This publish could comprise affiliate hyperlinks. See our affiliate disclosure for extra.

You probably have ever tried to get a mortgage, apply for presidency advantages, hire an condo or open a brand new bank card—mainly, when you’ve got had to make use of the banking system within the final 100 years—you might have possible been requested to show self employed earnings.

And the minute you say the phrases, “self employed,” you see the appears to be like on everybody’s faces flip to a cringe.

This isn’t as a result of they don’t respect your work as a enterprise proprietor, however one of many many challenges of being a self employed or freelance employee is coping with methods which might be arrange for a full-time worker, W2 workforce.

It’s straightforward for banks to tug up employment information and tax returns for workers who earn the identical quantity, month after month, whose employers preserve information on their behalf.

If you want to show self employed earnings, the method turns into far more concerned. As a result of your earnings possible varies radically over weeks, months, and years, and since you are greater than possible your personal document keeper, you’ll have to get a bit extra inventive with the documentation that you simply present.

To not fear, it’s not as tough as banks and mortgage officers wish to make it sound. And, when you’ve got been freelancing for a very long time, you’re possible used to creating changes and making your lifestyle match right into a course of arrange for another person.

On this article, we’ll discover what folks imply once they ask you for proof of earnings, why you must hassle, and the several types of documentation that may enable you to navigate any scenario the place you do must know methods to show self employed earnings.

Collectively, we’ll wipe that half-alarmed look off of your mortgage dealer’s face, since you are so ready!

What’s proof of earnings?

“Proof of earnings” simply means official verification within the type of documentation that you simply make the amount of cash you say you do. Anybody who is perhaps asking you for cash for any kind of fee on an ongoing foundation will need to guarantee you’ll be able to make these funds.

It is smart. If somebody provides you a mortgage, or permits you to hire their property, or one thing comparable, is taking a threat on you. When you know the way to show self employed earnings, that threat is lessened of their eyes and everybody feels higher and is extra prepared to open up their pocketbooks.

In my time as a freelancer, I’ve been requested for proof of earnings when making use of for medical insurance, earlier than signing an condo lease, at automotive dealerships, when organising our utilities, on bank card purposes and after we purchased our first home.

Typically I get pushback, and different occasions I’ve had folks attempt to merely use my husband’s earnings as a substitute (he’s a standard W2 worker). There have been conditions the place I’ve opted to simply try this, nevertheless it by no means sits proper with me. I’m gainfully employed, I make a good wage, and there’s no motive I shouldn’t be in a position to get a mortgage in my very own identify.

So as a substitute of stewing about it, I’ve as a substitute discovered methods to navigate cash, banking, loans and the remaining from a self-employed standpoint. And I not often run into hassle anymore.

It should all the time be simpler (or a minimum of, for the foreseeable future), to depend on W2 earnings if that’s an possibility for you. However understanding methods to show self employed earnings helps you are taking cost of your personal scenario and your personal funds.

Subsequent time you wish to improve your life in any means—financing a big buy, shifting into a brand new place, making use of for insurance coverage, getting a journey visa, becoming a member of a rustic membership (hey, purpose excessive, proper?)—you should have all the instruments you want to make it occur.

The best way to show self employed earnings with these 6 paperwork

Upon getting been requested to show self employed earnings, you may instantly begin to panic a bit of bit inside. You in all probability don’t have the pay stubs {that a} majority of individuals simply whip out to cross that first hurdle.

However anybody who tells you that pay stubs are the solely approach to present constant earnings is both very ignorant or simply lazy and doesn’t need to cope with different choices. There are literally a myriad of the way to show self employed earnings, and lots of of them are literally fairly easy. Let’s go over among the most typical methods to show self employed earnings, so you understand what is going to give you the results you want and methods to come up with the totally different paperwork.

1. Financial institution Statements

That’s proper, you may show self employed earnings simply by offering your bak statements. Assuming you might have regular deposits for a minimum of 3-6 months, relying on the kind of mortgage or different program you’re making use of to, most establishments will have the ability to common out your earnings and offer you phrases based mostly on that info.

