Searching for Alpha is likely one of the most well-respected funding analysis platforms. It’s potential to obtain protection for shares and ETFs plus uncover totally different investing concepts.

If you happen to recurrently swing commerce shares or spend money on particular person shares, high-quality analysis is important to be a profitable investor. It’s why I recurrently use this service to be taught extra about potential investments and display shares.

Whereas this on-line group gives a Fundamental free plan, you’ll be able to improve to Searching for Alpha Premium, however is it value it? Discover out on this evaluation.

Abstract

Searching for Alpha Premium provides buyers limitless entry to its funding analysis articles and the Quant Ranking system. Traders can rapidly discover causes for different buyers to purchase or keep away from a inventory. Because of the excessive price ($29.99/month), rare buyers could not profit from upgrading.

Execs

- Limitless entry to Investing Concepts articles

- Opinions most shares and ETFs

- Can monitor your funding portfolio

Cons

- Excessive month-to-month price

- An excessive amount of data for informal buyers

- Not for technical merchants

Is Searching for Alpha Premium Price It?

Sure, Searching for Alpha Premium is value it when you maintain a number of particular person shares and need to save time monitoring your portfolio. I just like the recurring portfolio updates that increase consciousness about asset allocation and stock-related information.

You may additionally select Premium when you make a number of trades per 30 days and depend on the basic evaluation from different buyers.

It’s troublesome to justify the month-to-month price when you solely make investments small quantities of cash. Having a brokerage with helpful analysis instruments and analyst stories additionally makes upgrading to Searching for Alpha Premium not value the additional price.

You need to think about becoming a member of Searching for Alpha Premium in these situations:

- Maintain a minimum of 5 particular person shares

- Are a severe investor

- Wish to analysis shares and ETFs

- Need entry to Searching for Alpha content material older than ten days

What’s Searching for Alpha?

Searching for Alpha is an internet group of buyers that’s like Bogleheads however for investing in particular person shares. Additional, there’s extra protection for ETFs.

You will get investing newsletters about totally different subjects, together with the every day market headlines and evaluation of particular person tickers and market sectors.

When researching investing concepts or doing a portfolio checkup, you’ll be able to learn evaluation articles that skilled buyers write protecting particular shares, funds and asset courses.

Over 7,000 contributors write roughly 10,000 articles each month, in line with Searching for Alpha.

Most firms have articles with bullish and bearish commentary which helps you rapidly estimate the positives and negatives of a inventory’s potential efficiency. Personally, I get pleasure from following particular contributors and shares.

You can too entry the most recent market information, learn earnings name transcripts and monitor your portfolio efficiency.

What Does Searching for Alpha Value?

The Searching for Alpha Premium annual plan can be on sale and out there for $119 $99 or the primary yr, as an alternative of the common $239, which is a tremendous 59% low cost – Plus a 7 day Free trial.

There are three subscription plans to select from when utilizing Searching for Alpha:

- Fundamental: Free

- Premium: $119 for the primary yr (then $239 per yr)

- Professional: $499 yearly and billed upfront after a 14-day free trial

Most buyers will solely want the Fundamental or Premium membership plan. You’ll be able to attempt Searching for Alpha Professional with a 14-day free trial.

The costliest membership plan, Searching for Alpha Professional, offers unique newsletters and extra sturdy screening instruments.

As an illustration, you’ll be able to display shares by investing concepts or by shorting shares. Plus, additionally, you will have your personal VIP Editorial Concierge.

Searching for Alpha Premium: In-Depth Overview

You may already use the free model of Searching for Alpha however tire of hitting the paywall to entry unique content material.

Upgrading to Searching for Alpha Premium provides you entry to extra superior data, together with scores instruments and a inventory screener.

This prolonged entry could make researching and following investing concepts simpler.

