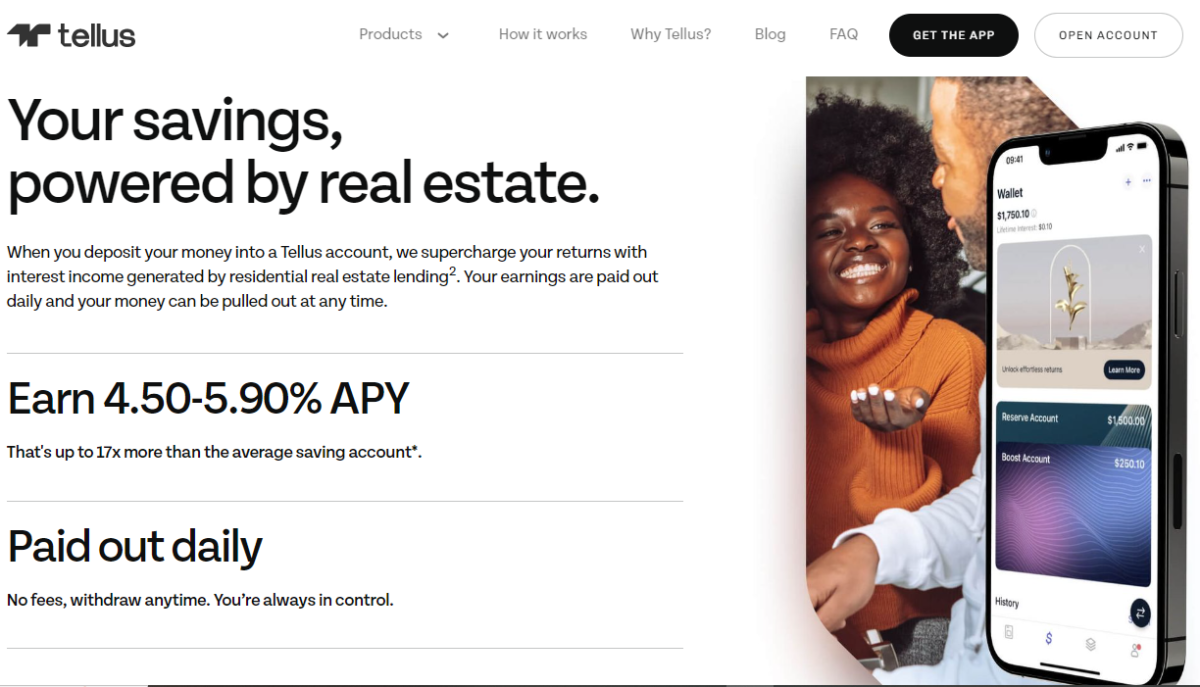

If you wish to construct wealth, chances are you’ll suppose it is advisable put money into shares, cryptocurrencies or different unstable markets. Happily, Tellus gives another that will help you enhance your web value.

Our Tellus overview shares how this app pays you rates of interest that common 17X what the everyday financial institution pays you in your financial savings steadiness.

Abstract

Tellus gives a variety of savers the choice to earn passive earnings via actual property. Low minimums and no charges make saving straightforward for many everybody. Nonetheless, the shortage of range and threat of loss ought to be thought of earlier than signing up.

Professionals

- Free to make use of

- No account charges

- Passive actual property earnings

- Low minimal deposit

- 100% liquidity

Cons

- Merchandise restricted

- Minimal customer support choices

What’s Tellus?

Tellus is a very free financial savings app powered by actual property. The truth that it depends on actual property lets you earn a lot greater rates of interest than you’d on a conventional financial savings account.

This platform permits customers to earn as much as 5.90% APY. Plus, you possibly can withdraw your cash at any time with no charges.

Higher but, utilizing Tellus helps you keep away from the volatility of funding choices like cryptocurrency or the inventory market. Primarily, it’s a option to earn passive earnings with minimal threat.

How Does Tellus Work?

Tellus funds mortgage loans to owners. These loans sometimes have 6- to 18-month phrases and, in response to Tellus, are all the time sufficiently collateralized.

The corporate additionally has a property administration platform that produces extra income and gives useful sources for property house owners.

As a saver, Tellus helps you earn a better rate of interest on the cash you save. As of this writing, Tellus Enhance account house owners earn not less than 17X extra curiosity on their balances than different financial savings accounts.

