Low rates of interest are nice if you wish to borrow cash, however not too useful when you find yourself attempting to reserve it.

At your typical financial institution, you’ll be fortunate to get even .10% curiosity on cash positioned in a financial savings account. Even long-term CDs aren’t very profitable.

Happily, there are some on-line banks that supply better-than-average rates of interest. A kind of is CIT Financial institution.

Abstract

The CIT Financial institution Financial savings Builder account is a really effective possibility for individuals seeking to get just a little bit extra return on their money financial savings. Its rates of interest for high-balance prospects are among the many greatest within the nation.

-

Lengthy Time period Financial savings Positive aspects

4.5

Execs

- Aggressive Curiosity Charges

- Lengthy Time period Savers

Cons

- No CIT Financial institution ATMs

- Minimums

What’s CIT Financial institution?

Earlier than you deposit cash in any financial institution, it’s useful to know concerning the firm. CIT Financial institution is a subsidiary of CIT Group, a publicly-traded monetary holding firm primarily based in Pasadena, CA.

CIT Group has a sturdy business financing section, in addition to a shopper banking section that features CIT Financial institution and OneWest Financial institution.

CIT is a shortened model of the corporate’s earlier title, Industrial Funding Belief. The historical past of the corporate dates again to 1908.

After being acquired by Tyco in 2001, it was spun off and have become a public firm, CIT Group, in 2002.

CIT Group acquired in bother in 2008 after being closely concerned in subprime mortgages. Monetary issues led it to file for chapter in 2009. After rising from chapter, CIT Group reformed and in 2015 acquired OneWest financial institution. And as of July 17, 2022, OneWest Financial institution branches and merchandise have turn into First Residents Financial institution branches and merchandise.

Along with providing the Financial savings Builder account, CIT Financial institution has a cash market account, one other high-yield financial savings account, certificates of deposit with phrases starting from six months to 5 years, and residential mortgage merchandise.

CIT Financial institution listed complete deposits of $32 million with complete belongings of $42 million on the finish of 2018, based on iBankNet.

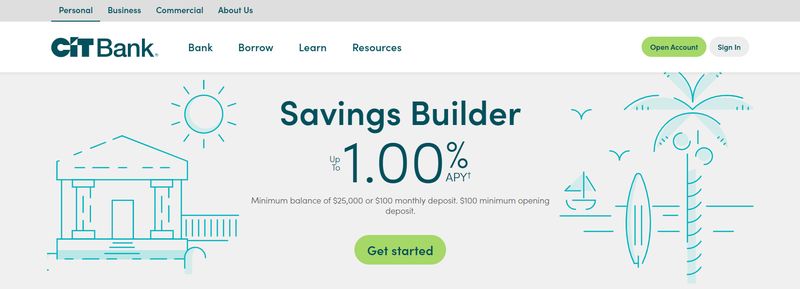

CIT Financial institution Financial savings Builder Overview

CIT Financial institution Financial savings Builder gives one of many highest rates of interest within the nation for these in a position to keep a excessive stability or make common deposits.

CIT Financial institution gives a aggressive APY for individuals who can meet that standards.

Thus, it’s a great possibility for 2 sorts of savers: those that have some huge cash saved already, and those that aren’t fairly there but however have the power to commonly put away an honest sum each month.

If you happen to can hold a minimal stability of $25,000 or make month-to-month deposits of no less than $100, you possibly can earn CIT Financial institution’s highest fee.

Even if you happen to can’t meet both of these necessities, you possibly can nonetheless earn an APY that’s as much as thrice increased than you’ll at most banks.

Let’s take a deep dive into the CIT Financial institution Financial savings Builder account to be taught whether or not it’s a great possibility for you.