In fact, this turns into a lot simpler when you’ve got a devoted enterprise checking account in your freelance earnings. That means, each transaction is said to your work, and you’ll merely print off a number of months price of statements and supply these.

Should you use your private account for work, you’ll need to focus on all earnings deposits in order that the opposite get together can clearly see the quantities you’re bringing in associated to your small business. You may additionally want to supply additional proof that that is in truth earnings.

2. Tax Returns

You probably have been freelancing for a minimum of two years, in all probability the only approach to show self employed earnings is thru your tax returns. You possibly can present copies your self, or in some instances, banks or landlords which might be half of a big company might be able to pull these information themselves.

If they’re filed accurately and all the things is calculated proper, your tax returns will present that you’re, in truth, self employed, and that you’ve got had a secure annual earnings. Your earnings will possible change from yr to yr, however so long as you’ve had a excessive sufficient earnings to qualify for no matter service you’re looking into for a number of years, you need to be good to go.

In fact, if you happen to aren’t doing all your taxes correctly or when you’ve got a variety of enterprise bills included that make it appear to be your total earnings is low, your tax returns won’t inform the complete story of your earnings, so preserve that in thoughts. It could be {that a} totally different methodology of methods to show self employed is a greater match.

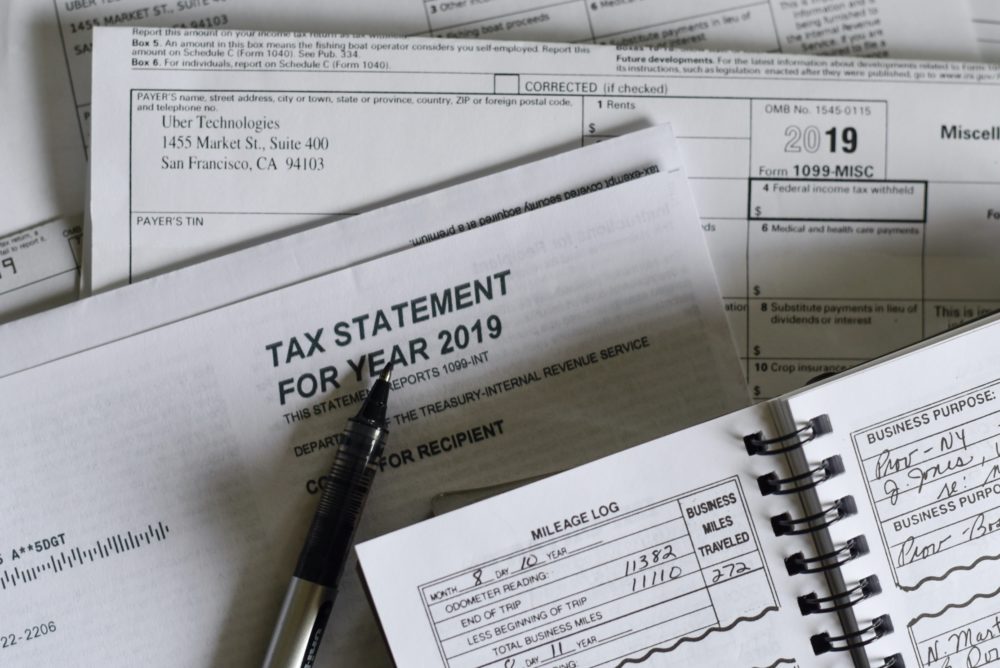

3. 1099s

In my expertise, not all shoppers file a 1099––it relies upon how massive the enterprise you do work for is, how a lot you invoice them over the course of a yr, and simply whether or not or not they perceive the ins and outs of contracting. (Apart: you’re nonetheless required to pay taxes in your earnings, even when your consumer shouldn’t be reporting it!)

But when most or your whole shoppers do submit a 1099, and you’ve got labored for a minimum of two years as a freelancer, then these 1099s are an ideal software for methods to show self employed earnings.

A 1099 Kind is a proper tax doc detailing the quantity that every consumer has paid you yearly. These varieties are submitted to the IRS, and you’re required to pay taxes on the reported earnings. Utilizing these paperwork and including the totals collectively provides anybody a transparent image of your annual earnings.