While you earn greater curiosity on the cash you save, you possibly can obtain your monetary objectives quicker. Nonetheless, the chance of potential loss within the occasion of an actual property market downturn or a defaulted mortgage is actual.

That mentioned, actual property tends to be extra of a secure market and never fairly as unstable as investing in shares or cryptocurrencies.

Right here’s get began with Tellus.

Make a Deposit

Opening a free Tellus Enhance account takes only a few minutes. Anybody not less than 18 years of age who’s a authorized U.S. resident can open a Tellus account.

There isn’t a deposit required to open an account and browse the app. Nonetheless, there’s a minimal funding quantity/steadiness requirement of $125.

Depositing this minimal lets you begin incomes curiosity immediately. Be aware that Tellus is just not a financial institution, however the funds held in your money administration account with Tellus are custodied by well-known banks corresponding to Chase.

You even have the choice to make use of Tellus Vaults if you wish to safe a better rate of interest. These operate like Certificates of Deposit (CDs).

Tellus Places Your Cash to Work

Tellus makes use of your cash to fund mortgage loans. Then, you’ll earn every day curiosity in your steadiness.

The platform additionally protects your cash with its Triple-Layer Safety framework:

- Collateral: Each greenback Tellus lends is backed by U.S. single-family residential actual property, primarily within the Pacific Northwest market.

- Capital: Tellus holds U.S. {dollars} in proportion to each greenback saved by its customers as a further safety buffer.

- Methods: The platform boasts bank-level AES 256-bit encryption and companions with Stripe, Plaid, IDology and Riskified to guard your cash and identification.

With these layers of safety, you possibly can relaxation straightforward understanding that your funding is as protected as attainable.

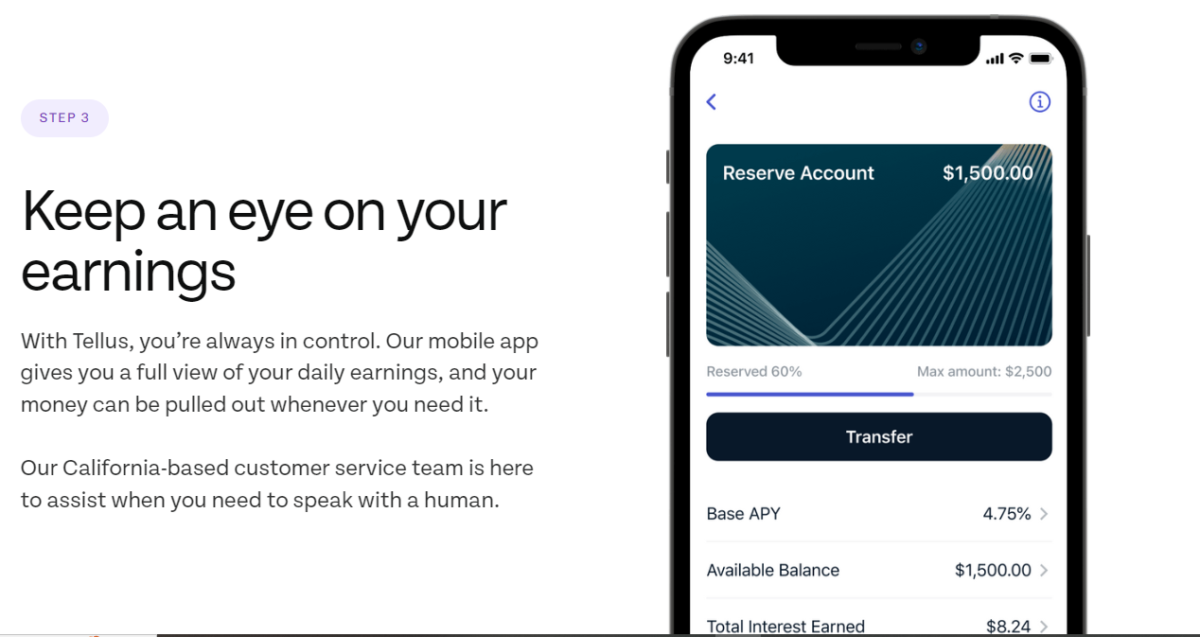

Monitor Your Earnings

You may control your account inside the app and see how a lot you’ve earned every day. Plus, you possibly can money out your cash everytime you want it.

Within the app, you’ll be capable of see issues like your base APY, the steadiness you will have out there, how a lot curiosity you’ve earned and extra.

