If somebody mentioned “startup” whereas we had been taking part in a phrase affiliation sport, I’d reply with “fundraising.” (I wager you’ll, too.)

Asking individuals for cash is a key facet of each founder’s journey, however Techstars Managing Director Collin Wallace says it could actually additionally “speed up your demise.”

For instance, elevating a spherical to rev up engineering, gross sales and advertising and marketing sounds optimistic — however what if the enterprise itself has detrimental unit economics?

Full TechCrunch+ articles are solely accessible to members

Use low cost code TCPLUSROUNDUP to save lots of 20% off a one- or two-year subscription

“More often than not, what stands between an organization and its capacity to attain scale isn’t a scarcity of cash,” writes Wallace in TC+.

“It’s higher to ask: Do we now have hustle issues? Product issues? Course of issues? Folks issues? Is my enterprise mannequin basically flawed?”

On this article, he examines 4 eventualities that always lead entrepreneurs to hunt out new money and explains why getting “a transparent image of what’s fueling losses” is way more essential.

Thanks for studying,

Walter Thompson

Editorial Supervisor, TechCrunch+

@yourprotagonist

Software program buyers should (re)be taught these 3 concepts earlier than stepping into deep tech

Picture Credit: Christian Sturzenegger (opens in a brand new window) / Getty Pictures

As a result of VCs turned “software program investing right into a low-margin finance sport,” it may be a internet optimistic that so many are “unable to maneuver ahead and put money into the following large factor: deep tech,” based on Champ Suthipongchai, co-founder and normal associate at Artistic Ventures.

A SaaS mindset simply isn’t related for deep tech funding, which suggests conventional VCs should recalibrate their conduct (and expectations) earlier than diving in.

“Software program buyers’ founder-first mantra is just improper on the earth of deep tech,” writes Suthipongchai.

“The sort of magical pondering is strictly why their software program playbook is doomed to fail.”

Clean Road cracked the code on making espresso outlets enticing to VC

Picture Credit: Getty Pictures

Tech buyers don’t are likely to again bodily companies as a result of they’ve so many literal shifting components: SaaS startups can’t get a flat tire or fail a well being inspection, and so they actually don’t want foot visitors.

“However Clean Road claims to have cracked the code on learn how to make a series of greater than 65 bodily espresso outlets have the fitting metrics to draw enterprise capitalists,” writes Rebecca Szkutak.

“They just lately closed on a $20 million Sequence B spherical amid a 12 months the place fundraising has taken a nosedive — even for corporations with low overhead prices.”

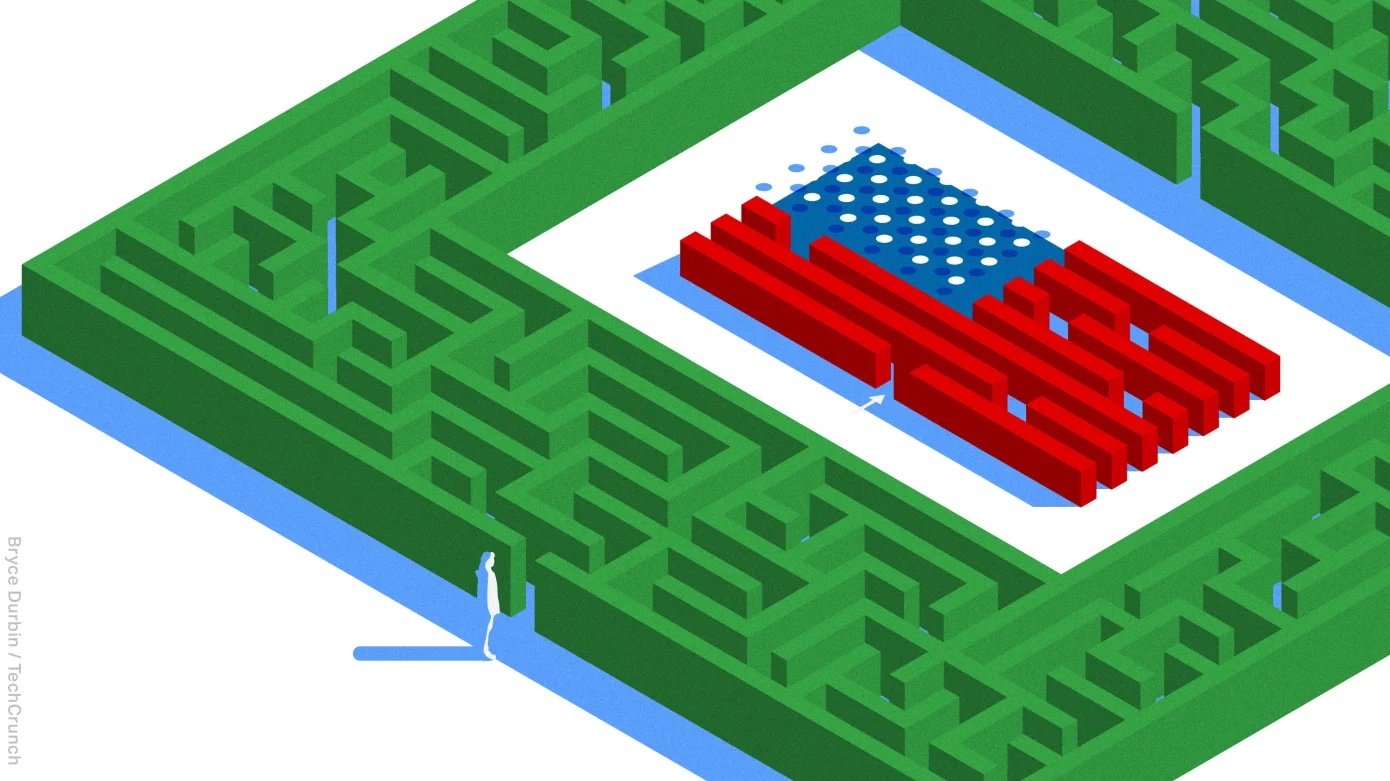

Ask Sophie: Can I launch a startup if I’m within the US on a scholar visa?

Picture Credit: Bryce Durbin / TechCrunch

Pricey Sophie,

I simply came upon that I’ve been accepted to an American college, which was my first alternative!

Someday, my dream could be to create my very own startup within the U.S. Is there any groundwork I’m allowed to put to make my dream come true?

— Ahead-Trying Founder