Eurokai Shareholder Meeting in Hamburg

This week I did something I didn’t do for some time: I visited an annual shareholder meeting, in this case that of Eurokai in Hamburg. The main reason was to get a better impression of Tom Eckelmann, the 6th gneration family CEO who took over last summer.

Apart from the venue (Hotel Hafen Hamburg) with great views over the harbour in Hamburg, these were my main take aways (AGM presentation in German can be found here) :

- Business in the first 5 months is doing (much) better than expected. This is the chart from the AGM showing the amount of containers:

The terminals in Marocco benefit from the current issue in the Suez canal. On top of increased container throughput, they mentioned that storage fees have increased as well, as the delays from the Suez issue require more and longer storage and generate more fees for port operators. Initially, Eurokai predicted a lower result in 2024 compared to 2023, but they mentioned that they might soon change the outlook.

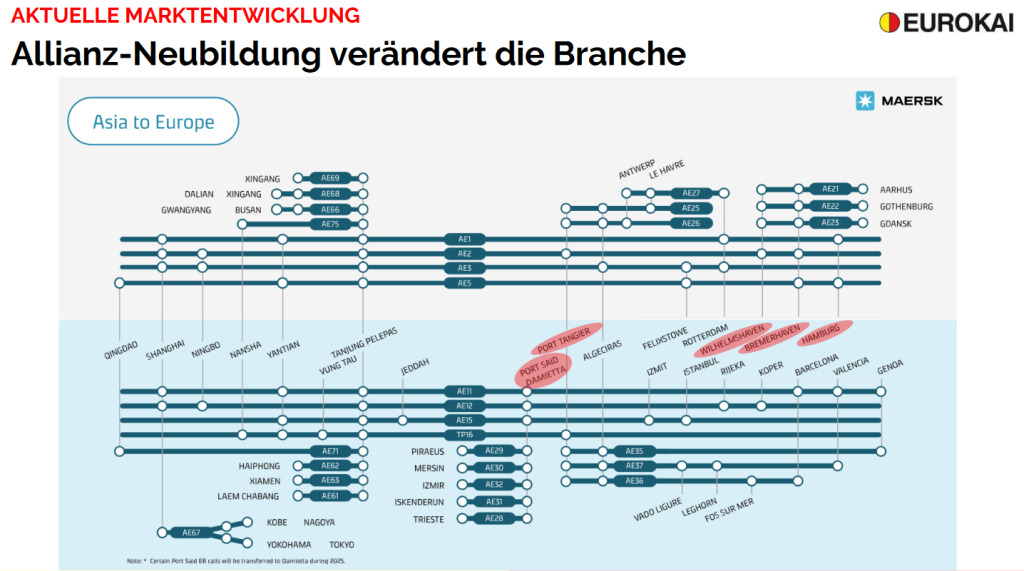

- New alliances: Gemini (Maersk & Hapag Lloyd)

An even more interesting topic seems to be that the end of the Maersk / MSC Alliance and the new Hapag Lloyd / Maersk Aliance starting in February 2025. If I understood that correctly, 5 terminals of Eurokai will get the status of a “Hub” for all Asian routes (Wilhelmshaven, Bremerhaven, Hamburg, Tanger & Damietta) which will potentially increase traffic significantly going forward. Maersk and Hapag Looyd don’t seem to go directly to the Baltic harbours any more and shift that traffic completely to the German ports. This was the chart they showed in the AGM:

Overall, Eurokai was quite unconcerned about the impact of the MSC investment into competitor HHLA. They expect that for the Hamburg terminal, the volume that will shifted over from MSC will be more than compensated from the competitors shifting volume away from HHLA. For Bremerhaven, which Eurokai runs as JV with MSC, they expect no change.

Overall, my impression was quite positive. So far he seems to continue what his father did. It will be interesting to see if and when he will be setting his own agenda.

Overall, things at Eurokai seem to go into the right direction. I have already “recycled” the dividend into the stock and might increase the position in the coming months.

