Australia’s federal parliament has accredited a A$15 billion Nationwide Reconstruction Fund, meant to reverse the nation’s dwindling manufacturing sector. It’s the “first step” in Prime Minister Anthony Albanese’s election promise “to revive our capacity to make world-class merchandise.”

The fund will concentrate on investing in high-tech manufacturing. There are seven precedence areas:

- clear vitality

- medical science

- transport

- value-added manufacturing in agriculture, forestry, and fisheries

- value-added manufacturing in mining

- navy tools, and

- “enabling capabilities.”

The fund is anticipated to function commercially and ship a return on its investments. Its strategy can be just like the Clear Vitality Finance Company, which over the previous decade has offered greater than $10 billion in grants and loans to low-emission vitality initiatives.

Investments can be within the type of loans, fairness and ensures. It is going to be a co-investment mannequin, that means personal traders should match funds offered.

It’s going to begin with $5 billion. The opposite $10 billion will offered in instalments over the remainder of the last decade. After 2030, investments are anticipated generate sufficient income to assist new initiatives. These selections can be made by a board that can be impartial of the federal authorities.

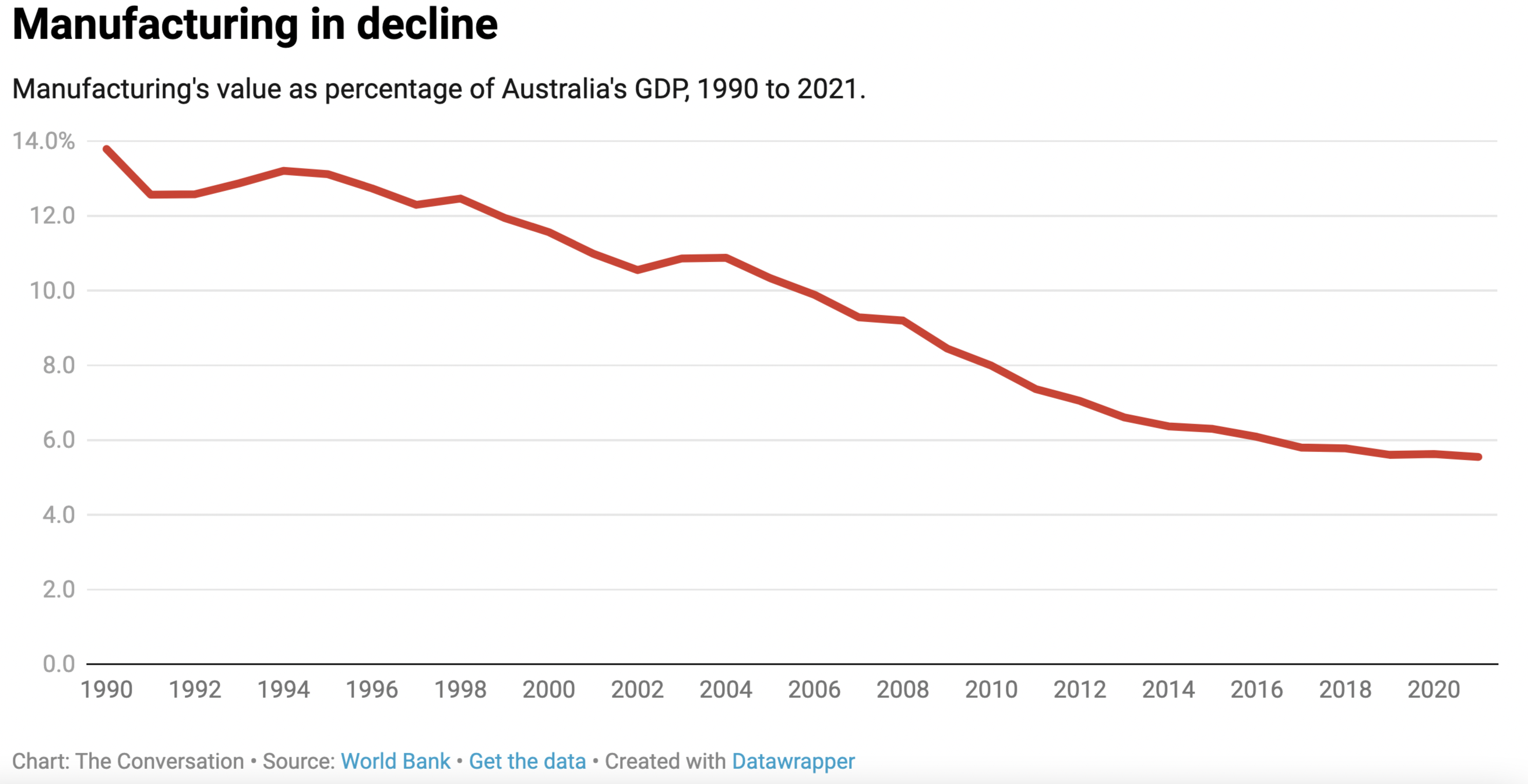

Manufacturing information

Criticisms of the fund

There’s assist for the fund from employer teams and commerce unions. However there are additionally criticisms.

Extra broadly, some economists argue government-supported funding schemes misallocate assets, give sure companies an unfair benefit, and decelerate innovation over time by investing an excessive amount of in a single space and ravenous different modern concepts of assets. As The Economist has put it, attempting to “choose winners” may also imply investing in losers.

However government-backed investments do play an important position in offering monetary assist to commercialise new know-how, for which attracting personal funding is usually robust.

The federal opposition has complained the Albanese authorities ought to concentrate on extra rapid challenges going through producers, resembling excessive vitality costs and labour shortages.

Opposition frontbencher Paul Fletcher has expressed concern the fund will finance initiatives that “wouldn’t achieve getting personal sector finance – however which for political causes the federal government desires to fund”. A manufacturing facility in a marginal seat, for instance.

There are precedents for such considerations. The Morrison authorities, of which Fletcher was a senior member, did such issues with funding for automotive parks and sporting services.

However it is usually the case that such pork barrelling didn’t occur with the Morrison authorities’s $1.3 billion Trendy Manufacturing Initiative, which offered grants in roughly the identical precedence areas as the brand new fund.

