BankFinancial (BFIN) is a small ($1.5B assets, $125MM market cap) community bank with 18 branches scattered across the Chicago suburbs. It was a mutual holding company conversion way back in 2004, unlike many former mutual conversions, BankFinancial is primarily a commercial bank with big chunks of their loan portfolio in Class B/C suburban multi-family properties, commercial working capital lines and equipment leases. Their deposit costs are surprisingly low at just 1.26% (Q4), over a full percentage point below the average bank, despite the strong deposit franchise, the bank struggles to turn a profit with an ROE in the 5%-7% range due to a high expense base. The stock trades for a hair under $10/share with a book value of $12.45/share (not mark-to-marking their loan portfolio, all of their securities portfolio is AFS), admittedly not the cheapest community bank.

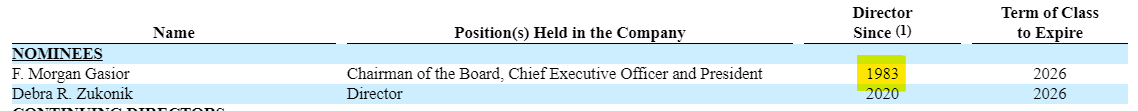

With regional bank tremors popping up again, BankFinancial doesn’t have the same problems plaguing others. The bank doesn’t lend to high rises or do significant construction lending, there’s minimal office exposure, multi-family is in Class B/C which isn’t as susceptible to overbuilding and they have a strong diverse deposit base. What they do have is an entrenched CEO, Morgan Gasior has been the CEO since the mutual conversion, and remarkably, at the age of 60, has served as a director at Bank Financial since 1983.

Not entirely sure how that’s possible, would have made him 19 at the time, in 1988 he became EVP/COO at 24, BankFinancial is Morgan Gasior and Morgan Gasior is BankFinancial. I’m guessing there’s some nepotism involved, but going back to the original conversion docs, couldn’t find any previous relationship ties. I would be curious to hear the origin story. Despite being a bank executive for nearly 40 years, he only owns 2.5% of the shares yet collect $600+k in annual compensation.

This story isn’t too uncommon in the community bank world, but what caught my attention (in addition to this being a local bank for me) was the Q4 earnings call which quickly went off the rails (courtesy of BamSEC):

Operator

And our next question will come from the line of [ Stephen Buckman ] from [ Buckman ] Capital.

Unknown Analyst

I have been a shareholder that took part in the conversion 18, 19 years ago. And I have a more holistic question as well. And that is what is the role of the Board of Directors? And I’m going to refer you to a conference call comment you made on May 2, 2022. And what you said, I’m quoting, is, “Well, first of all, I think we’re in a position now where our goal for the third quarter and fourth quarter is to sustain right around $0.23 to $0.26 a share. So I’m going to try to hit that $1 per share in our third quarter and fourth quarter.” This is 2022. And then beginning next year, the goal would shift to getting into the $0.30s or somewhere between $0.30 and $0.34. I could go on, but the fact is, 18 years later, the only guy who’s made out here is you. Our book value, our stock price, our franchise value are all lower than they were in 2004 when you converted. What is the role of the Board of Directors in terms of your underperformance during this time?

F. Morgan Gasior BankFinancial Corporation – Chairman, CEO & President

No, this is the investor conference call. We’re here to discuss earnings.

Unknown Analyst

I’m quoting you directly from May 2, 2022 [indiscernible] take a look at the conference call.

F. Morgan Gasior BankFinancial Corporation – Chairman, CEO & President

Well, I’ll just say that, if you want to discuss this offline, we’re happy to.

Unknown Analyst

No. No. I’d rather this be in a public forum.

F. Morgan Gasior BankFinancial Corporation – Chairman, CEO & President

Well, we’re going to leave it there. I don’t think that this is — that’s the right forum for this. If you want to…

Unknown Analyst

Well, your underperformance for 19 years is a matter of public record. And so do you want to address it publicly or do you want to pretend that it doesn’t exist?

F. Morgan Gasior BankFinancial Corporation – Chairman, CEO & President

Well, I think we’re going to leave it where I said. This is the investor conference call. If you’d like to talk about it off-line, we’re happy to do so. But I mean…

Unknown Analyst

And I find that your cowardice in addressing issues that affect all public shareholders is severely — is staggering. I’ll leave it at that. I think you could be doing a much better job. I think you should be looking at strategic alternatives. I’ll leave it at that.

And another one:

Unknown Analyst

Morgan, this is [ Charles Winnik ]. On February 5, 2013, you were asked questions on your last call, you received questions about selling the bank and you implied that it was not the right decision because better days are ahead of you. Well, I definitely can’t disagree with your assessment, especially considering the performance over the last few years. I don’t really see any other avenue that would be more beneficial to shareholders than a sale. And while the earnings outlook has definitely improved, your full earnings capacity still generates returns much less than your cost of capital, which, in effect, destroys shareholder value. Your efficiency ratio is just too high. And while loan growth is always right around the corner, you admit on every call that competition is intense, which I agree, which really just justifies the fragmented nature of the markets and need consolidation. And so, yes, we have improved outlook and hefty capital, but all negatives really speak for themselves.

So, my question really is — you’ve got most of your credit issues behind you now. Obviously, can you offer shareholders a credible plan that generates value superior to what you could potentially receive in an M&A transaction?

And finally from Jason Stock, whose fund owns just under 10% of the shares:

Jason Stock

As you know, we’ve been long-term investors in BankFinancial, and we’re generally not the type of investor who likes to be much of a nuisance. But as owners of over 9% of the company, I think it’d be probably irresponsible of me to not pipe in and say that we agree with all the comments that have been made about the outlook for the bank as an independent entity.

Then a week after, Ben Mackovak of Strategic Value Bank Investors, a fund that specializes in community banks was added to the board after accumulating a 5.2% position. From the 13D filing:

The Reporting Persons acquired the Common Stock reported on this Schedule 13D for investment purposes. The Reporting Persons purchased the shares based on the belief that the shares, at the time of purchase, were undervalued and represented an attractive investment opportunity. The Reporting Persons believe significant opportunity exists to enhance shareholder value by simplifying the business, improving operations, resolving certain non-performing loans, and evaluating strategic alternatives.

Mackovak follows a similar strategy of other community bank activists, he’s on the board of some 10 small banks, pushes them to make operational changes, if that doesn’t improve the multiple, then pushes for an M&A transaction to unlock value. He recently went on Meb Faber’s podcast and sounds like a smart, sober, capable board member that could crack the BFIN nut. I don’t anticipate an immediate M&A deal here (they have $52.8MM of mark-to-market losses on the loan portfolio an acquirer would need to realize), the bank does have some shorter duration loans that are coming off the books this year that they can put to work at higher rates improving profitability, but the pressure is on as a high expense base is much easier to fix (by selling out) than a flightly deposit base, long duration securities portfolio or credit issues, none of which really apply to BFIN.

Disclosure: I own shares of BFIN