Hutchison Port Holding Trust

Because it was on my to do list, I decided to look quickly into Hutchinson Ports, the Port subsidiary of CK Hutchison. The first look at TIKR’s overview page shows that we have a very different company here compared to Eurokai:

The company looks highly leveraged and the share price has lost almost -90% over the last 15 years. Accorng to TIKR, Hutchison “only” 27,6% and Temasek from Singapore around 16%.

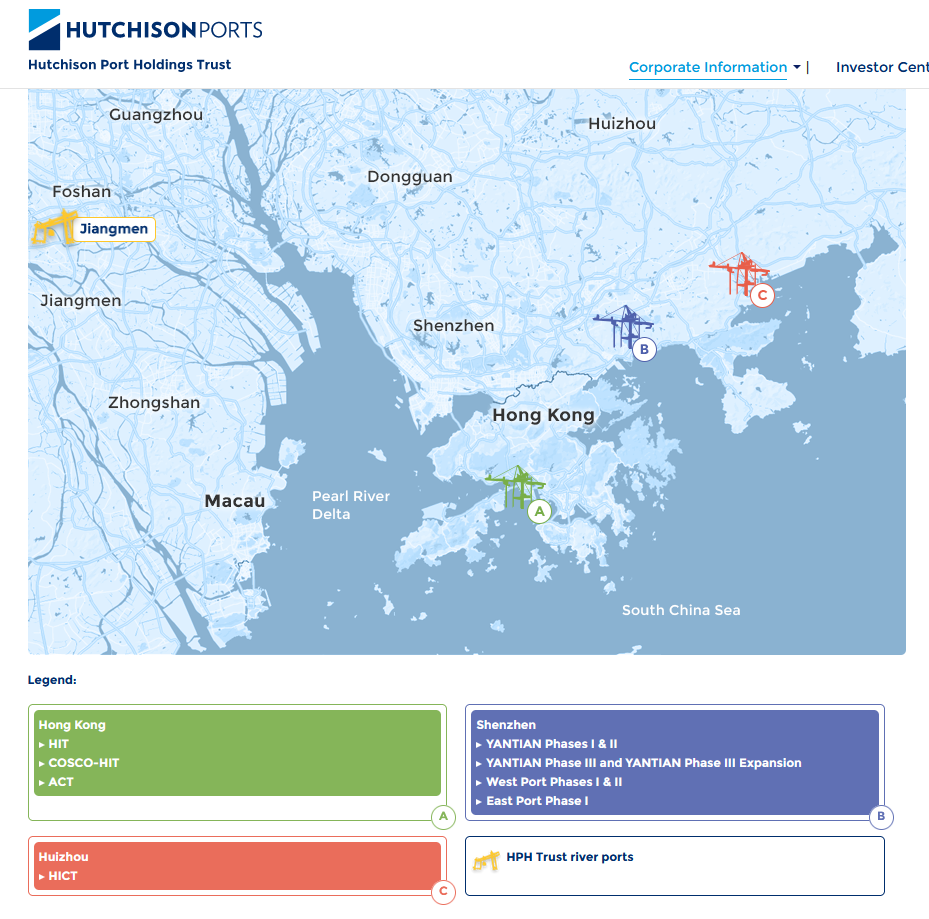

Accoring to theri hompeage, the listed entity is only part of the full Hutchison Ports Group:

It also seem to comprise only Chinese/Hongkong based ports:

Financially, the most relevant part in my opinion is the Cash flow statement which shows that they distribute divdends that are not earned and that most of the profits “evaporate” to minorities:

Overall, this clearly doesn’t look like something I want to be involved in.

The only interesting aspect here is that one can see “the other side” of the business form the Eurokai ports. This is for instance what they wrote in Ferbuary:

So one could see this as an early indicator. Therfore I will try to read the reports of Hutchson Ports form time to time on how “the other side” is doing.

P.S.: And of course I used the trip to Hamburg for some “on site” Container terminal DD: