This submit might include affiliate hyperlinks. See our affiliate disclosure for extra.

Have you ever ever filed your tax return solely to appreciate that you would’ve deducted a major enterprise expense? Hopefully, a tax deduction cheat sheet can make sure that you by no means miss out on one other deductible expense once more.

As a freelancer or self-employed sole dealer, you’ll be able to declare deductions on any enterprise buy that’s extraordinary and vital in your line of labor. So, every thing from your house utilities to what you are promoting meals are classed as tax deductible.

However, like just about each tax-related exercise, there are plenty of guidelines and much more confusion.

Overlook tax deadline stress—tax return stress is a really actual factor. Based on Credello, one-third of People are nervous that they failed to maximise their tax refund. And, 25% fear that they’re going to get audited by the IRS as a result of they’ve made a mistake.

So, we’ve created a tax deduction cheat sheet that can assist you maximize your tax refund or scale back your tax invoice. We’re additionally going to debate some greatest practices for submitting your tax return to hopefully ease a few of your tax deadline stress.

Tax deduction cheat sheet for freelancers and self-employed

What tax-deductible enterprise bills are you able to benefit from? Let’s check out a few of the fundamental bills which you could deduct no matter your business.

Lease, mortgage, and utilities deduction

In case you work at home, you’ll be entitled to the house workplace area deduction no matter whether or not you personal or hire. That is most likely essentially the most substantial tax deduction you’ll be able to declare, however it’s additionally essentially the most complicated.

Put merely, the house workplace area you employ repeatedly and solely for enterprise operations is tax deductible. So if, for instance, your house workplace amounted to twenty% of your total residence, you’ll be able to deduct 20% of your hire as a tax-deductible expense.

The identical goes to your mortgage curiosity and utilities too. If 10% of your electrical energy invoice powers your house workplace, then you’ll be able to deduct that portion. That is referred to as the common methodology for calculating residence workplace area deductions.

After all, really making these calculations is a reasonably intensive process. Speaking them in your tax varieties is much more so—it’s a must to full type 8829, which is a prolonged 43 strains. Because of this, IRS has devised a simplified methodology.

The simplified methodology deducts $5 for each sq. foot of your house workplace area (as much as 300 sq. toes). Which means that residence workplace deductions utilizing this methodology are capped at $1,500.

Regardless of the cap, many freelancers discover worth within the simplified methodology. There’s no want for type 8829 (the worksheet for the simplified methodology is just six strains), so it’s a critical time-saver. Moreover, you don’t have to make a lot of particular person calculations to your totally different bills.

In case you have a small residence workplace, you’re prone to see monetary advantages, too.

For these of you freelancing within the UK, residence workplace tax deductions are even simpler. HMRC makes use of simplified flat-rate deductions based mostly on the variety of hours you’re employed in your house workplace monthly. Just like the US simplified methodology, this contains utilities, insurance coverage, and so forth.

Work-related training bills

The IRS acknowledges that steady coaching and training are vital to freelancers. Since you don’t have an employer to cowl these prices for you, the IRS has made work-related training bills tax deductible.

So, what counts as a work-related training expense?

You’ll be able to deduct any convention you attend, course you enroll in, or textbook you purchase so long as it straight pertains to your present skilled occupation. They need to even be for the needs of sustaining and refining your skilled expertise.

So, in the event you had been a contract graphic designer, you’d be capable of declare on design-related refresher programs however not on the meals diet course you accomplished for enjoyable—not even in the event you had been planning on switching careers.

The identical guidelines apply to UK freelancers, too. HMRC lets you deduct coaching programs which might be straight associated to your present space of enterprise. This implies which you could’t write off a coaching course that helps you enterprise into a brand new space of enterprise, even when it pertains to your present enterprise.

Enterprise insurance coverage

In case you pay for insurance coverage to guard what you are promoting, you’ll be able to deduct them as enterprise bills. For instance, you might need enterprise legal responsibility insurance coverage, particular occasions insurance coverage, or insurance coverage to guard what you are promoting within the case of a fireplace or pure catastrophe.

Everyone knows that it’s higher to be secure than sorry. However there’s no denying that insurance coverage premiums can put an enormous dent in your funds. Hopefully, with the ability to listing insurance coverage premiums as tax deductions can encourage you to bulk up what you are promoting safety.

Bank card loans/curiosity

Any bank card loans you’ve taken out are tax deductible so long as the funds are used solely for enterprise functions. For loans that you just use for enterprise and private purchases, the funds have to be distinguished accordingly. The identical goes for bank card curiosity, too.

Journey bills

Out of your airplane fare and mileage to your resort room and meals, you’ll be able to write off a good portion of your journey bills.

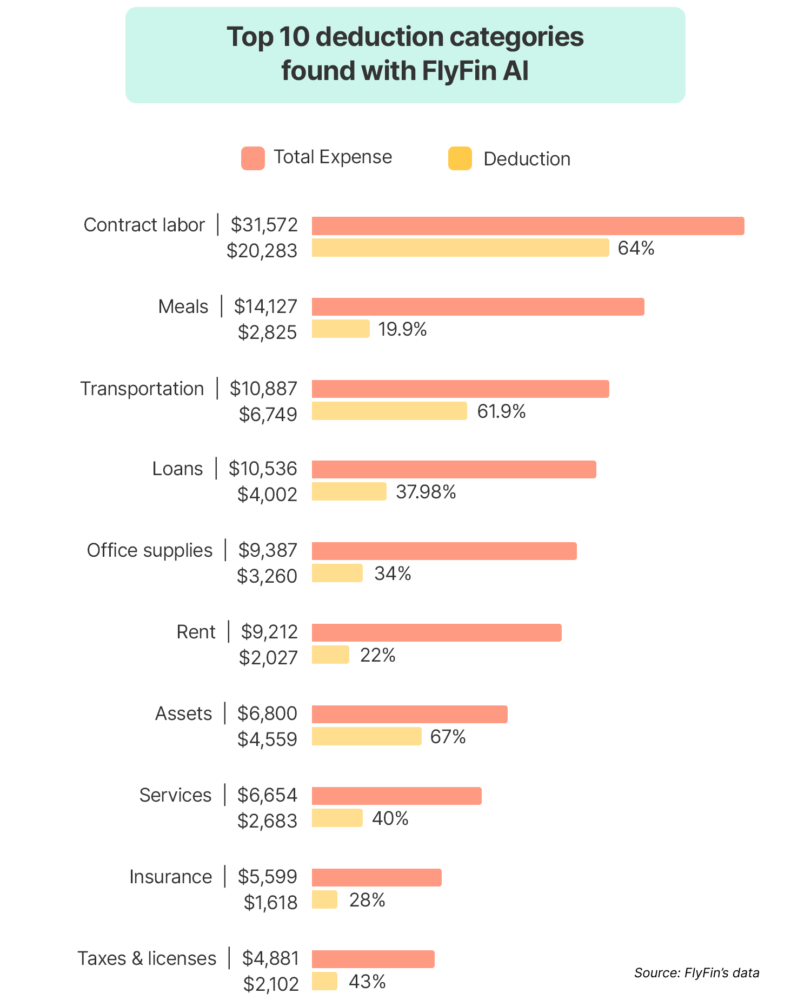

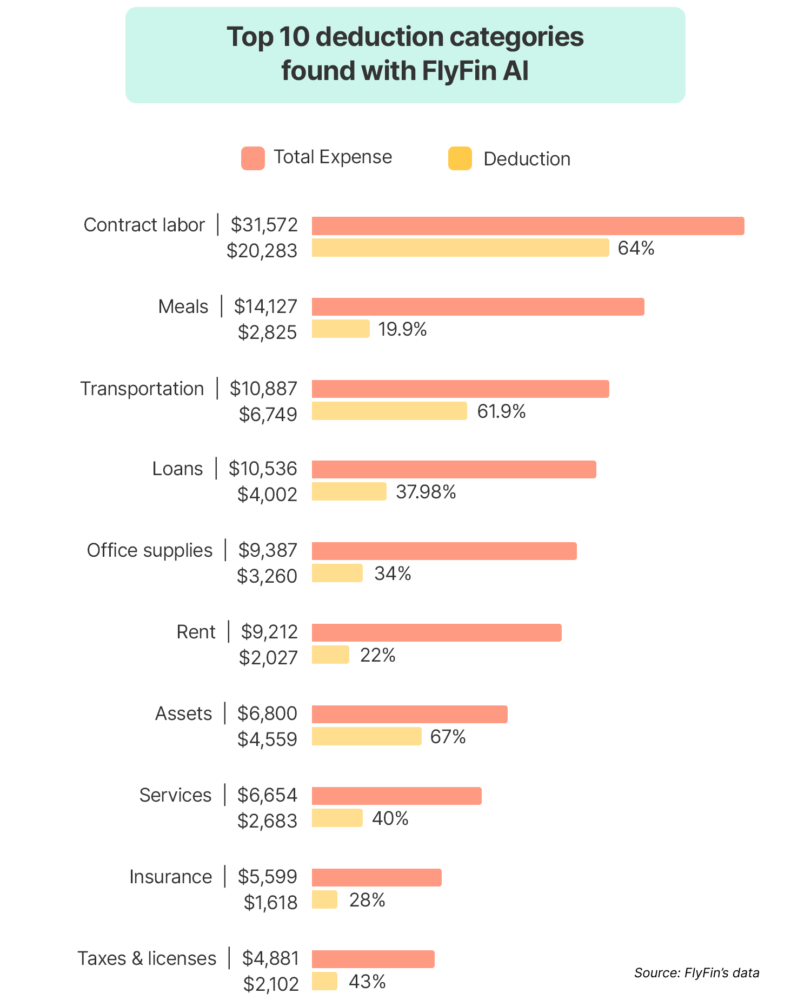

The truth is—after contract labor—meals and transportation are the 2 mostly deducted enterprise bills, based on a latest evaluation by FlyFin.

With that being stated, the IRS is fairly strict about this class and there are plenty of guidelines concerning enterprise journey bills.

For one, enterprise journey should be a sizeable distance from the common place of business and, of their phrases, “considerably longer than an extraordinary day’s work.” So, as a common rule, you’ll be able to’t deduct the prices of day journeys or journeys inside your metropolis.

Moreover, the journey is just classed as deductible if it’s made for enterprise functions (e.g. attending a convention or assembly a consumer). If you wish to take a mini-vacation when you’ve completed what you are promoting actions, none of these prices are deductible.

As for the journey bills which you could declare, a few of the fundamental ones embrace:

- Lengthy-distance transportation: Such because the airplane, practice, and automobile bills used to achieve what you are promoting vacation spot.

- Quick-distance transportation: For instance, the taxi or Uber between the airport and the resort.

- Lodging: You’ll be able to deduct the price of your resort keep, though it shouldn’t be unreasonably extravagant.

- Meals: That is for enterprise meals solely and, as soon as once more, can’t be unreasonably extravagant.

Within the US, issues like baggage delivery, dry cleansing, and even ideas are additionally classed as tax-deductible bills.

HMRC are equally as strict about enterprise journey and thus the entire above guidelines apply. Together with the entire fundamental journey bills we’ve talked about above, you’ll be able to declare tax aid on issues like congestion costs, tolls, and parking charges.

Enterprise promoting

Many people pay for promoting in some type, whether or not it’s on social media, Google, or in {a magazine}. It may be a pricey expenditure for freelancers who depend on steady paid promoting to draw new purchasers. Fortunately, it’s additionally a tax-deductible expense.

In addition to conventional and internet advertising, the IRS lets you deduct the prices incurred from any enterprise playing cards or brand-focused merchandise you create. HMRC lets you deduct free samples and web site prices.

Phone and web

You’ll be able to declare a share of your phone and web bills as tax-deductible bills. To work this out, you’ll have to calculate how a lot of your web and phone utilization is credited to enterprise operations.

In case you use the identical cellphone for enterprise and private communications, you’re going to have to select your cellphone payments aside with a fine-tooth comb. By utilizing two separate telephones for enterprise and private use, you’ll be able to merely deduct 100% of your phone bills (and keep away from working into points with the IRS or HMRC).

Software program subscriptions

Relying in your business, you most likely depend on at the very least one software program subscription. Whether or not it’s image-editing software program like Photoshop or word-processing software program like Microsoft Workplace, you’ll be able to deduct the price of all of the software program that what you are promoting must thrive.

You’ll be able to even declare tax deductions on the net accounting software program you employ to handle your funds.

Whereas we’ve lined a lot of the fundamental tax deductible bills, you too can declare deductions on issues like workplace provides and tools, depreciation, and even contract labor. So, be sure to do your analysis to get essentially the most out of your tax refund.

5 Ideas for submitting freelance taxes

It’s all nicely and good understanding which enterprise bills you’ll be able to deduct. However, in the event you don’t have a streamlined tax administration and returns technique, it’s simple to run into issues together with your tax authority.

Bear in mind the Credello examine we talked about earlier? Nicely, not solely are 25% involved about getting audited by the IRS, however 14% fear that they gained’t get any cash by any means due to a mistake they’ve made on their tax return.

This, together with the frequent fear of lacking deadlines and misplacing paperwork, all make for a really anxious tax return expertise.

Following some easy greatest practices could make submitting your freelance taxes a lot much less irritating. One of many first issues it is best to do is think about using an accounting or tax return system.

Make the most of an accounting system

We get it—handbook tax submitting may be so laborious that calculating your tax deductions would possibly really feel like simply one other chore.

The answer? Accounting software program that automates a lot of the tax submitting course of for you.

Choosing software program that makes a speciality of managing self-employed taxes is a good suggestion. For instance, options equivalent to Hectic and Sage are designed to satisfy the distinctive wants of sole merchants. This software program can import your whole transactions routinely, supplying you with real-time perception into your totally different earnings streams.

Accounting software program isn’t just for serving to you handle your cash as a freelancer. Together with storing and organizing your tax data, one of the best accounting software program can acknowledge any tax deductions you’re entitled to and calculate them routinely. All you’ll want to do is enter your tax data into the system, and the software program will do the remaining.

In addition to being a time-saving shortcut, accounting software program minimizes the chance of human error.

Paper-based tax submitting practices are susceptible to disorganization and miscalculations that may have important money and time repercussions. Accounting software program ensures that your whole tax data is strictly organized and appropriately calculated. In case you do enter one thing flawed, one of the best accounting software program will flag it as a possible error.

Additionally, as a result of consumer-based accounting programs are designed for non-tax professionals, they’re extremely user-friendly and extra reasonably priced than hiring an accountant. What’s extra, many suppliers provide round the clock buyer assist from licensed public accountants (CPAs).

For these self-employed within the UK, take notice that you just gained’t be capable of submit paper tax returns in any respect by April 2026. That is a part of HMRC’s MTD (Making Tax Digital) initiative. Accounting software program will enable you to put together for tax digitization nicely prematurely of the deadline, serving to you keep compliant and arranged.

Hold an organized report of your earnings and bills

When you’ve a number of aspect hustles, purchasers, and tasks on the go, maintaining monitor of all of your earnings streams can shortly turn out to be overwhelming. However, slightly than rent an accountant (which might get actually costly), you need to use a web based spreadsheet or, even higher, accounting or tax return software program.

Accounting and tax return software program routinely information and organizes your freelance earnings and enterprise bills. They eradicate the various inefficiencies of paper-based tax submitting. And, in contrast to spreadsheets, they make the most of automation which streamlines your total record-management course of.

