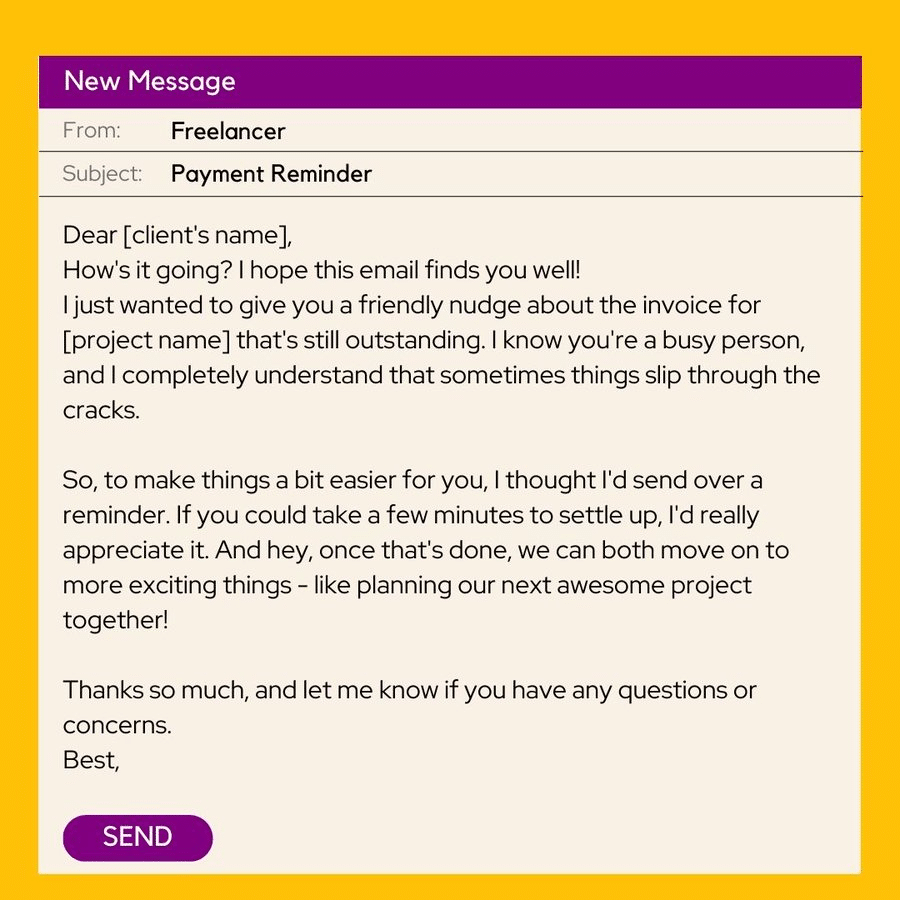

1. A simple and sweet reminder email

This gentle reminder email template is for when you’ve worked with a client for a considerable period of time and know they usually pay on time but have unfortunately forgotten to pay you by the necessary timeframe. Think of a delay of maybe 2–3 days for this scenario.

“Subject: Quick reminder about outstanding payment

Hey [Client Name],

Hope things are going well with you!

I wanted to drop by and let you know that invoice no. XYZ is still unpaid. I know things happen, which is why I’m quickly sending a reminder message to ping you about the same.

I’ve reattached the invoice to this email. Please let me know if you have any questions or concerns about it.

I’d also appreciate it if you could drop me a message once the payment has been processed!

Best,

[Your Name]”

SOURCE: TheFreelanceFiles.com

Alternatively, here’s another payment reminder template you can consider sending:

Since you’d already have some credible trust in your client (assuming you’ve previously worked with them), it pays to be polite and not assume the worst. When you send the first reminder email, always give your clients the benefit of the doubt.

2. Specifies dates in your reminder messages

Another way to structure your reminder emails is to add due dates. In most instances, if you send your original invoice to your person of contact, they’re likely forwarding it to the accounting team without knowing much about when your payment is due (or how late it’s been since you’ve been paid).

If you specify dates directly in your message, it helps them see just how behind they’re on payment, and they can internally escalate the matter with the accounting team to help you get paid.

On that note, here’s one payment reminder template from Kat Boogard that specifies due dates:

Hey [Name],

I hope you’re doing well!

I’m checking in to confirm you received the invoice. Friendly reminder that payment for this is due on [Date].

Please let me know if you have any questions!