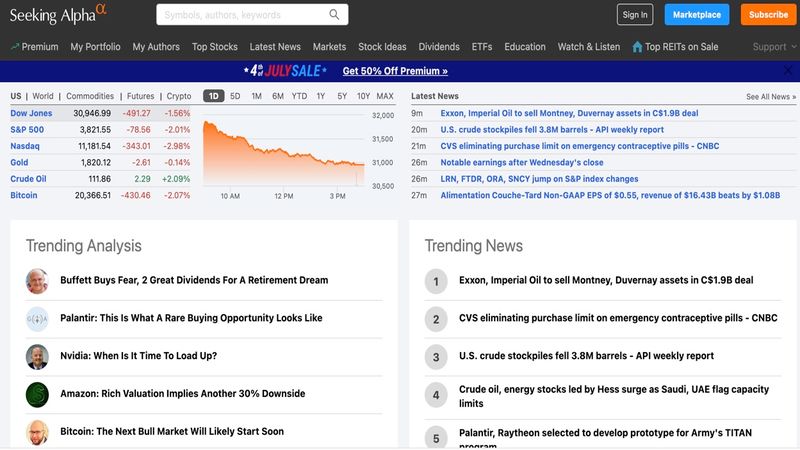

Discover Investing Concepts

Top-of-the-line causes to make use of Searching for Alpha is for its quite a few investing concepts articles. They’ve extra concepts than lots of the greatest funding websites.

For instance, you’ll be able to scroll by these sources on the principle web page alone:

- Editor’s Picks for the top-rated articles

- Notable calls and insights

- Trending market information

- High-rated shares

Moreover, you’ll be able to seek for a particular inventory or fund if you have already got an concept in thoughts. I get pleasure from having the ability to browse the headlines and inventory scores to find out about new firms and decide what’s trending and the way my portfolio is affected.

Most funding concepts articles can be found free of charge for the primary ten days. Nevertheless, Premium members get limitless entry to all investing concepts articles.

Contributors share their predictions in article format, and the Searching for Alpha editorial group screens the article for statistical accuracy.

Each Fundamental and Premium members can go away feedback sharing their ideas on whether or not they imagine the creator’s prediction is appropriate.

These articles current the bullish, bearish and impartial case for a inventory. In fact, each bit is a matter of opinion. You need to learn each the bull and bear case to carry out thorough funding analysis.

Additionally, having limitless entry helps you to learn earlier articles from the identical creator protecting a inventory that pursuits you.

If you happen to’re trying into shopping for a brand new inventory, the corporate’s investor relations web page and Searching for Alpha will be two important analysis sources. In fact, not one of the content material is private funding recommendation however helps you full your due diligence.

You may additionally use Searching for Alpha as a companion to Motley Idiot Inventory Advisor, which recommends two month-to-month inventory picks.

Inventory Scores

Searching for Alpha Premium lets authors assign one in all 5 scores to a inventory or ETF:

- Very Bullish

- Bullish

- Impartial

- Bearish

- Very Bearish

Each authors and the Searching for Alpha scoring instruments observe this ranking system. Fundamental members can’t see the creator or Searching for Alpha scores.

Along with a basic ranking for a inventory ticker, you’ll be able to learn a short “Bulls and Bears say” synopsis. This fast learn helps you to see why a inventory is value shopping for and why you may keep away from or promote shares.

I notably get pleasure from Searching for Alpha’s Quant Scores which rating shares by funding model. As an illustration, you’ll be able to see a particular ranking for components together with valuation, profitability and momentum.

Article Sidebar

Subsequent to every article, Premium members can see an article sidebar.

This sidebar accommodates additional particulars:

- Creator’s inventory ranking (i.e., bullish, impartial or bearish)

- Inventory value chart

- Scores from proprietary Searching for Alpha scoring fashions

With Searching for Alpha, the sidebar might help you rapidly perceive and examine the creator’s sentiment of a particular inventory. This device can even assist scale back your analysis time per article.

Low cost on-line brokerages like Constancy or Schwab could supply comparable scores utilizing their proprietary formulation. What I recognize about this platform is you can view the consensus of the article authors, Wall Road analysts and Searching for Alpha’s Quant Scores to search for overlapping opinions and potential divergences.

Creator Scores

Premium subscribers can see the long-term monitor file of the contributors submitting investing concepts. This information might help you discover contributors that make higher long-term predictions.