Plus, if you happen to want assist, you may as well stay chat within the app with Tellus’ California-based buyer assist representatives for help along with your earnings, deposits and cashing out.

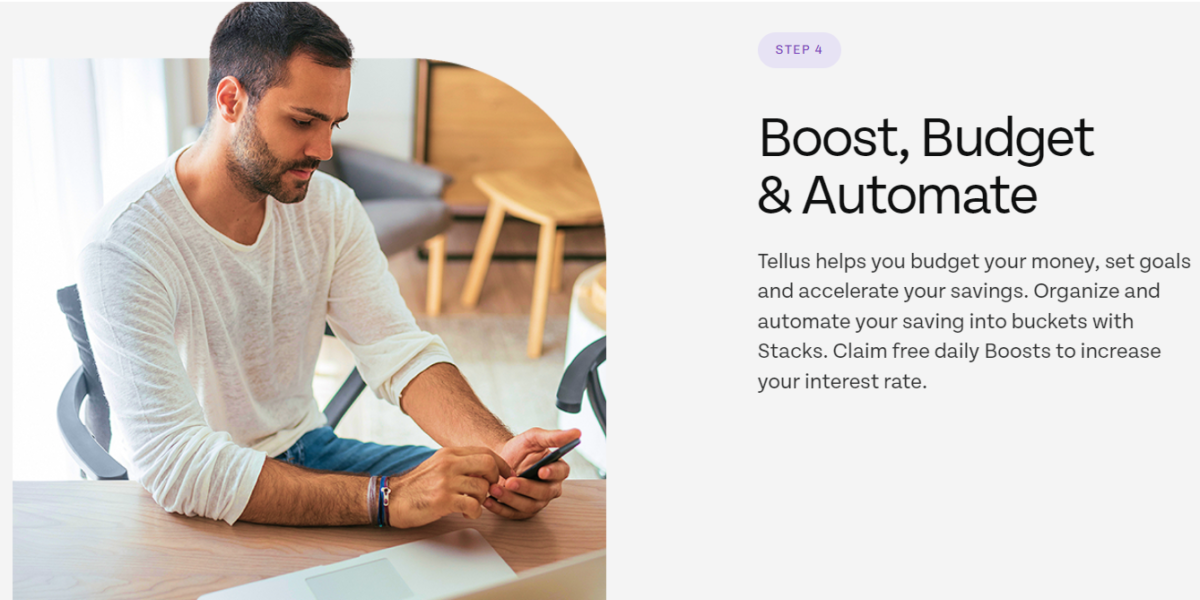

Enhance, Finances and Automate

With Tellus, you get further instruments to do issues like fast-track your earnings, automate your contributions and even set objectives, making the app greater than only a option to earn passive earnings.

The Enhance characteristic is a software that lets you earn much more curiosity in your steadiness for a set time frame. Boosts are random however happen steadily. To benefit from boosts, it is advisable entry your Tellus account on daily basis and activate a Enhance if it’s out there.

You can even earn Boosts by answering quiz questions. These Boosts will help you earn extra in your Tellus financial savings for brief intervals of time.

Tellus lets you make deposits everytime you need. Past that, the app enables you to finances for normal Tellus contributions and have automated deposits made into your account.

As well as, you possibly can put your financial savings into buckets with the Stacks characteristic that will help you attain your completely different monetary objectives. This will help you with budgeting.

Money Out

One other engaging characteristic about Tellus is that you could money out your funding at any time. You may even money out the day after you deposit your cash, giving your funding 100% liquidity.

There are not any time period necessities for the Enhance financial savings account and no charges for withdrawing your cash with this account. Nonetheless, chances are you’ll lose any curiosity you accrued if you happen to money out a Tellus Vault early.

How A lot Does Tellus Price?

There are not any charges for changing into a member of Tellus or for utilizing Tellus. It’s completely free.

Nonetheless, your financial institution may cost you charges for some Tellus transactions, corresponding to wire transfers into or out of your Tellus account.

Tellus does its finest to inform you of financial institution or different charges that accomplice establishments cost, however the platform itself doesn’t cost any charges.

Remember the fact that Tellus does require a minimal account funding quantity/minimal steadiness of $125 so that you can earn curiosity via the app.

Is Tellus Value It?

Tellus gives a method so that you can earn a horny yield in your financial savings balances. Nonetheless, the funds you place into your Tellus account usually are not with out threat.

As with every funding, actual property will be dangerous. Downturns within the economic system, mortgage defaults and different elements might put your deposited funds susceptible to loss.