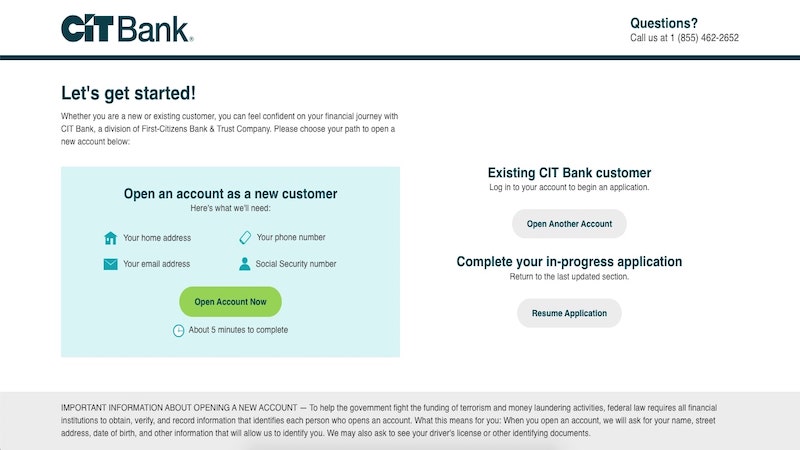

Opening a CIT Financial institution Financial savings Builder Account

Getting began is simple. Comply with this hyperlink to the CIT Financial savings Builder Account and click on on the inexperienced button that claims, “Open an account.”

Then, click on on the “I’m a brand new buyer” button and also you’ll see an inventory of required objects to open an account.

They embody:

- Legitimate electronic mail tackle

- House tackle

- Telephone quantity

- Social Safety quantity

You additionally should be a everlasting resident or citizen to open an account. In the course of the course of, the financial institution will ask if you wish to open a person or joint account.

You’ll then be requested to enter the knowledge listed above, in addition to your citizenship standing and (for safety causes) mom’s maiden title. Federal laws additionally require you to supply your occupation and employer.

As soon as these particulars are entered, you’ll be requested to supply data on funding the account. The best approach to do that is thru an digital switch from one other checking account.

Nevertheless, you may also write a verify or arrange a wire switch. Particular particulars on how to do that are on the FAQ part of the financial institution web site.

Word: It’s attainable to open a Financial savings Builder account for a kid utilizing a custodial account. This implies you possibly can management the account till the kid is eighteen, or as previous as 25 in case your state permits.

Beneath the Uniform Switch to Minors Act, you possibly can switch as a lot cash as you need into the account as a present.

Vital CIT Financial institution Options

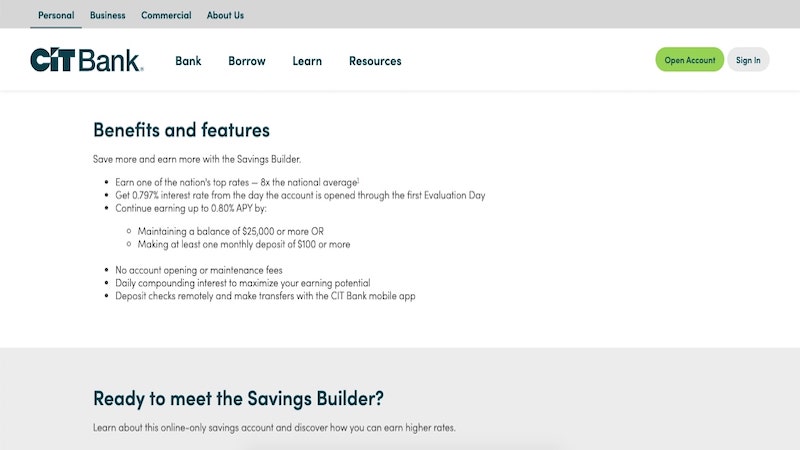

Listed below are among the options of CIT Financial institution’s Financial savings Builder Account that make it actually engaging.

Curiosity Fee

Let’s be sincere: when you find yourself searching for a financial savings account, the factor that issues most is the rate of interest.

You need to know how a lot passive earnings you possibly can earn out of your cash.

The CIT Financial savings Builder account gives one of many highest rates of interest for a financial savings account within the nation. They provide a aggressive APY with a minimal stability of $25,000 or a $100 month-to-month deposit.

In accordance with Bankrate.com, that is at the moment the most effective fee accessible for on-line financial savings accounts, although there could also be cash market accounts that pay barely extra.