Along with the creator’s ranking historical past, you’ll be able to see every contributor’s favourite shares. Some contributors work for well-known funding corporations.

Consequently, you will get an inside take a look at their funding technique whereas avoiding excessive advisor charges.

You’re additionally in a position to entry loads of viewpoints with a flat subscription price. It’s additionally simple to keep away from the opinions of unmoderated investing teams the place you’ll be able to simply obtain inventory ideas from a complete stranger which will have minimal funding expertise.

Earlier than digging too deeply into an creator’s commentary, I take the time to view their ranking historical past and skim feedback left by reader’s to find out their accuracy. No investor can be 100% correct, however some are extra constant.

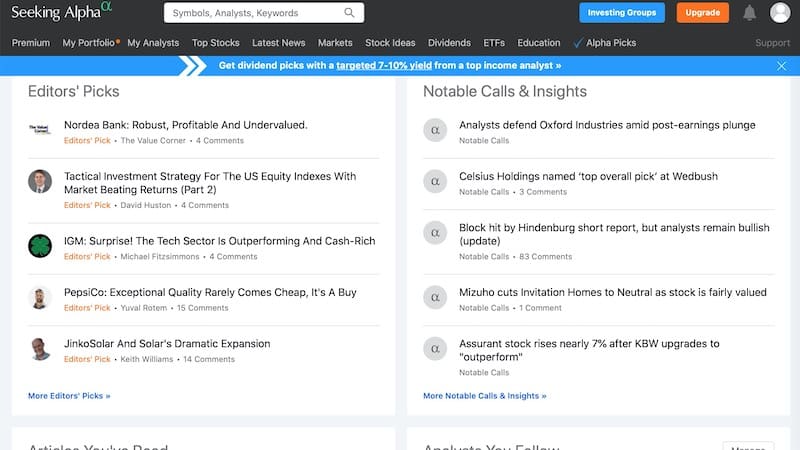

Inventory Screening Instruments

Premium members have entry to in-depth inventory screening instruments.