All the best,

[Your Name]”

SOURCE: TheFreelanceFiles.com

In this edition of the newsletter, she also recommends creating a logistical plan for payments with clients upfront (e.g., in some instances, clients may require you to fill out a direct deposit form or sign up on a payment portal).

3. Re-mention the terms of your contract

In the scenario that you’re new to working with a client, and you’ve already sent them multiple payment reminders and have only heard crickets in return, it might be beneficial to re-mention the terms of your contract.

This overdue payment reminder email could look something like this:

Hey [Client],

I’m writing this email to you to remind you about the pending payment for invoice no: [#] that’s due on [date].

Please note that, as per the terms of our contract, if the payment is not made by this due date, a late fee of [X]% will be applied.

If you have any questions, feel free to send them over!

Best,

[Your Name]”

SOURCE: TheFreelanceFiles.com

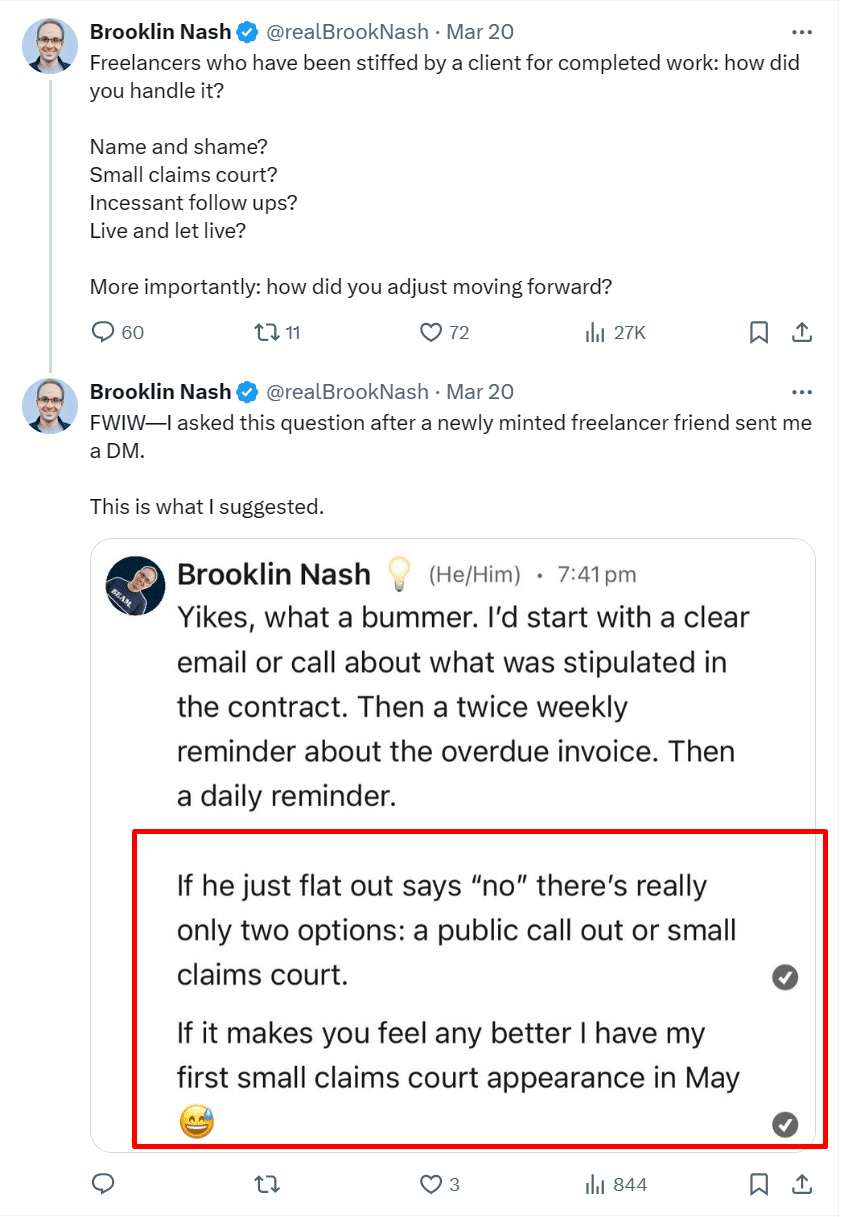

If the issue escalates, and you’ve exhausted all options to reach out to the client and get your money from them, many freelancers have also considered the option of enlisting the help of a lawyer and serving clients a notice.

