We’re at present in a market the place one week appears to be already an extended time frame. One week in the past I wrote about Silicon Valley Financial institution and the totally different cycles in a typical banking disaster (First liquidity, then credit score troubles).

Final week: SVB

In between, the financial institution run accellerated and SVB was then closed and rescued by the FDIC. Within the age of social media, there’s now loads of protection on this occasion out there, personally I discovered this Odd Heaps Podcast Episode helpful in addition to Matt Levin’s take. Matt Levin additionally has a solution on why SVB was not bought over the weekend: Within the wake of the GFC, lots of the banks who purchased failing lenders have been then punished with lawsuits and it appears that evidently one thing like this might occur to SVB as effectively.

Present consensus is that SVB failed each, due to very unwise rate of interest bets on its asset aspect in addition to an unhealthy focus of its depositor base linked by just a few massive VCs on its legal responsibility aspect. In accordance with many tales, SVB was a really lively member of the Silicon Valley VC ecosystem and someway the VCs (and startups) mainly killed the Goose who laid them golden eggs with this bankrun. Within the present tough funding atmosphere, It will have made extra sense fot the VCs to help the financial institution however I suppose they have been all in panic mode.

This week: Credit score Suisse

This week, the remark of a consultant of the Saudi Funding fund led to the implosion of the share value of Credit score Suisse. In the future later, the SNB and FINMA launched an announcement that they’ll backstop 50 bn of liquidity necessities which for now appears to have stabilized issues to a sure extent.

Credit score Suisse – Rogue Financial institution

CS was a sluggish shifting practice wreck ever because the former McKinsey “Wunderkind” Tidjane Tiam took over as CEO in 2015. When he was fired in 2020, not solely it was revealed thaty he used non-public investigators to spy on fellow board members, however extra importantly, Credit score Suisse was concerned in nearly each main fuck-up in the previous few years. Just a few examples:

- 5,5 bn USD loss with Archegos/Invoice Kwan in 2021

- 1,7 bn USD loss with Greensill

- Pushed 1 bn of Wirecard bonds into Purchasers portfolios shortly earlier than the collapse

- Was a creditor to Chinese language faux espresso chain Luckin Espresso

- CS is meant to carry at the very least 80 bn USD property of criminals and corrpupt politions

Solely up to now few months, the Swiss regulator brazenly critisized CS’s weak controls and in addtion, CS discovered “materials weaknesses” of their monetary reporting. For extra dangerous stuff, simply googling “Credit score Suisse scandal” offers extra outcomes on cash laundering, Bulgarian Cocaine rings and different “juicy” stuff, it’s actually unimaginable.

Wanting on the CS share value, it’s fairly apparent that there’s actually no backside:

Though it’s at all times very tough to make predictions, I personally suppose {that a} true and lasting turn-around for CS could be very unlikely. There are only a few circumstances in banking historical past the place a monetary establishment survived such a “clusterfuck”. Credit score Suisse wouldn’t be the primary massive title in Banking that simply disappears. Apart from Leahman and Bear Stearns, who remembers Salomon Brothers, DLJ, Bankers Belief, Barings, Smith Barney, Chemical Financial institution, Dresdner Financial institution and all of the others ?

The almost definitely situation in my view can be that the ring-fenced Swiss operation will someway survive. What which means for Bondholders and shareholders on Group stage is open, however in my view the CS shares are at finest a “far out of the cash choice” on a really optimistic situation. In fact something will be traded profitably within the quick time period, however mid- to longterm, a whole lack of capital could be very seemingly for CS shareholders.

In the present day: First Republic Financial institution

First Republic, a “mid sized” 200 bn plus US financial institution with ~21 that banks to “Excessive internet price shoppers in costal areas” continued its plunge and mentioned it might be open to nearly something, together with a hearth sale with the intention to survive.