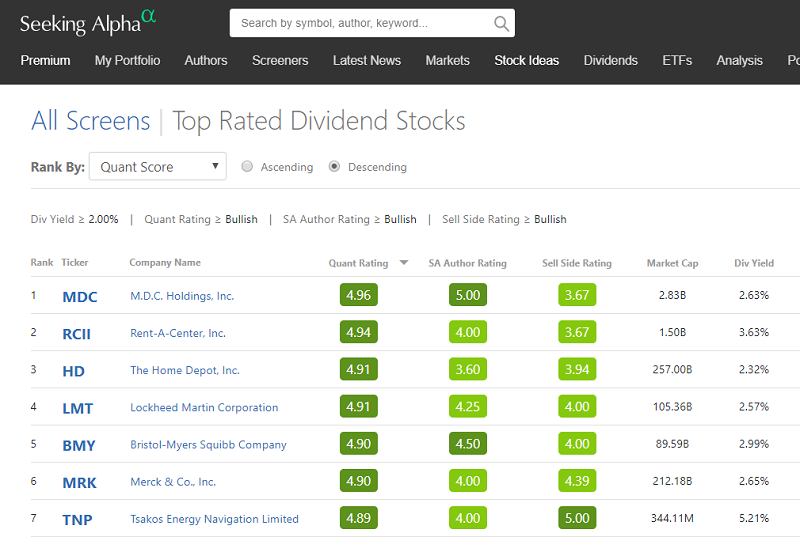

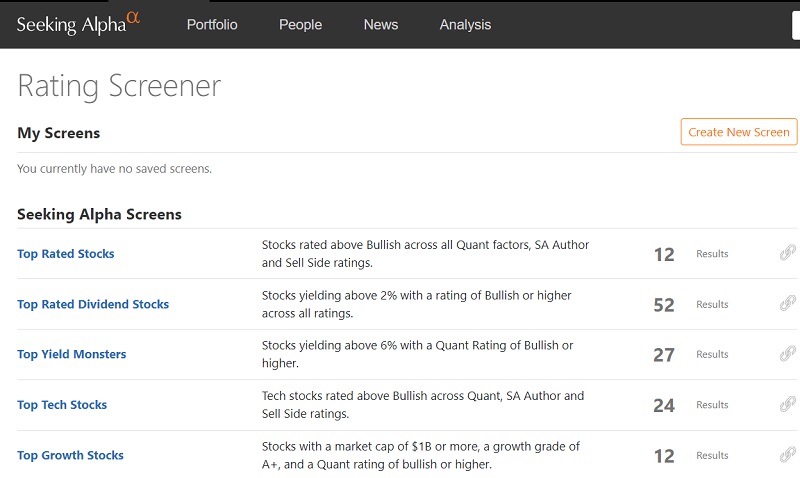

Inventory Screener

Like most on-line brokerages, Searching for Alpha has a inventory screener to run your customized filter, together with Searching for Alpha’s creator scores, market cap, or a basic ranking like development or momentum.

You need to use a premade display to search out top-rated shares and ETFs.

Listed here are among the premade Searching for Alpha screens:

- Shares with an above bullish ranking throughout all ranking components

- Dividend shares yielding a minimum of 2% and with an above bullish ranking

- Greatest development shares with a minimal $1 billion market cap

- Greatest worth shares with a minimal $1 billion market cap

You can too browse one of the best shares by market sector, reminiscent of expertise and client staples. These premade screens generally is a fast technique to discover potential trades and fine-tune an investing concept.

Most investing apps don’t supply in-depth inventory screeners so it is advisable rely extra on investing newsletters to current inventory concepts otherwise you search for trending symbols. This device makes it simpler to personalize your watchlist and discover shares ignored by others.

This screener is likely one of the most sturdy that I’ve used. It’s additionally simple to navigate and its color-coded scores might help you establish one of the best funding concepts.

Quant Scores

Expertise is reworking investing from an artwork into science as computer systems can analyze plenty of information in minimal time. {Most professional} buyers use quantitative evaluation to analysis shares and handle their portfolios.

Searching for Alpha has a proprietary “Quant Scores” system to assist odd buyers perceive the advanced numbers.

The quant rating derives from these components:

- Worth

- Progress

- Profitability

- EPS revisions

- Inventory value momentum

Every inventory undergoes a backtest to calculate its closing quant ranking.

Whereas each individual’s analysis course of is totally different, my eyes gravitate to the Quant Scores sooner as an alternative of later. They make the preliminary analysis course of quite a bit simpler.