I haven’t gone through this process myself, but from most of the stories I’ve heard, most clients, even the ones who haven’t responded in eons and practically ghosted you, still end up paying the money at this stage.

Lest they don’t respond at this stage, my freelancing friends tell me the next step of the process is to visit an actual small claims court.

4. Reach out to different folks at different positions

It may also happen that your late payment may not be the fault of your client or your person of contact. It could be an easy mistake, like your point of contact leaving the organization and your invoice getting lost within the cracks.

For such situations, you could remind the new point of contact about the overdue invoice. Or you can shoot an email to different folks from the same organization.

Usually, this person would either be the CEO, owner, or someone from the accounting team — whatever contact you can get. LinkedIn or a tool like Hunter is a great way to find the proper contact information.

On that note, here’s how you can structure this email:

Hi [Name],

My name is [Name], and I’m writing to you because I have an outstanding invoice with [name of organization] and thought you’d be the right person to contact.

As you might know, my point of contact, [Name], has left the organization, and I think my invoice has slipped through the cracks due to their departure.

Due to the same, I’ve attached my invoice to this email. You can also contact [name of point of contact] to reconfirm all details.

Please let me know if you have any questions!

Best,

[Your Name]”

SOURCE: TheFreelanceFiles.com

You can also copy and tweak this template even if your point of contact hasn’t left the company and instead has just ghosted you—-it’s a sadder reality, but it happens.

A few best practices from one freelancer to another

Now that you have a few templates you can try, let’s cover a few best practices to keep in mind when sending these emails to get you paid faster.

- Consider automating the entire payment process so you don’t have to sit and track each payment and send reminders. You can use money tracker apps for this use case, and many of them will send reminder emails on your behalf. Your payment details are already locked and loaded.

- Always create a contract — in the long run, this is something that’ll help both parties. As a freelancer, you can mention payment terms (like net-X days, late payment fees, scope of work and payment for each deliverable, etc.).

- If you can, try to send your invoices on the last business day as opposed to the last day of the month (this is something I learned from Stefan Palios).

- Always mention the payment due date in your invoices. Why? If you’re working with a large organization that hires multiple freelancers, all of them would likely have different payment terms. If you don’t specify your payment due date, the accounting team might pay you according to their pay cycle.

- Make it super easy for your clients to pay you. Many freelancing friends I know sign up for different payment portals (like Payoneer and Wise) that allow clients to process payments through credit/debit cards or other payment methods.

[Side Note: As a freelancer who lives in a different country than most of my clients, I can personally vouch for this tip. This is mainly because direct bank transfers from one country to another can cost a pretty penny in transaction fees, but payment platforms have a considerably lower fee.]

- If you can, always get some upfront fee so that even if you don’t make any money on the project, you don’t lose out on much. For reference, most of the freelancers I’ve spoken to charge a 100% upfront fee for smaller projects and a 20–50% upfront fee for larger projects.

It’s also worthwhile to mention that upfront fees are mainly necessary when you’ve only just started working with the client — most long-term retainer clients might not require an upfront fee as the trust has already been established.

- Try to have a few more payment templates on hand (e.g., thank you notes for payments — on that note, you can copy a few templates from here).

- When in doubt, you can always consider legal action for severely overdue payments (and lack of response). Send one final email reminder with the invoice payment details and any missed payment deadlines. Keep a professional tone.

Grow your freelancing business with Millo

Because freelancing is a profession that requires most of us to work in our own bubble from home, it also creates some discrepancies about important topics like money, client management, work opportunities, creativity, and more.

But one thing I’ve noticed about freelancing is that it’s a genuinely helpful community. You can:

- Grow your business through online resources that have expert-led advice.

- Find answers to your burning questions on platforms like X and LinkedIn.

- Share your stories on places like Superpath.

- Reach out to a fellow freelancer for tips.

One resource that I’ve personally enjoyed in the past few months is the Millo newsletter, and here’s why:

- It doesn’t take much time from your day-to-day routine to read (I’d practically be doing a disservice to my business if I didn’t need a free, 5-minute email every week).

- It covers all the necessary topics (i.e., clients, money, growth, productivity, legality, creativity, etc).

- It also sources its insights from actual freelancers, so you know their money is where their mouth is.

On that note, if you’d like to access this resource, here’s where you can sign up!

Keep the conversation going…

Over 10,000 of us are having daily conversations over in our free Facebook group and we’d love to see you there. Join us!