Type out tax-deductible expenditures

Utilizing the tax deduction cheat sheet as a information, it is best to kind out your tax-deductible expenditures nicely earlier than the due date. This entails itemizing, categorizing, and repeatedly updating all related data, so it’s able to submit in your tax date.

Now, the place this could typically get difficult for freelancers is in relation to distinguishing enterprise and private bills. As a strict rule, you’ll be able to solely declare on enterprise bills. Nonetheless, grey areas come up when an merchandise is used for each enterprise and private use (e.g., a cell phone that you just use for enterprise and private communications).

To keep away from working into points together with your tax authority, think about using separate objects for enterprise and private use. If that’s not doable, be sure to appropriately distinguish the portion allotted to enterprise use. So, in the event you bought a cell phone that you just use for enterprise 60% of the time, solely 60% of that price could be tax-deductible.

To make issues even simpler, think about opening a separate checking account to your self-employed enterprise.

Hold a calendar of tax due dates and file early

Based on the IRS, freelancers who anticipate to owe greater than $1,000 on their subsequent tax return are required to make quarterly estimated tax funds. It’s best to nonetheless file earnings tax returns yearly on or earlier than April 15

In case you fail to satisfy quarterly repayments, you’ll incur important penalties and scale back the advantages of tax-deductible bills.

In case you’re within the UK, the self-assessment tax deadline is January 31 for on-line submissions. The deadline for paper tax returns is a number of months earlier. Nonetheless, understand that you gained’t be capable of file paper tax returns by April 2026. You could find out extra about UK tax deadlines on the GOV UK web site.

So, when you’ve collected your tax dates, add them to a web based calendar or, even higher, your accounting software program to get routinely notified of upcoming dates. Utilizing accounting software program to file your tax returns early has an a variety of benefits.

For instance, it may:

- Provide help to keep away from processing delays: Early filers and digital filers are much less affected by holdups.

- Provide you with extra time to arrange for tax payments: Understanding how a lot your invoice shall be forward of time helps you funds accordingly and reduces monetary pressure.

- Eradicate a few of your tax deadline stress: If you’re not speeding to satisfy deadlines, your entire tax return course of turns into a lot much less anxious.

Hold a digital report of invoices, receipts, or ledgers

Digital record-keeping is rather more handy than the paper various. Digital invoices, receipts, and ledgers may be saved and arranged for straightforward accessibility and compliance. You’ll be able to even digitize your paper paperwork by scanning them with a scanner or cellular scanner app.

There are a number of greatest practices it is best to comply with to enhance the effectivity of your digital record-keeping. A very powerful factor you’ll want to do is again up your paperwork in multiple place.

So, don’t simply save your whole paperwork in your accounting system and be accomplished with it. Save them in your Google Drive, Dropbox, or native exhausting drive, too.

One other greatest apply is to make sure that your paperwork are organized. Identify your paperwork appropriately (ideally a reputation that describes the file’s context), and maintain all of your associated information collectively. Whilst you’re at it, think about using OCR (optical character recognition) software program to make your scanned paperwork searchable.

By implementing these greatest practices, you enhance effectivity and eradicate the wrestle that comes with sifting by mountains of paper. Plus, in case your information are saved, organized, and backed up on-line, all of your earnings and bills shall be accounted for ought to the IRS have to do an audit.

Conclusion

Submitting your taxes as a freelancer doesn’t should fill you with dread. By referring to this helpful tax deduction cheat sheet and adopting one of the best practices talked about above, you can also make your tax return course of as stress-free as doable whereas having fun with higher tax returns.

And bear in mind, the enterprise bills listed on this tax deduction cheat sheet aren’t the one ones that is perhaps accessible to you.

Take a very good take a look at any enterprise expense you make and ask your self whether or not it’s extraordinary and vital to your business. In case you’re not sure, seek the advice of a CPA earlier than submitting it as a tax deduction.

Hold the dialog going…

Over 10,000 of us are having every day conversations over in our free Fb group and we might like to see you there. Be part of us!