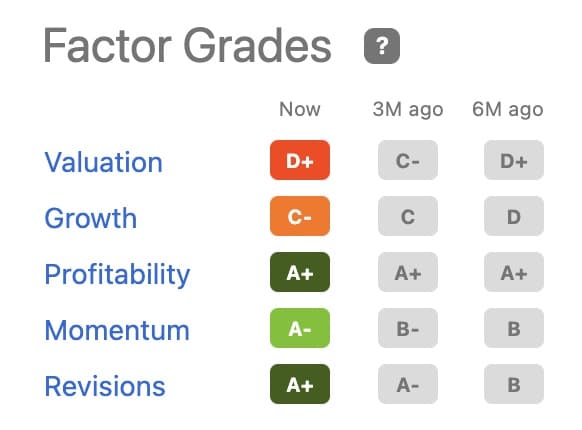

Issue Scorecard

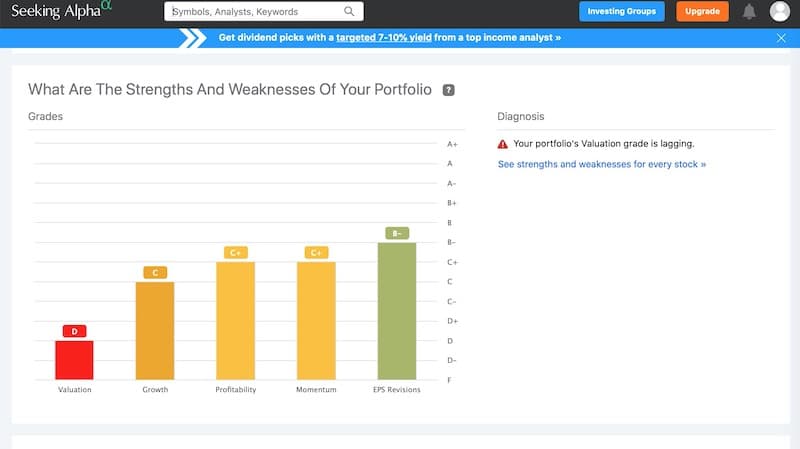

Along with screening shares by quant rating, you’ll be able to analyze the underlying inventory fundamentals. Searching for Alpha compiles an element scorecard compiling the inventory’s worth, development, profitability, momentum and EPS revisions.

When grading actual property funding trusts (REITs), Searching for Alpha scores the Funds from Operations (FFO) and Adjusted Funds from Operation (AFFO) as effectively.

The scorecard scores for these 5 components vary from “A+” to “F.” Like your faculty grades, an A+ is one of the best rating a inventory can obtain for every merchandise.

You’ll be able to see why a inventory receives the ranking it does by clicking the letter grade. In addition they present you the underlying information to find out the rating.

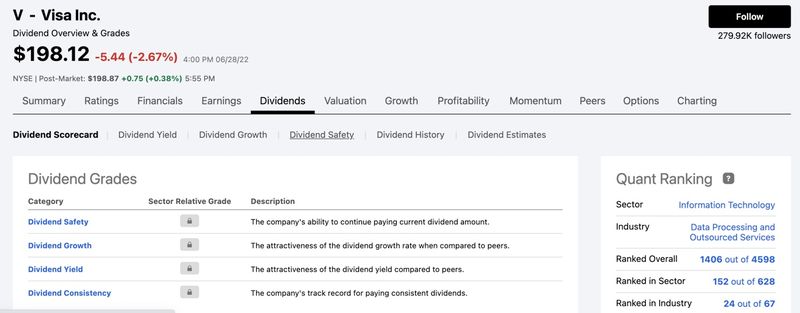

Dividend Inventory Scorecard

Do you need to earn dividend earnings? To your long-term investing concepts, the dividend inventory scorecard might help you keep away from shares with unsustainable yields.

Dividends are typically ignored as folks give attention to share value development. The scoring components are important for dividend buyers wanting dependable and sustainable yields.

For instance, if a sexy dividend is one motive I’m contemplating a inventory, the dividend helps you estimate if the present payout is protected and prone to develop. You can too examine it to the competitors when you’re not loyal to a selected model.

Inventory Comparability Software

You’ll be able to examine a number of shares by quant ranking and issue with a single search display. Many full-service on-line brokers supply this device, however free investing apps most certainly don’t.

The platform additionally helps you to make peer comparisons to see how the metrics stack up between comparable shares and funds.

What makes this device distinctive is the flexibility to match as much as 20 symbols directly. You can too get an in-depth take a look at the corporate fundamentals and Quant Scores as an alternative of simply the value historical past and choose metrics such because the PE ratio.

Earnings and Convention Name Transcripts

A premium subscription helps you to hearken to audio recordings of earnings and convention calls. You can too print and obtain the presentation slides and transcripts.

As a Fundamental member, Searching for Alpha solely helps you to learn the transcripts on-line.

Premium members can even learn as much as 10 years of economic statements. Nevertheless, Fundamental members can solely entry as much as 5 years.

Gaining access to these sources can encourage you to finish the due due diligence course of. For instance, I like breezing by the earnings transcripts as you’ll be able to uncover particulars that the market headlines and commentary could overlook.

Earnings Forecasts

All Searching for Alpha members can see a inventory ticker’s dividend cost schedule and firm earnings. Premium membership helps you to see additional components, together with earnings estimates and surprises.

Notable Calls

Along with the Searching for Alpha scoring programs and the investing concepts articles, you’ll be able to entry “notable calls” that Wall Road professionals and fund managers make.