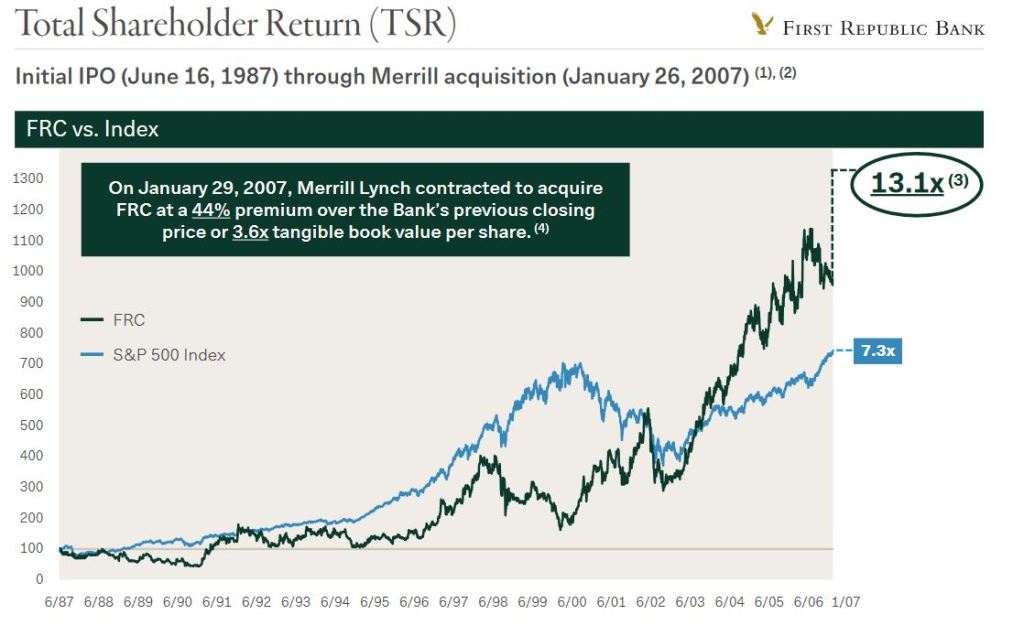

When studying the January invetsor presentation, First Republic seems like an absolute success story, amongst others, their share value went up 13x since 1987, nearly 2x the extent of the S&P (i suppose ex dividends) which is outstanding for a financial institution:

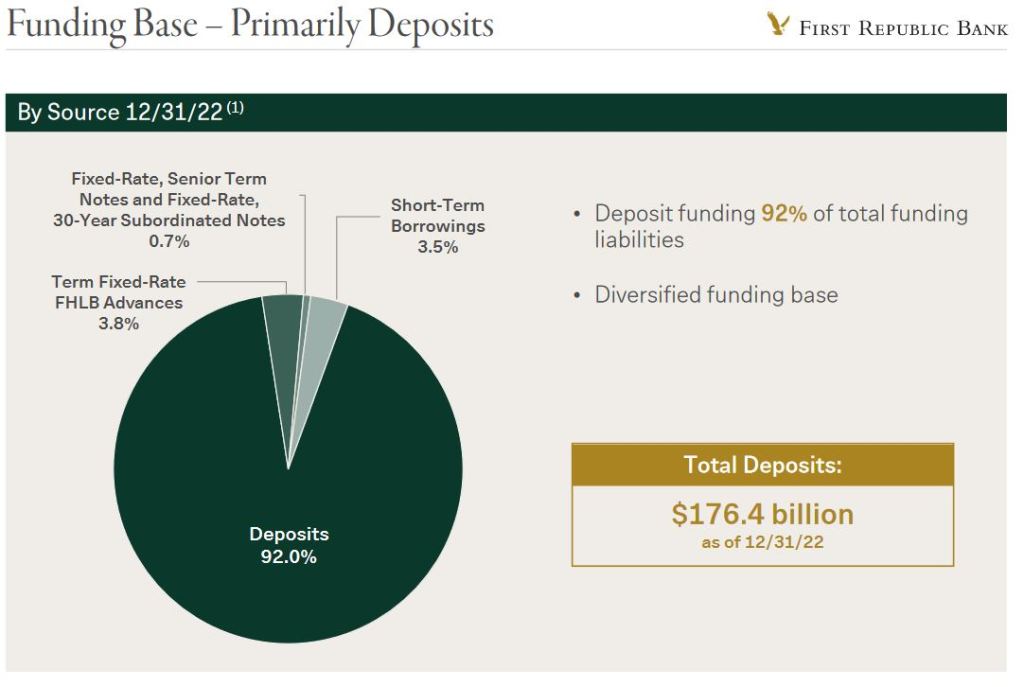

Nevertheless, these slides, it turns into comparatively clear the place the issues of Republic are: Funding is usually through deposits:

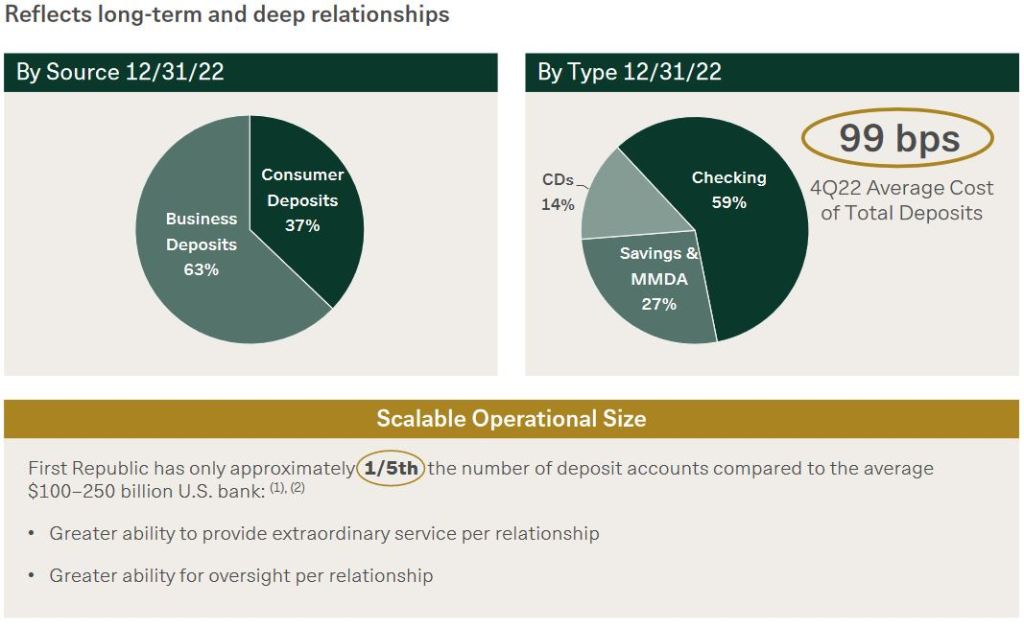

The deposits are principally enterprise accounts and bigger measurement:

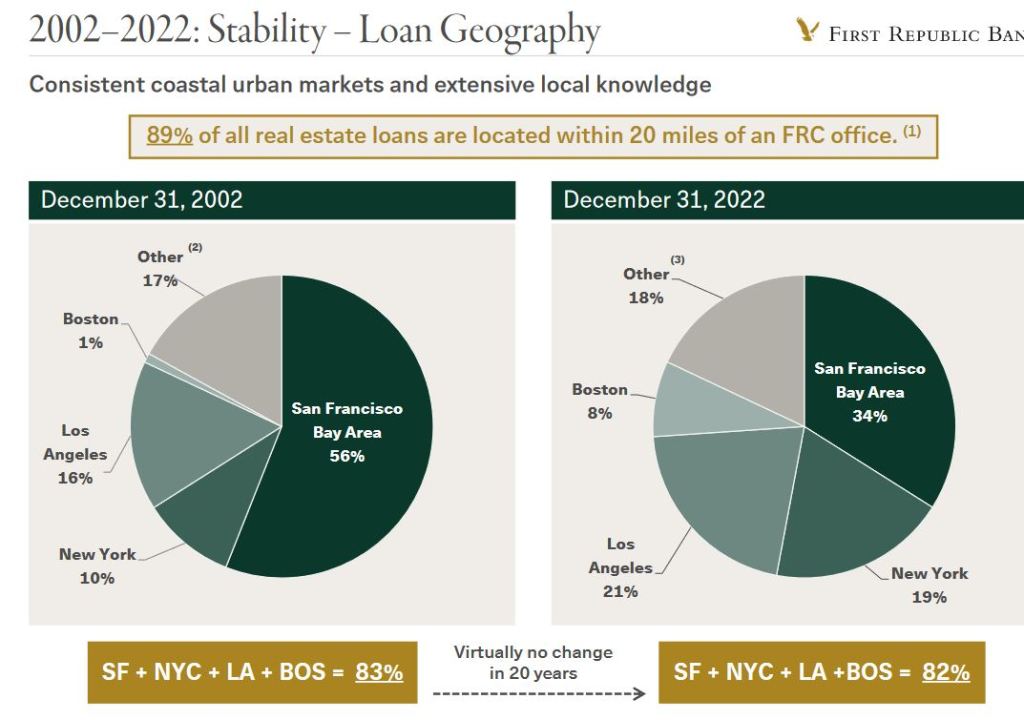

And, the Asset aspect consists principally of “coastal actual property loans” and enterprise loans to venturec Capital funds, each property that could be in bother:

It didn’t assist that the Ranking Companies simply downgraded First Republic to “junk” due to the weak funding construction.

To be trustworthy, If I’d have identified about First Republic earlier and browse the investor presentation, I might need thought of it as a possible funding. The financial institution additionally traded at uncommon excessive P/E multiples within the vary of 20-30 earnings, so only a few traders

Subsequent week and thereafter: What may very well be the extra lasting results of this episode ?

I suppose that for the following two or extra weeks, the market is “looking” for additional weak gamers and all of them can be backstopped by their respective Governments and Central Banks. A “Lehman second” in my view nonetheless stays a really low chance situation. Nevertheless additionally it is clear that this entire growth might need wider penalties.

For the banks, it will likely be much more tough to remodel quick time period deposits into long run property, which by definition is likely one of the fundamental operate of the banking system. For the US, extra and harder regulation is already on the way in which.

Amongst different unwanted effects, general the present growth will almost definitely enhance funding value and restrict borrowing capability for the banking sector. This in flip will make it harder for debtors to acquire or roll over financial institution loans. And if debtors are capable of acquire financial institution loans, they might want to pay increased credit score spreads. A sure enhance in Company Credit score spreads was already observable up to now few days.

General this might have a siginficant affect on enterprise exercise as the provision of financial institution loans is a number one indicator for financial exercise. This in flip might then result in the second a part of the cycle, the true credit score cycle with extra defaults and so forth.

Relying on how inflation charges are creating, the central banks would possibly counter with decrease rates of interest, which nonetheless, do little to make lending simpler for the banks. In fact, Governements and Central banks will attempt to counter an enormous credit score squeeze, nonetheless with out tighter credit score situations it’s unlikely that inflation will cool off shortly.

I want to emphasise right here that I’m not a Macro man in any respect, however general, I believe the chance for an actual credit score cycle has elevated considerably. As a consequence, in my view one ought to restrict publicity to uncovered monetary firms in addition to companies with close to or mid time period funding necessities.