It has been a pleasant week for shares, and if the debt ceiling difficulty will get resolved with out an excessive amount of trouble, we might see additional rallying. It goes with out saying, but it surely’s lots simpler to become profitable when the S&P 500 (SPY) goes up, even when our portfolio is much less correlated than giant caps to the broad market. That mentioned we nonetheless made further modifications to the portfolio this week to arrange ourselves for what’s forward. Learn on to get my newest tackle the present market circumstances and the place I believe it heads subsequent….

(Please get pleasure from this up to date model of my weekly commentary initially printed within the POWR Shares Below $10 publication).

As I discussed above, shares are wanting lots stronger this week. Whereas the debt-ceiling is the first difficulty to traders, the percentages are that it’s going to get resolved earlier than any form of precise default occurs.

As soon as the self-inflicted drama passes us by, the main focus will return to inflation, Fed conferences, and different economics information.

The summer time tends to decelerate when it comes to market motion. Nonetheless, this yr could also be a bit totally different because the summer time FOMC conferences will probably be intently watched.

As I mentioned final week, I want an even bigger image of market circumstances somewhat than taking a look at day after day strikes.

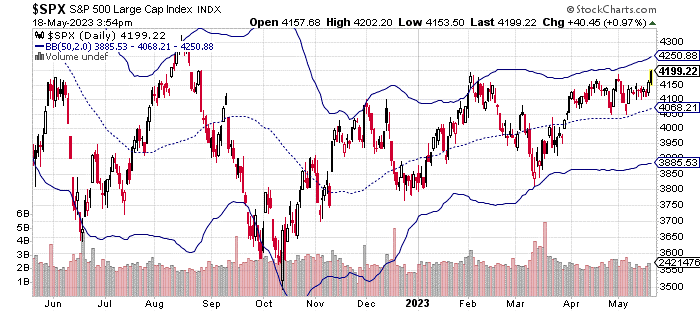

The S&P 500 (SPY) has had a pleasant week to this point, however as you may see within the chart above, we aren’t even 2 normal deviations from the 50-day transferring common.

Clearly, this does not imply the rally will proceed. Nonetheless, we additionally have not seen a pointy sufficient transfer greater to essentially count on a bout of revenue taking earlier than the weekend.

Economics and earnings information had been pretty uneventful this week. Walmart (WMT) posted stronger than anticipated outcomes, elevating revenue and income steering for the yr.

Retail gross sales numbers had been additionally stable for the month of April. All in all, the buyer spending image nonetheless appears to be like optimistic.

With the economic system remaining resilient, it is tough to say whether or not the Fed will elevate charges on the subsequent assembly (in June).

The market is about 65% certain they will not elevate charges, however that might change fairly shortly based mostly on new financial information.

I do not assume we want one other quarter level fee hike, however the Fed typically does not ask for my opinion.

A brush with default (the debt-ceiling stuff) might change the Fed’s thoughts, however as soon as once more, I do not count on an precise default to happen.

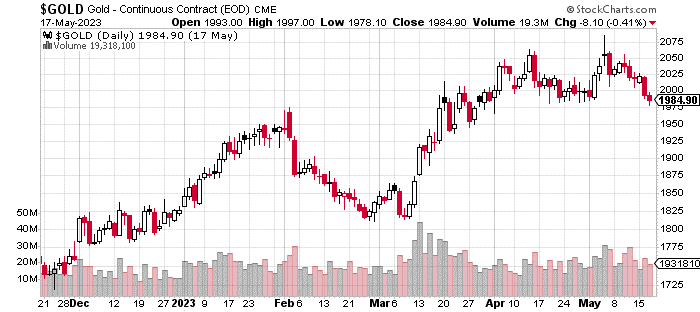

The drop within the value of gold under $2000/ounce, seen above, could also be an indication that traders are much less involved about being in safe-haven investments.

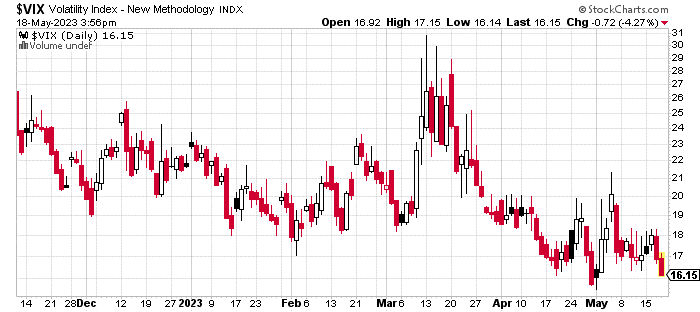

The VIX (the market volatility index) additionally continues its sluggish pattern downwards. The VIX could have short-term spikes based mostly on one-off information occasions.

Nonetheless, its basic path in most years goes to be down or sideways (relying on what sort of yr we had beforehand).

You may see that the VIX is approaching 16. That means roughly a 1% transfer per day in shares. Below 15 is often thought-about a low-volatility surroundings. We could get there this summer time, assuming nothing loopy occurs with the debt-ceiling or the Fed.

What To Do Subsequent?

If you would like to see extra high shares beneath $10, then it’s best to take a look at our free particular report:

3 Shares to DOUBLE This 12 months

What provides these shares the correct stuff to change into large winners, even on this challeging inventory market?

First, as a result of they’re all low priced corporations with essentially the most upside potential in in the present day’s unstable markets.

However much more vital, is that they’re all high Purchase rated shares in line with our coveted POWR Rankings system they usually excel in key areas of development, sentiment and momentum.

Click on under now to see these 3 thrilling shares which might double or extra within the yr forward.

3 Shares to DOUBLE This 12 months

All of the Greatest!

Jay Soloff

Chief Progress Strategist, StockNews

Editor, POWR Shares Below $10 E-newsletter

SPY shares . 12 months-to-date, SPY has gained 10.04%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Jay Soloff

Jay is the lead Choices Portfolio Supervisor at Buyers Alley. He’s the editor of Choices Ground Dealer PRO, an funding advisory bringing you skilled choices buying and selling methods. Jay was previously an expert choices market maker on the ground of the CBOE and has been buying and selling choices for over 20 years.

The submit Bulls Again in Cost? appeared first on StockNews.com