This function is one other supply of discovering funding concepts. You can too get a glimpse into how the “sensible cash” is investing the money of their rich shoppers.

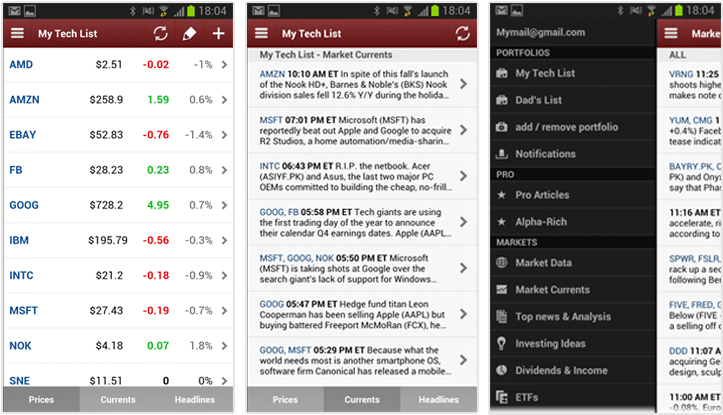

Portfolio Monitoring

You’ll be able to monitor your portfolio efficiency in Searching for Alpha. Fundamental members can monitor their portfolio holdings and obtain some alerts.

Premium members get extra options that may assist you be among the many first to see information on positions you personal.

Sync Brokerage Accounts

Premium subscribers can hyperlink most US brokerage accounts to Searching for Alpha. You probably have a number of brokerage accounts, you’ll be able to monitor your entire investments in a single place.

Fundamental members should manually enter every inventory they need to monitor.

Like many buyers, I’ve a number of brokerage accounts and logging into every app is time consuming and simple to neglect. The automated syncing lets me efortlessly monitor the efficiency of every account and my complete portfolio.

Anticipate receiving every day portfolio summaries with these particulars:

- Portfolio well being rating

- Dividend security rating

- At the moment’s achieve

- Whole efficiency

- Inventory warnings (when vulnerable to performing badly)

- Related articles, information and transcripts

Customized Alerts

You’ll be able to obtain breaking information, improve and downgrade alerts in your portfolio holdings.

Premium members can learn the complete alert instantly from their e mail inbox as an alternative of visiting the Searching for Alpha web site.

This private service could make Searching for Alpha simpler to make use of than your brokerage.

Information Dashboard

Searching for Alpha members can use the platform to learn market headlines and ticker-specific information. However Premium members have enhanced in-article capabilities for additional studying.

Upgrading additionally provides you a fully-functional information dashboard. You’ll be able to have articles for particular sectors, and funding methods seem first.

The information dashboard generally is a good various to CNBC or an costly subscription to The Wall Road Journal or Barron’s.

Earnings Calendar

You’ll be able to view an earnings calendar that lists upcoming calls and stories from shares in your portfolio. Premium members can even see EPS revision scores because the market adjusts to the most recent firm stories.

Monitor Portfolio by Valuation Metrics

Along with monitoring the inventory value, you’ll be able to view your place efficiency by particular valuation, basic and creator ranking metrics.

If there are potential weaknesses, you’ll be able to see which ranking has a lagging rating in your portfolio. You’re in a position to see the scores for every particular person inventory which might help you resolve which positions to trim.

This portfolio evaluation doesn’t consider shares by place dimension like some checkup instruments do however primarily considers the underlying high quality of the funding. Consequently, I primarily use this device to see if my holdings live as much as their authentic potential are if the danger exceeds the potential reward at the moment.

Different Searching for Alpha Options

Searching for Alpha Premium could have all of the options that it is advisable analysis shares and monitor your portfolio.

These options can be found to all Searching for Alpha members and assist you get extra out of Searching for Alpha as your main supply for inventory market analysis.

Market

A number of Searching for Alpha contributors supply a subscription service much like an investing publication. This content material provides you in-depth evaluation and mannequin portfolios that you simply gained’t see within the free Investing Concepts articles.