The typical rate of interest nationally is simply 0.10%, Bankrate says. CIT’s fee is considerably greater than that.

The $25,000 minimal stability requirement for the Financial savings Builder account is excessive, however it may be waived if you happen to deposit $100 per 30 days into the account.

After an analysis interval, which ends on the fourth enterprise day previous to the top of the month, the financial institution will decide whether or not you qualify for that fee shifting ahead.

If you don’t meet the necessities for the very best rate of interest, you’ll obtain the bottom rate of interest APY. Clearly, it is a noticeably decrease fee, however nonetheless a lot increased than the nationwide common.

Compounding

When analyzing financial institution rates of interest, it’s greatest to look past simply the quantity. That you must perceive how the financial institution calculates rates of interest and when it really makes funds.

CIT Financial institution Financial savings Builder compounds curiosity every day.

What this implies is that when calculating how a lot to pay you in curiosity, the financial institution will add the curiosity every day, versus quarterly or month-to-month as different banks do.

This will help you earn extra over time.

For instance, let’s say you begin with an account stability of $25,000 and the rate of interest is .65% (a typical fee for the CIT Financial savings Builder). For the primary 12 months, you’d earn $162.50.

That won’t seem to be a lot, however it implies that the following time curiosity is calculated, it is going to be primarily based on a stability of $25,137.50 and so forth and so forth. It actually will add up sooner than typical banks.

Different banks will compound curiosity much less continuously, doing so on a month-to-month or quarterly foundation. Within the brief time period, this doesn’t make an excessive amount of of a distinction in your earnings.

However over a very long time horizon, it will possibly add as much as noticeable financial savings.

Not like many different financial institution accounts, the CIT Financial savings Builder account doesn’t cost a month-to-month upkeep payment. There are additionally no charges for on-line transfers or incoming wire transfers.

Charges

The financial institution will cost the next charges:

- $10 payment for an outgoing wire switch for account holders with balances of lower than $25,000.

- $10 for extreme transactions. (Withdrawals and deposits are restricted by legislation to 6 per 30 days.)

CIT On-line Banking and Cell App

For any online-only financial institution, a high quality on-line expertise is paramount. It’s uncertain that you just’ll have a lot to complain about with CIT Financial institution.

The financial institution’s web site and dashboard interface are uncluttered and permit for straightforward viewing of your monetary image. Account transfers are additionally straightforward.

The CIT Financial institution free cell app lets you view accounts, switch funds between CIT accounts, and even deposit checks. One huge downside, nonetheless, is that it’s not attainable to make use of the app for transfers between a CIT account and an exterior one.

Safety

Clearly, anytime you’re banking on-line you need your funds to be safe. All CIT accounts are FDIC-insured as much as $250,000. (Word: This $250,000 restrict consists of funds deposited with OneWest Financial institution.)

The corporate additionally has strong safety protections in place.

Along with requiring you to make use of a login and password to entry your accounts, the financial institution does common transaction monitoring and has 128-bit Safe Socket Layer encryption to make sure that your net connection is safe.

Another monetary establishments use a stronger 256-bit encryption.

Buyer Service

As a result of CIT Financial institution is an internet financial institution, you gained’t benefit from going right into a department to get customer support. However there are individuals accessible that will help you through cellphone.

Right here’s the right way to attain customer support:

Name: 855-462-2652 (throughout the U.S.)

626-535-8964 (from outdoors the U.S. — toll name)

Fax: 866-914-1578

Hours:

Monday by means of Friday: 9:00 a.m. — 9:00 p.m. (ET)

Saturday: 10:00 a.m. — 6:00 p.m. (ET)

Sunday: Closed

Drawbacks

The CIT Financial savings Builder account will help you get monetary savings, however there are some downsides you ought to be conscious of.

First, as we talked about, the very best rate of interest is just accessible to these with account balances above $25,000, or those that can deposit $100 month-to-month.

Some individuals might discover this threshold too excessive to satisfy. Different on-line banks supply rates of interest which are almost pretty much as good, with out the minimal stability necessities.