Tellus minimizes these dangers by having giant money reserves and well-collateralized loans. Nonetheless, any borrower might default on a mortgage at any time, which might lead to a lack of funding for you.

It’s as much as you to resolve if the potential yields are definitely worth the threat.

Different actual property funding choices embrace Fundrise. This platform lets you put money into industrial actual property rental properties for as little as $10.

There are different actual property crowdfunding platforms so that you can take into account investing in. Moreover, there are many actual property investing alternatives for non-accredited buyers in addition to accredited buyers.

Remember the fact that whether or not you make investments with Tellus or different actual property investing platforms, all actual property investing comes with the chance of lack of your preliminary funding.

Tellus Options

The next options include each Tellus account.

Earn 4.50% on Deposits

The cash in your Tellus Enhance account earns not less than 4.50% APY as of this writing. Though there are a few high-yield financial savings accounts that earn on this vary, most don’t pay that a lot.

The rate of interest on a Tellus Enhance account fluctuates, however the fintech’s purpose is to maintain the rate of interest engaging to reward members for partnering with them.

Tellus Vaults

Tellus additionally presents a product known as a Vault. While you save utilizing a Vault, you’ll lock your cash up for a specified time frame, just like how a CD works.

There’s a minimal $1,000 deposit quantity you have to adhere to if you wish to put your cash in a Vault. Phrases vary from 3–24 months, with the rate of interest being greater for longer intervals.

Should you don’t want liquidity out of your investments, Vaults may very well be value contemplating.

Withdraw Your Cash Anytime

You may respect that you could withdraw the cash in your Tellus Enhance account at any time. There are not any phrases with Enhance and no penalty for taking your cash out early. In reality, you possibly can withdraw your Enhance contributions as early as the subsequent day after they’re deposited.

With Tellus Vaults, you may as well withdraw your cash at any time. Nonetheless, doing so will trigger you to forfeit any curiosity you’ve accrued.

Curiosity Paid Day by day

Tellus pays earned curiosity every day into your Enhance account. Higher but, you may as well withdraw that earned curiosity immediately.

This may be an effective way to generate profits quick.

Comparability Calculator

Tellus additionally presents a financial savings calculator on the location’s homepage. This calculator will help you examine how cash in a Tellus Enhance account compares to cash saved in a conventional financial savings account over specified intervals of time.

For instance, if you happen to deposit $100 per thirty days into your Tellus Enhance account over a 10-year interval on the present rate of interest, you would have as a lot as $58,043 in your Tellus Enhance account.

Nonetheless, if you happen to put that very same $100 month-to-month in a typical financial institution financial savings account, you’d solely have $36,703 on the finish of these ten years. That’s an enormous distinction.

Go to Tellus’ homepage to make use of the comparability calculator and see how far more cash you may be capable of earn with Tellus.

Tellus Buyer Opinions

Earlier than signing up for any monetary product, it may be useful to know what different clients must say about their expertise.

Right here’s how Tellus stacks up on the completely different score websites:

| Web site | Rating | Variety of Opinions |

| Apple App Retailer | Excessive | 4.4K |

| Google Play | Excessive | 791 |

| Trustpilot | Excessive | 34 |

Listed here are some Tellus overview excerpts from clients:

“I actually LOVE saving with Tellus……Plus there’s the every day enhance. So it’s all the time above the 4.5%. Been saving for nicely over a 12 months now with them.” – Kathleen S.

“I’m having critical points with getting customer support to assist me. I can’t discover a option to get somebody on the telephone……..” – Kyle

“Simple method to save cash whereas incomes excessive curiosity. It’s a reasonably easy idea: deposit the cash and so they pay you (the required) curiosity. I’ve had a few issues with the app however assist was actually good about serving to repair them fast.” – Drew P.

“I simply invested with Tellus due to the good opinions on-line…..But nobody seems to be house after quite a few makes an attempt to achieve a customer support rep.” – MarinKat

Incessantly Requested Questions

In case you are nonetheless on the fence about utilizing Tellus, these steadily requested questions may be capable of assist.

Abstract

With low minimal deposit necessities and no charges, Tellus gives a horny financial savings possibility. It presents a option to faucet into the facility of actual property and earn a better curiosity in your financial savings, all whereas retaining your money liquid.

So long as you retain the chance degree in thoughts, you may discover Tellus to be a superb possibility so that you can make passive earnings with actual property.