Podcasts

Searching for Alpha hosts eight totally different investing podcasts. Some podcasts cowl the every day market happenings whereas others give attention to particular themes like buying and selling shares or investing in ETFs.

You’ll obtain fifteen free newsletters with totally different themes, together with the morning market headlines and centered sectors. You’ll be able to rapidly discover hyperlinks to related articles in every subject. I’ve personally browsed Wall Road Breakfast for practically a decade.

Inventory Concepts

The Inventory Concepts feed collects articles with investing themes. The Searching for Alpha homepage reveals a listing of items that persons are studying probably the most. Visiting each locations helps you to discover extra articles that may curiosity you.

Among the concept themes you’ll be able to browse embrace:

- Lengthy concepts

- IPO evaluation

- Fast picks

- Fund letters

- Editors picks

- Inventory concepts by sector

You may additionally see firm releases within the Inventory Concepts part as their information group periodically publishes articles.

Investing Technique

The Investing Technique part options articles that may assist form your total portfolio funding technique. Different write-ups are for monetary advisors, however common buyers could recognize them as effectively.

Who Ought to Keep away from Upgrading to Searching for Alpha Premium?

Traders who use a robo-advisor or don’t spend money on particular person shares or ETFs ought to keep away from Searching for Alpha Premium.

New buyers could resolve to stick with the fundamental model of Searching for Alpha and use the platform to learn the investing concepts articles. Nevertheless, you’ll need to improve to learn articles a minimum of ten days previous and entry the Searching for Alpha inventory scores.

Lengthy-term Searching for Alpha customers (reminiscent of myself) might also discover upgrading value it to have limitless entry as earlier than when the platform was ad-supported. Along with the article library and scores, the portfolio monitoring instruments are in all-in-one answer.

In contrast to investing newsletters that suggest one or two month-to-month inventory picks, Searching for Alpha is a analysis device that presents the purchase and promote causes for every inventory. However you have to resolve what to spend money on.

Additionally, when you choose investing in mutual funds, Morningstar Premium generally is a higher match.

Frequent merchants who depend on technical evaluation and charting are much less prone to profit from the Premium service because it primarily caters to fundamentals. The quant scores could make it simpler to search out potential shares and examine insights from different buyers.

The capabilities will be good for informal merchants and aggressive with most brokerage providers.

Alpha Picks

Searching for Alpha lately launched a service referred to as Alpha Picks the place you will get 2 inventory suggestions to purchase and maintain per 30 days. Take into account this feature if you need a mannequin portfolio and discover the common platform too open-ended.

Here’s what else you get:

- An in depth clarification of why every inventory is rated so extremely

- An alert if we predict it is best to promote one of many shares within the service

- Common updates on present ‘Purchase’ suggestions

Usually $199 however proper now you’ll be able to get Alpha Picks for less than $99.

Positives and Negatives

Execs

- Covers most shares and ETFs

- Limitless entry to investing concepts articles

- Quant Scores for many shares

- Can monitor private portfolio efficiency

- Hear and obtain firm name transcripts and shows

Cons

- Plan payment will be too excessive for informal buyers

- Few technical evaluation instruments

- Doesn’t suggest shares to purchase

- Minimal protection for mutual funds

Searching for Alpha Options

If you’re on the lookout for an alternative choice apart from Searching for Alpha, take a look at Zacks which is at the moment providing a free report on 5 Inventory Set to Double.

Motley Idiot is one other investing service that gives inventory picks regularly. With their Inventory Advisor service, Motley Idiot sends out a listing of inventory picks each month for as little as $79 for brand spanking new members. Billed yearly. Introductory value for the primary yr for brand spanking new members solely. First yr payments at $79 and renews at $199

Associated article: Searching for Alpha Versus Motley Idiot

Abstract

Searching for Alpha Premium will be value it for lively buyers who depend on analysis. Hopefully this Searching for Alpha evaluation must you that can get worthwhile insights that you simply gained’t essentially get out of your brokerage analysis platform or free inventory screening instruments.

Nevertheless, informal buyers ought to think about sticking with the free model as an alternative.