4. Invoices

To be clear up entrance: I don’t assume a mortgage dealer would settle for your private invoices as proof of earnings for a half million greenback mortgage.

Nonetheless, if you’re fighting methods to show self employed earnings for one thing like renting an condo from a sole proprietor landlord, or making use of for presidency advantages, or if you want to complement one other type of documentation, your small business invoices are one software in your toolbox.

Invoices work greatest when they’re constant and official. Should you use a program like QuickBooks, Wave, Bonsai, Honeybook, or one of many different nice freelance invoicing softwares which might be obtainable, you should have clear information and printable invoices that can assist you present proof of earnings.

Even when your invoices are simply an excel spreadsheet, make sure that to quantity them and embody an organization brand. This lends credence to them when wanted to indicate your earnings for any motive.

5. Pay Stubs

Wait — freelancers don’t have pay stubs, do they?

Really, if you happen to set your small business up proper, you may completely have pay stubs, and your days of questioning methods to show self employed earnings will likely be over!

When you might have a enterprise checking account, and you set all income into it, you may then pay your self a wage out of the enterprise.

To be legitimate, a pay stub wants to indicate each gross and internet earnings, which implies you want to calculate issues like Medicare, Social Safety and state and federal tax deductions. This mannequin doesn’t work for everybody, but when your freelance enterprise turns into massive sufficient, utilizing a proper pay stub can assist propel you thru a variety of authorized hurdles, so it’s one thing to think about.

6. Accounting Software program Statements

Once more, once you use an organized system, it can all the time be simpler to determine methods to show self employed earnings.

A great accounting software program like Hectic, Bonsai, or Lili will observe earnings, losses, bills, and so on., and you’ll generate reviews based mostly off of those figures. In some instances, a report like this can be utilized both as a sole supply of earnings proof, or to complement different paperwork like a financial institution assertion.

The best way to show self employed earnings when paid with money

The paperwork listed above will work most often, however what when you’ve got shoppers preferring to pay you in money? You wouldn’t be the primary individual to marvel methods to show self employed earnings when there is no such thing as a digital or paper path.

First, let me say this. You probably have shoppers who insist on paying you in money…I’d assume twice about taking them on as shoppers. It isn’t unlawful to be paid in money, however there are only a few reliable causes somebody would wish and even need to do that.

Money funds nonetheless depend as earnings, and have to be reported to the IRS. Typically, employers pay contractors in money to keep away from paperwork or doable taxes. Being paid in money makes it tougher for everybody to maintain information. That doesn’t imply your consumer is shady, nevertheless it’s price a re-examination.

That mentioned, if you’re working for household or associates, or a small group that for some unfathomable motive nonetheless hasn’t arrange a checking account and must pay you in money, and you are feeling snug with the scenario, go for it. Being paid in money doesn’t imply you may’t use these funds as proof of earnings.

The very first thing to do in these conditions is to ensure that your bookkeeping is meticulous. Doc each money transaction and its date. Second, instantly deposit the money into your checking account. This offers you an official document of the fee.

Now you might have a financial institution assertion and bookkeeping information—so subsequent time you marvel methods to show self employed earnings, it’s all proper there in black and white.

If a variety of your small business is transacted in money, I’d assume severely about organising a authorized LLC or sole proprietorship, with an accompanying checking account, and distributing a wage to your self, with pay stubs. This can assist not solely with methods to show self employed earnings, however with avoiding a variety of complications throughout tax season.

Begin getting ready!

Freelancers and different self employed staff will possible get sideways appears to be like from monetary professionals for a very long time to return. An inconsistent earnings coupled with haphazard document holding is a recipe for catastrophe with regards to methods to show self employed earnings.

But it surely doesn’t need to be like that!

Being a freelancer shouldn’t be an excuse for a disorganized enterprise. The truth is, working for your self implies that you must care greater than anybody what your small business information appear to be. You don’t need to make expensive errors or have points when it’s time to get a mortgage or file your taxes.

When you might have meticulous information, you should have entry to all the documentation you want to show your earnings as a self employed employee.

Preserve the dialog going…

Over 10,000 of us are having every day conversations over in our free Fb group and we might like to see you there. Be part of us!