Regardless of political and monetary incentives to search out fault with it, the Albanese authorities has endorsed the Trendy Manufacturing Initiative’s expenditure. It has criticised solely the way in which the Morrison authorities manipulated the timing of funding bulletins.

Nor has the Clear Vitality Finance Company, established by the Gillard authorities in 2012, confronted such criticisms. It’s considered a hit story throughout the political spectrum, from teams such because the Australian Conservation Basis to mining magnate Clive Palmer.

The institution of the Nationwide Anti-Corruption Fee ought to additional give confidence that Albanese, a longtime champion of constructing issues in Australia, is honest about “full transparency” for the Nationwide Reconstruction Fund.

3 methods to enhance the fund

To however to enhance the fund’s likelihood of success, there are three issues that may be executed.

First, to realize the transparency Albanese has promised, the fund ought to publicly share the reasoning behind its funding selections, just like how the Reserve Financial institution of Australia’s board publishes minutes of its month-to-month coverage conferences. Being open about decision-making will construct public belief within the fund’s transparency and equity.

Second, the Nationwide Reconstruction Fund’s funding board might want to clearly define funding priorities whereas staying versatile, so initiatives that span a number of sectors or purposes don’t fall between the cracks. Breakthrough concepts might not match neatly right into a single class. As an illustration, artificial biology know-how can be utilized in meals manufacturing and plastic recycling. It doesn’t belong to only one precedence space.

Third, supporting particular person initiatives isn’t sufficient. Right here’s the place these “enabling capabilities” are essential. Altering the trajectory of producing in Australia requires a supportive ecosystem that aligns issues like funding and coverage priorities in training and coaching, analysis being executed in universities, immigration settings, and pure benefits.

Tasks received’t succeed with out expert staff, sturdy analysis backing, and quick access to suppliers and clients.

Australia’s renewable vitality sector is an instance of a supportive surroundings that may result in success. Australia has loads of solar and wind, a rising variety of expert staff within the renewable vitality discipline, high analysis establishments, a educated investor base because of the Clear Vitality Finance Company, and a rising quantity of people that care about eco-friendly vitality options.

By setting clear targets, encouraging innovation, and making selections clear, the fund stands the most effective likelihood to realize what it has been created to do.