The CIT Financial savings Builder account — and CIT Financial institution usually — doesn’t supply the complete suite of banking providers you may get elsewhere. CIT Financial institution solely gives one checking account, for instance.

Whereas the financial institution does supply some mortgage merchandise, they’re restricted to residence mortgages.

There aren’t any retirement accounts or planning providers, and no entry to credit score or debit playing cards. There aren’t any financial institution branches, both. To be honest, it’s the shortage of all these providers that enables CIT to supply increased rates of interest.

If you happen to plan to financial institution with CIT, it is advisable be comfy banking completely on-line by means of the financial institution’s web site or cell app, or by means of phone banking.

Almost certainly, you’ll want an account with one other financial institution with the intention to fund the CIT account and make withdrawals.

And do not forget that federal legislation limits deposits and withdrawals to a complete of six per 30 days. CIT Financial institution doesn’t supply entry to ATMs.

CIT Financial institution Financial savings Builder Critiques

CIT Financial institution’s Financial savings Builder is one in every of many merchandise supplied by the financial institution.

You’ll discover a mixture of evaluations about CIT Financial institution. A take a look at the client evaluations will help you determine if this financial institution is the best match in your financial savings.

“This app doesn’t work with my password supervisor. Lastpass is a serious password supervisor and it’s important to enter in an additional character on the finish of the password when lastpass provides it, then delete it, because it gained’t allow you to log in except you really sort one thing into the password area. That is 2022 and password managers are almost required for safety and the concept that a banking app won’t work with one is sort of astounding.” – Sean W

“My general expertise has been optimistic, however it could possibly be extra clear with its features. To provoke transfers, you would need to hit the + button within the account view web page which might then immediate you to decide on between choices beginning a brand new switch, deposit, account, ect. The assistance part didn’t assist me discover the button both, so there may be room for enchancment.” – Consumer

“This app has so many UX issues. Simpler than the web site, however not very user-friendly. The designers didn’t be sure the quantity keypad pops up if you want it, it continuously reverts again to alphanumeric, which causes typos. I’m grateful for the fingerprint log-in although.” – Penny S

“Love the financial institution, use it for the financial savings account. ” – Anna B

Alternate options to CIT Financial institution Financial savings Builder

CIT Financial institution’s Financial savings Builder account is an effective possibility for long-term savers, however there are opponents which may be price a glance.

Ally Financial institution

Ally Financial institution is a well-liked on-line financial institution with better-than-average rates of interest and no minimal account balances or charges. However you’ll face a $25 inadequate funds payment if you happen to overdraw your account.

In addition they gives a free interest-bearing checking account. You may earn as much as 0.10% APY on account balances lower than $15,000. In case your stability goes avoce $15,000, you’ll earn 0.25% APY.

One other perk is entry to over 43,000 Allpoint ATMs. With that, you possibly can keep away from ATm charges. If it’s important to use an out-of-network ATM, Ally Financial institution will reimburse you as much as $10 every month.

Uncover Financial institution

Uncover Financial institution gives a 1.50% APY with its On-line Financial savings Account. The curiosity is compounded every day and paid out on a month-to-month foundation.

You gained’t encounter a slew of charges with this account. In actual fact, there aren’t any month-to-month upkeep charges, extreme withdrawal charges, inadequate fund charges, or account closure charges.

With no month-to-month stability necessities, you’ll benefit from the financial savings options that Uncover Financial institution has to supply.

Abstract

The CIT Financial institution Financial savings Builder account is a really effective possibility for individuals seeking to get just a little bit extra return on their money financial savings. Its rates of interest for high-balance prospects, particularly, are among the many greatest within the nation.

If you happen to can’t meet the minimal stability necessities for prime charges, it’s possible you’ll discover a higher match with a competitor.

Additionally, shoppers on the lookout for a full banking expertise together with branches, ATMs, and mortgage merchandise will doubtless discover CIT missing.

As an easy financial savings account for these with quite a bit to avoid wasting, nonetheless, it’s powerful to beat.